Euro-Dollar Still Going Sub-1.05 says Lombard Odier

- Written by: Gary Howes

Image © Adobe Images

U.S. growth exceptionalism and China's pessimism should keep the USD well supported against the Euro in the first half of 2024, says Lombard Odier.

In a new currency research update, the Geneva-based private bank still believes the Euro to Dollar exchange rate (EUR/USD) will continue declining over H1 2024.

The call comes after the EUR/USD rallied to 1.11 in December but then succumbed to losses that brought it back to 1.08 amidst a repricing lower in U.S. Federal Reserve rate cut expectations amidst a slew of stronger-than-forecast data releases.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

"The most pressing risk to our assumption of a subdued EUR/USD in H1 2024 was the prospect of an earlier Fed rate cut. However, the Fed has pushed back explicitly against this happening, and a still-strong labour market and sticky services inflation suggest the first move is unlikely before May, if then," says Kiran Kowshick, Global FX Strategist at Lombard Odier.

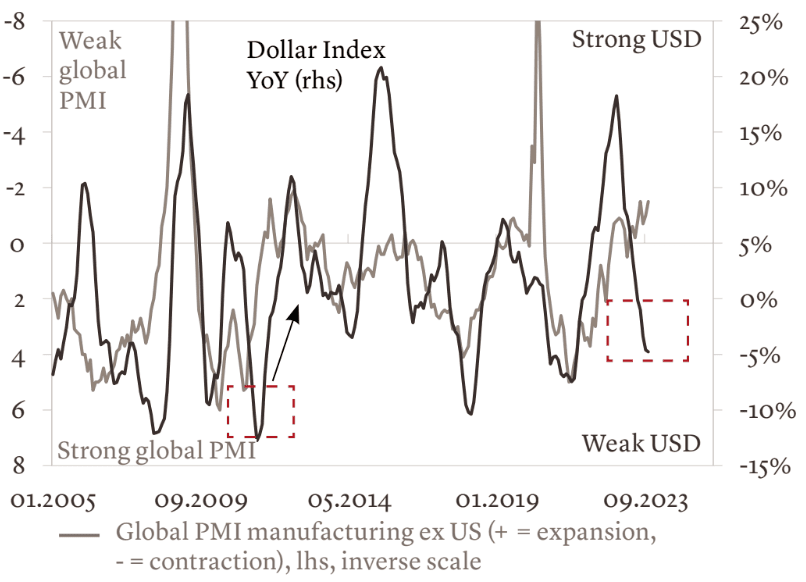

Lombard Odier says valuations also favour the USD, noting it screens undervalued relative to the soft trend in economic growth outside of the U.S.

"The dollar appears weak relative to sluggish ex-US growth" - Lombard Odier.

The bullish USD view also rests with an assumption that rate cuts at the Fed are not necessarily the bearish outcome for the currency that the consensus expects.

"The USD is likely to retain its yield advantage even as the Fed cuts rates," says Kowshick, "the historical record of USD performance following the first Fed cut in an easing cycle suggests the context in which the cut occurs matters".

These observations mean the risks are skewed higher for the U.S. dollar in both U.S. soft-landing and hard-landing scenarios over H1.

"Positioning still appears conducive to further declines in the EURUSD," says Kowshick, "we still believe the pair will continue its decline over H1 2024, and keep our three-month target of 1.04."

A "likely dovish ECB shift" is also expected to occur in H1, which can underpin Euro underperformance.

Risks to the view include U.S. politics with Lombard Odier reckoning a return of Donald Trump to the White House would likely prove USD-supportive and work against the bank's existing call for a softer USD in H2.

The 12-month forecast for EUR/USD is currently set at 1.08.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes