UK to Avoid Recession says Barclays, but Berenberg Forecasts a Four Quarter Long Recession

- Written by: Gary Howes

Image © Adobe Images

Barclays says the UK economy will avoid recession, however economists at Berenberg Bank say the UK could already be in the grip of a recession that will last for four quarters.

UK high street lender Barclays acknowledges the UK economy is slowing, but the slowdown won't be enough to result in two consecutive quarters of contraction.

"While the economy is certainly set to slow further, tight labour market conditions, excess savings, and well targeted fiscal support should prevent a material fall in GDP and an outright recession," says economist Abbas Khan at Barclays in London.

Khan's assessment comes in the wake of the flash PMI survey results for June which came in stronger than expected.

The Composite PMI for the UK read at 53.1, unchanged on May and better than the consensus was looking for at 51.8.

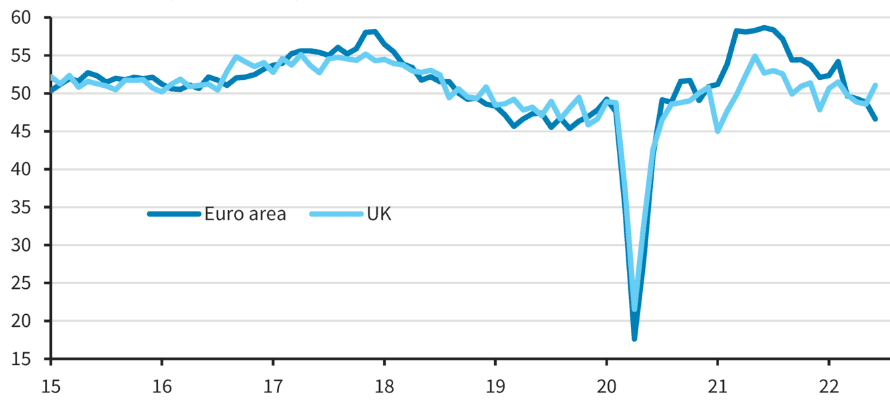

The UK PMI contrasted positively with similar data out of the Eurozone which showed a sharper than expected deterioration, and we note here this divergence has helped the Pound-Euro rate move higher.

Above: PMI Composite New Expected Orders. Source: IHS Markit, Haver Analytics, Barclays Research. "Europe takes a hit from global trade" - Barclays.

However the PMI survey's sub-indicator readings for UK business expectations and new order inflows were especially soft, suggesting that a further deterioration in coming months is likely.

New orders fell sharply in services by 3.2 points, and by 1.5 points in manufacturing, with both now comfortably below long-run averages.

Business expectations in both sectors showed a very large fall, now at levels that in the past have been consistent with an imminent recession.

"This suggests that the slowdown in activity is likely to become more acute as the support from backlogs fades over the coming months," says Khan.

But "employment remains the bright spot," he adds. "Employment was little changed and remains well above historical averages. Hiring intentions are clearly still strong."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Barclays thinks labour market conditions should remain constructive, coming from very tight levels now.

Furthermore, the PMI surveys reveal price pressures experienced by firms have not intensified, and are showing signs of topping out.

This would be consistent with Wednesday's inflation data that showed an unexpected cooling in core UK inflation.

The UK's robust labour market, the recent fiscal boost announced by Chancellor Rishi Sunak and the excess savings accrued during the pandemic are all seen as providing buffers for the economy.

"At the same time, price pressures do not appear to be intensifying and may have topped out, possibly signalling the benefits of the MPC starting its hiking cycle well before other developed market central banks," says Khan.

They therefore remain in the camp of institutions saying although the economy is slowing it will avoid recession.

Barclays thinks there is little strong evidence in today's print for the Bank to hike by 50bp at its upcoming August meeting, although the June inflation print (20 July) will be key.

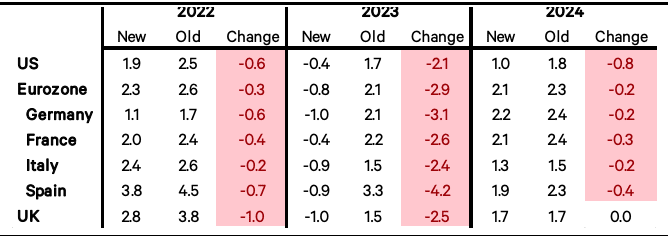

Economists at Berenberg Bank meanwhile say their new base case call is for recessions in the UK, Eurozone and the U.S.

"While output currently is still holding up quite well and employment continues to increase as firms are trying to close staffing shortages, the outlook is turning bleaker," says economist Salomon Fiedler at Berenberg in a note out following the publication of the PMI data.

Above: Berenberg's projections for the year-on-year change in real GDP on 21 June versus 15 June 2022, difference in ppt. Source: Berenberg.

"The survey notes significant drops in the indicators for new order volumes and business expectations falling to its lowest levels since May 2020," he adds.

Berenberg says a recession seems to be underway in the UK economy as worsening supply shocks, surging inflation and tightening monetary policy overwhelm mostly good fundamentals.

The recession is forecast to last four quarters from the second quarter of 2022 to the first quarter of 2023, with Berenberg projecting a peak-to-trough hit to real GDP of around 2.2%.