The End of Payment Protection Insurance Payouts Won't Drag On Spending

© Alice Photo, Adobe Stock

Moribund wages and high inflation have meant every little helps, and PPI payouts have been a life-saver for struggling households, could their removal cause a crisis?

Some economists argue that claims from mis -sold payment protection insurance (PPI) have provided such a boost to people's incomes that when the final deadline for making claims is reached in December 2019, it could cause a noticeable slowdown in consumer spending.

In 2011 a landmark court rulling determined that PPI added to loans, which insured borrowers met their repayments in the event of accident, ill health or redundancy, had been mis-sold and the money could be legitimately reclaimed.

Since then banks have paid out over £29.6bn in claims, providing a welcome boost to many workers struggling on typically low average pay, with real pay falling due to wages not keeping pace with inflation, especially after Brexit.

With the deadline now under two years away, the pace of claims could rise temporarily before falling to zero after the deadline - but are the amounts large enough to rock the economy?

Paul Hollingsworth, an economist specilaising in the UK at advisory service Capital Economics thinks not.

"Overall, then, while we could see a bit of a pick-up in PPI pay-outs ahead of the deadline next year, any boost to incomes or spending is likely to be small. As a result, any drag further ahead should be minimal and more than offset by a pick-up in real wage growth over the next few years," says Hollingsworth.

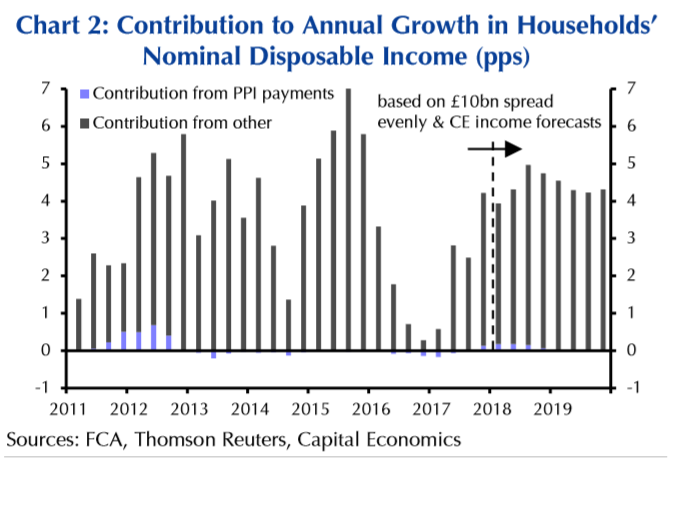

Indeed, even at its peak in 2012, the contribution of PPI payouts to overall income was very small as the chart below attests:

Claims have also overall been diminishing as time has gone by, no doubt due to the declining pool of people who have still not got around to making a claim. A television advertising campaign from the Financial Conduct Authority (FCA) in August 2017 lead to a short-term spike in claims but as the chart below illustrates the long-term trend is down.

Hollingsworth thinks that there probably will be a temproary rise in payouts as people rush to get in last-minute claims before the deadline but that afterwards there will probably not be a noticeable decline in consumer spending as by 2019 real wages will be rising again.

"Some have argued that the ending of compensation related to mis-sold PPI will remove a valuable support to consumers who are facing falling real wages and higher interest rates. However, a near-term pick-up in compensation will support spending and, by the time the scheme ends, any drag will be more than offset by a recovery in real wages," says Hollinsgworth.

An estimated £10.0bn extra has been set aside by banks to settle claims over the rest of the period and assuming all this is used up it will add 0.1% to spending, according to Hollingsworth's calculations.

As far as the likely impact of the increase in income goes, the anecdotal evidence suggests that PPI claims payouts may help "some industries more than others," with the "beleagured" car industry being an example of a sector which might gain a boost, as the relatively large payouts help enable larger capital goods purchases.

Once payouts end the drag on income growth should be pretty minimal, says the economist, as by then real wages will have picked up to fill the gap.

From a foreign exchange perspective increased consumer spending can be positive as it is more likely to increase inflation and then interest rates.

Higher interest rates boost the local currency by attracting more inflows of foreign capital drawn by the promise of higher returns.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.