South African Rand Facing Risk of High Volatility in Central Bank Bonanza

- Written by: James Skinner

"Inflation, interest rates and economic growth continue to dominate market concerns, although the latter is seen as the least of the problem, with the overwhelming view from most Central Banks that high inflation needs to be met with a strong interest rate hike trajectory," - Investec.

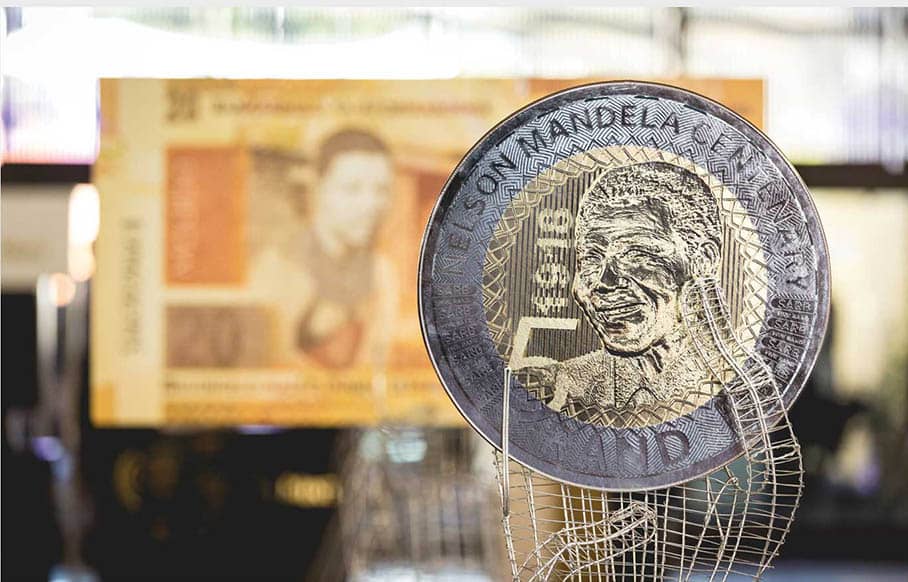

Image © SARB

The South African Rand fell to two-year lows in the penultimate session of the week and could be heading toward highly volatile week in which the South African Reserve Bank (SARB) is set to announce its latest interest rate decision amid a bonnanza of other central bank policy pronouncements.

South Africa's Rand was far from being the worst performer among the G20 currencies on Thursday although it did reach its lowest level against the U.S. Dollar since August 2020 and is potentially about to embark onto something of a rollercoaster ride.

"South Africa’s Monetary Policy Committee (MPC) will deliver its next interest rate decision on 22nd September, one day after the FOMC meeting on the 21st," says Annabel Bishop, chief economist at Investec.

"The US is likely to frontload its rate increases, as concerns of recession in 2023 are growing. A high level of uncertainty persists in global markets for the economic outlook, while risk to inflation is still seen to the upside," she wrote in a note to clients following Tuesday's release of U.S. inflation figures.

Thursday's losses come days after Bureau of Labor Statistics data revealed a fresh upturn in the core rate of inflation that could have game-changing implications for Federal Reserve interest rate policy next Wednesday, which matters for the Rand and all other currencies.

Above: USD/ZAR shown at daily intervals alongside GBP/ZAR. Click image for closer inspection.

Above: USD/ZAR shown at daily intervals alongside GBP/ZAR. Click image for closer inspection.

With some Fed officials having expressed increasing concerns about rising inflation expectations, which are thought to lift actual inflation rates, and begun citing the approach of 1980s Fed Chairman Paul Volcker as a model for dealing with inflation there may now be a risk of an exceptionally large interest rate step from the Fed next week.

"Looking at the immediate future, the balance of risk has tilted from concerns about a possible weak US CPI number today to instead thinking about whether a 100bp Fed rate hike is on the slate for the 21 Sep FOMC. In this circumstance, the near-term path of least resistance for USD is to keep rising, at least until a 100bp Fed rate hike is at least 50% priced in," says Shahab Jalinoos, head of FX trading strategy at Credit Suisse, in a Wednesday note.

Mounting market expectations for next Wednesday's decision have lifted the Dollar and weighed on the Rand, which is typical of the market response to any significant U.S. interest rate step, although it is far from assured that this reaction would be repeated if the Fed actually delivered something as large as what markets are expecting.

Even more so if the Fed outhawks the markets with a Volckerian interest rate decision next week, although many analysts do still hold bullish outlooks for the Dollar while Rand gains have been limited and short-lived in the wake of South African Reserve Bank interest rate decisions during recent months.

At the very least, the above may mean there is a risk of significant volatility in the Rand over the coming week no matter what the Fed and SARB decide.

Above: USD/ZAR shown at weekly intervals alongside GBP/ZAR. Click image for closer inspection.

"Inflation, interest rates and economic growth continue to dominate market concerns, although the latter is seen as the least of the problem, with the overwhelming view from most Central Banks that high inflation needs to be met with a strong interest rate hike trajectory," Investec's Bishop said this week.

"With FOMC members, particularly Jerome Powell, communicating increasingly in favour of a 75bp increase in US interest rates, South Africa is now seeing a significant probability of one too next week," she added.

The SARB raised its cash rate by 75 basis points to 5.5% back in July in what was the largest increase since shortly after the turn of the new millenium.

It cited recent increases in inflation expectations and raised forecasts for South African inflation during the months and years ahead but gave no details about the likely path of the cash rate up after saying previously that "gradual normalisation" was most likely through 2024.

Since then the overall rate of South African inflation has risen to 7.8%, which above the top end of the SARB's three-to-six percent target band, while after overlooking stratospheric energy and food prices the rate of core inflation increased to 4.6% in August.