Pound-Canadian Dollar Rate Testing 1.75 as Bullish Trend Builds on Charts

- Written by: James Skinner

- GBP/CAD testing 1.75 ahead of landmark update from BoE

- May see pullback if BoE bats away rate hike, QE taper talk

- Or if CAD mounts recovery, but dominant trend still bullish

Image © Adobe Stock

- GBP/CAD reference rates at publication:

- Spot: 1.7445

- Bank transfer rates (indicative guide): 1.6834-1.6957

- Money transfer specialist rates (indicative): 1.7323-1.7358

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Pound-to-Canadian Dollar exchange rate was closing in on multi-month highs when testing 1.75 during the mid-week session, amid price action that is cultivating an increasingly bullish trend on the charts.

Pound Sterling slipped back into the lead of the G10 contingent of major currencies for 2021 when advancing back above 1.7380 against the Canadian Dollar on Tuesday of this week amid a softening of the Loonie.

This is after Canada’s Dollar turned away from last week’s highs against the U.S. Dollar and amid range-bound trading in the main Sterling exchange rate GBP/USD ahead of Thursday’s Bank of England (BoE) monetary policy decision.

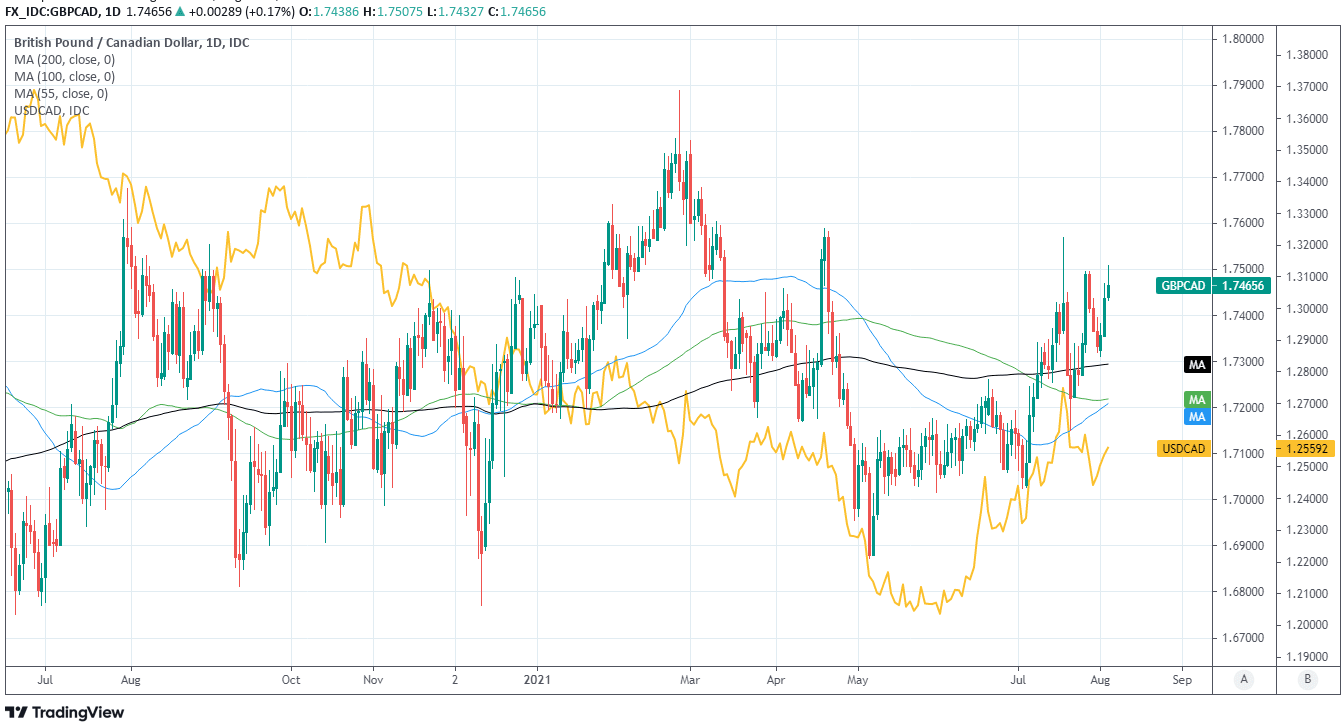

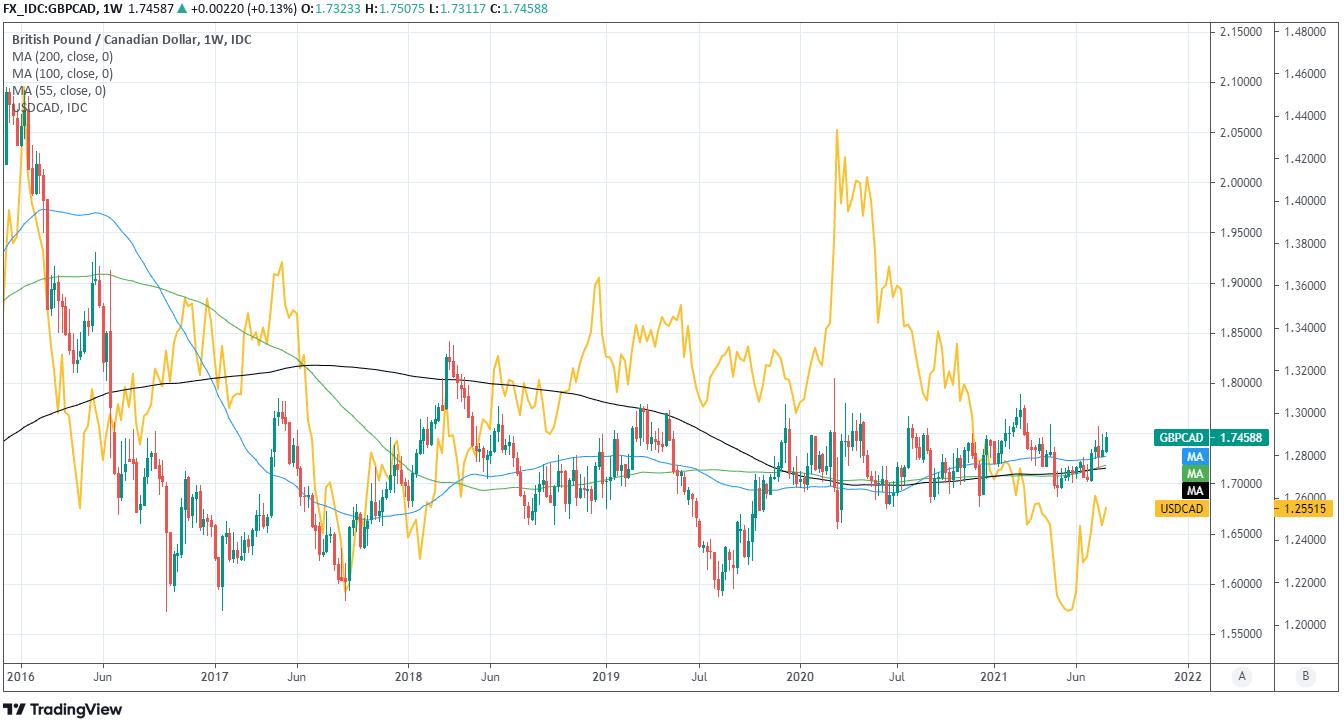

The underlying Pound-to-Canadian Dollar rate trend is increasingly bullish on the charts irrespective of whether viewed from a short, medium or longer-term angle, which has got strategists at Scotiabank watching for a possible advance toward 1.7585 over the coming days.

“Trend signals across the short, medium and long-term oscillators are in GBP-bullish territory, suggesting a push through 1.7460 is likely to occur in the next few days. The position of the trend oscillators and the bullish daily set up suggests the GBP will retest the 1.7585/00 area at least in the next few days if the pound can break through 1.7460,” says Juan Manuel Herrera, a strategist at Scotiabank, writing in a Monday research note.

Above: GBP/CAD at daily intervals with 55 (blue), 100 (green) and 200-day (black) moving-averages, alongside USD/CAD (yellow).

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Everything depends for GBP/CAD on a combination of whether the main Sterling exchange rate GBP/USD holds above Wednesday’s 1.39 handle through to the weekend, and if the Canadian Dollar itself remains on its back foot.

The Pound-to-Canadian Dollar rate would rise as far as 1.7793 if USD/CAD returned to its recent high of 1.28 over the coming weeks and if at the same time GBP/USD stayed a steady course, or vice versa.

However, and before that could happen the Pound must first navigate Thursday’s BoE decision, which will see new forecasts for GDP growth, inflation and other economic variables unveiled in a new Monetary Policy Report, at the same time as decisions on interest rates and quantitative easing (QE).

“Expect BoE commentary to be largely dovish, citing one-off or transient factors as responsible for the inflation surge, and receding heading into 2022, with CPI returning to target over the medium term,” says Christopher Graham, a Europe economist at Standard Chartered, anticipating a potentially stifling outcome for Sterling.

Recently expectations of the BoE have moderated after July’s commentary from Monetary Policy Committee members Michael Saunders, David Ramsden, Jonathan Haskel, Catherine Mann and Ben Broadbent cultivated the impression of there being a fine balance on the committee between those who view current policy as appropriate for the foreseeable, and those who think it may soon be necessary to reduce monetary support for the economy.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“We see two-way directional risks around 1.40 [GBPUSD] as summer trading conditions prevail. That would also favor buying into dips,” says Ned Rumpeltin, European head of FX strategy at TD Securities, in what is a potentially bullish outlook for GBP/CAD.

“Ultimately, we think the USD will likely remain primarily anchored to familiar ranges against most G10 currencies — GBP included. That also means that risk sentiment will remain a key driver regardless of what the BoE delivers,” Rumpeltin says.

With actions and guidance for future policy aside, the most important item inside the various documents published on Thursday will be the bank’s inflation forecast for the third quarter of 2024; most notably, where it sits in relation to the BoE’s 2% target for the consumer price index inflation rate.

Balanced expectations set a high bar for Sterling to come away from Thursday’s meeting disappointed, and may see the Pound-to-Canadian Dollar rate looking to the positively-correlated USD/CAD and Friday’s Canadian job data for direction ahead of the weekend.

GBP/CAD often correlates well with USD/CAD, which will also be sensitive to the outcome of Friday’s non-farm payrolls report from the U.S.

“USDCAD’s late July move lower has stalled and may be reversing,” says Scotiabank’s Herrera. “The move higher from Friday’s low is impulsive and is developing strong, if only short-term at the moment, upward momentum. The USD’s breach of the 1.2525/30 zone, which was the base of the late July sideways range for the USD, implies scope for additional gains towards 1.2605 which was the top of that range.”

Above: GBP/CAD at weekly intervals with 55 (blue), 100 (green) and 200-week (black) moving-averages, alongside USD/CAD (yellow).