For Mortgage Rates to Settle Look to Bond Markets

- Written by: Sam Coventry

Image © Adobe Images

Homeowners in the UK are facing increased financial strain as the interest rates on standard two-year fixed mortgage deals have surpassed 6% for the first time since December of last year.

This rapid escalation in mortgage rates can be attributed largely to rising bond yields, which in turn reflect expectations for inflation to stay higher for longer and for the official Bank Rate at the Bank of England to rise to as high as 6.0%.

The repayment rate on the principal of a new mortgage is typically determined by the presiding market-implied yield of government bonds, particularly the two-year bond, as lenders essentially use these bonds as backing for the mortgages they issue.

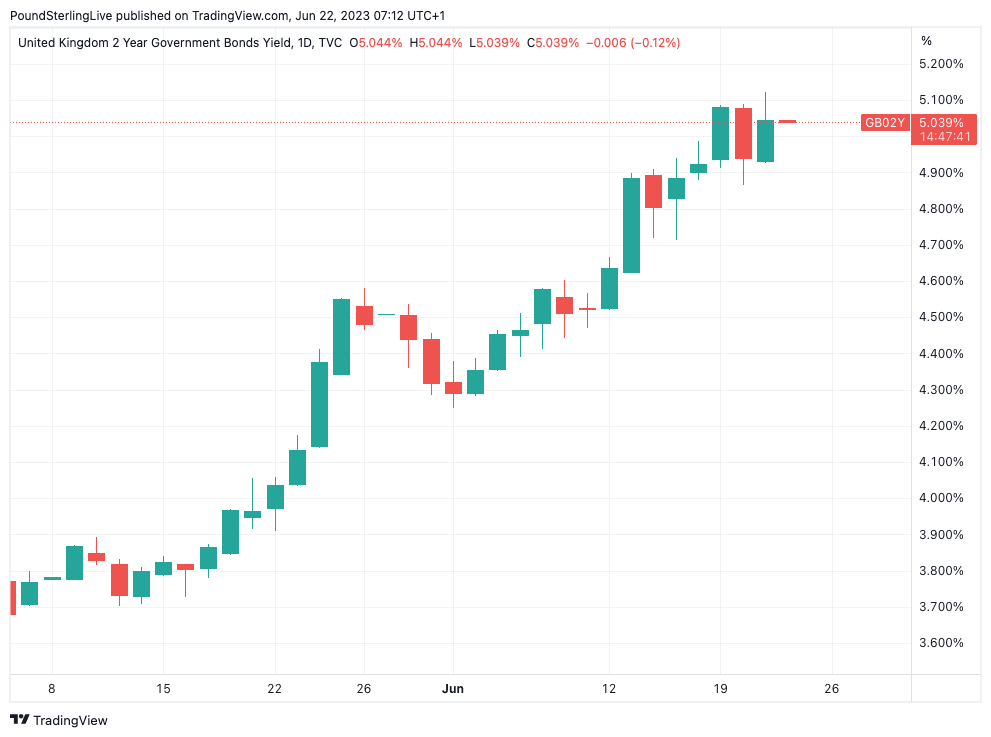

The two-year borrowing rate for the UK government, which significantly influences mortgage rates, reached 5% on Monday for the first time since 2008.

Mortgage lenders have swiftly adjusted rates and withdrawn deals, sometimes with little notice.

TSB, for example, announced on Monday the withdrawal of its mortgage range sold through brokers, with plans to re-price them by Wednesday.

Above: The climb in two-year bond yields underscores the rise in mortgage rates.

According to the financial information service Moneyfacts, the average rate for a two-year fixed-rate mortgage stood at 6.01% as of Monday. Last autumn, these rates spiked to 6.65% following the mini-budget announcement before stabilizing somewhat.

However, they have been on an upward trajectory again in recent times. Similarly, the standard five-year fixed rate has climbed to 5.67%, a notable increase compared to last year's peak of 6.51%.

This issue becomes more urgent as over 400,000 individuals are expected to see their fixed-rate deals expire between July and September, forcing many to adjust their budgets to accommodate higher monthly repayments.

Today, the Bank of England (BoE) will conduct a review of its current base rate, which stands at 4.5% with the market split on whether Bank Rate will rise by 25 basis points or a more aggressive 50bp.

"In response to May’s inflation data... we now expect the MPC to raise interest rates by 50bps to 5.00%," says Neil Shearing, Group Chief Economist at Capital Economics.

But Sir Howard Davies, a former deputy governor of the Bank, recommends that the BoE take a cautious "wait and see" approach in order to fully comprehend the ramifications of the previous rate hikes.

The full extent of the impact of higher borrowing costs is yet to be seen, but it is evident that the housing market and homeowners are facing significant pressure. Whether the UK can navigate this challenging situation without falling into a recession remains uncertain.

Although the government is keeping the possibility of assistance for struggling mortgage holders "under review" there are presently no plans to provide mortgage relief.

A recent report by the Resolution Foundation estimates that the average cost of remortgaging next year will rise by £2,900.

With the average two-year mortgage rate not expected to drop below 4.5% until the end of 2027, the UK is experiencing a challenging 'mortgage crunch.'

Rightmove reports that the average asking price for properties entering the market has declined for the first time this year, dropping by £82 in June to £372,812.

This decline is largely attributed to rising mortgage rates and high inflation, both of which have a negative impact on household finances.