Buy Australian Dollar on the Dips: Westpac

- Written by: Gary Howes

- Buy AUD on dips

- AUD is 2022's top performer

- But near-term USD poses headwinds

Image © Adobe Images

The Australian Dollar is 2022's top performing major and any bouts of weakness - as seen in the past week - are likely to be short-lived says a major Australian lender.

Strategists at Westpac remain constructive on the Australian Dollar, with further support likely to emerge from the Reserve Bank of Australia's (RBA) recent admission that interest rates will need to rise over coming months.

"The RBA sparked highs since June 2021 but the reversal was swift. Strong US$ should cap A$ in the week ahead but multi-week we are still inclined to buy dips rather than call a top in the rally," says strategist Sean Callow at Westpac in Sydney.

The Australian Dollar jumped to new highs against the Pound, Euro and U.S. Dollar earlier in the week on RBA guidance on the need for interest rate rises over coming months.

"Just as the Aussie lost some of its commodity price support, the RBA discarded its 'patient' outlook, stoking a fresh wave of yield support for the currency," says Rennie.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The RBA at its March updated dropped the communication that it is "prepared to be patient" when considering raising interest rates.

It acknowledged a strong uptick in Australian economic activity and inflation, as well as low unemployment and signs of rising upward pressure on wages.

The market now expects up to 200 basis points of rate hikes to be delivered by the RBA in 2022, which amounts to a frantic pace of rate hikes that would need to be delivered to keep AUD bid.

"The RBA dropped its 'patient' stance, backed by more confidence on the wages outlook as vacancies soar. This sparked steep A$ gains," says Rennie.

The Australian Dollar-U.S. Dollar exchange rate rose to a high of 0.7661 while the Pound to Australian Dollar exchange rate fell to 1.7175. (Set yourself a rate alert, here).

But the Aussie ultimately gave back its gains and retreated against its major peers as traders appeared to 'sell the fact' of the RBA's pivot.

However Westpac view the Australian Dollar's initial reaction to the RBA's guidance as being instructive as to what the future holds.

"The scale of the rally – from 0.7540 pre-RBA – was striking, given how aggressive market pricing of the cash rate was even before the meeting," says Rennie. "This suggests that the RBA’s less dovish stance could provide substantial fresh support to the currency which already enjoys very elevated commodity prices."

This week's losses by the currency were also aided by a decline in commodity prices, most notably in energy prices.

The Australian Dollar had rallied sharply as the war in Ukraine pushed global commodity prices sharply higher, offering Australia improved terms of trade given the country's rich natural resource base.

It therefore stands when commodity prices moderate so too would the currency.

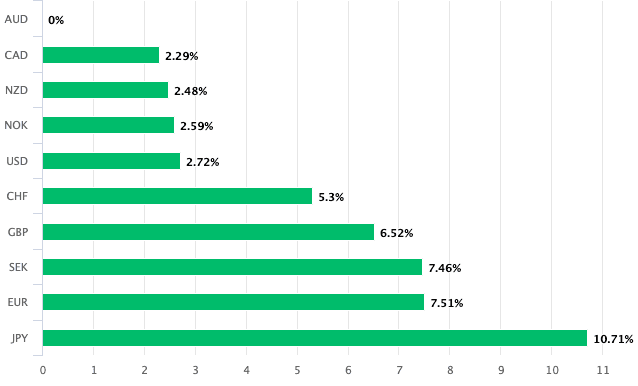

Above: AUD is still 2022's king.

For now however the Australian Dollar's pullback from recent highs appears temporary and momentum favours the antipodean currency which could press fresh multi-year highs again before long.

"On the multi-week view, we are still inclined to buy dips rather than call a top in the rally," says Rennie.

But near-term Australian Dollar bulls should be wary of headwinds in the form of a strong U.S. Dollar which itself is benefiting from central bank rate hike expectations.

The U.S. Federal Reserve's minutes for the March policy meeting were released midweek and showed policy makers were becoming increasingly agitated by surging inflation.

They hinted that a series of 50 basis point hikes could be delivered at upcoming meetings.

This stoked the months-long U.S. Dollar rally further, and although this source of support will inevitably fade for now it keeps the U.S. currency elevated.

When the U.S. Dollar withdraws the next leg of the Aussie Dollar's rally could be initiated.