GBP/EUR: Analysts Hold Positive Bias Post-inflation

- Written by: Gary Howes

Image © Adobe Images

"Overall, we maintain a relatively positive bias on GBP vs. EUR" - Nomura.

Pound Sterling will be preferred to the Euro say analysts who expect the Bank of England to embark on a more gentle rate cutting path than peers at the European Central Bank.

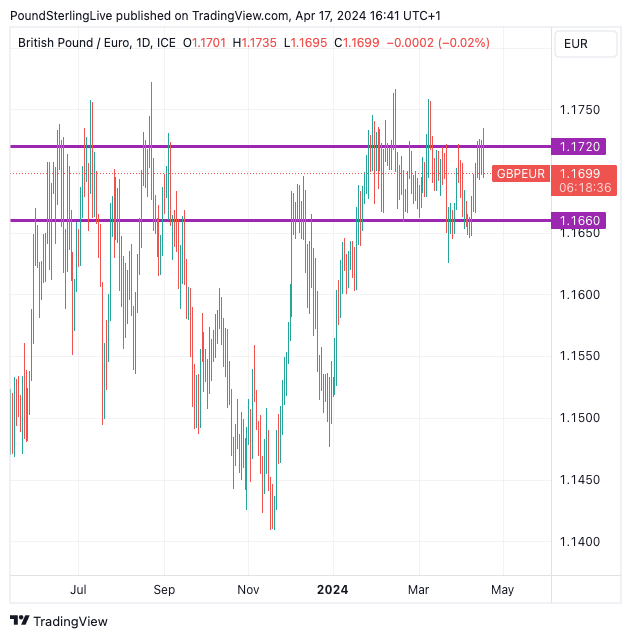

The Pound to Euro exchange rate tested the upper limits of the 2024 range near 1.1720 in the wake of March inflation data that proved firmer than markets were expecting.

Pound Sterling was amongst the day's best-performing currencies after headline CPI read at 3.2%, exceeding estimates for 3.1%. A strong service CPI inflation print - something the Bank of England watches closely - of 6.0% that signalled to analysts that inflation was unlikely to anchor at 2.0% in the coming months.

"Sterling got a much-needed lift from just released modestly hotter than expected UK CPI data. Both headline and core prices fell but proved stickier than consensus expectations," says Jamie Dutta, Market Analyst at Vantage. "The key number for rate setters at the Bank of England is the services inflation figure. This didn’t fall as much as forecast."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Although the Pound initially rallied against the Euro, it ultimately gave most gains back, confirming near-term strength is difficult to achieve when markets expect the Eurozone and UK to follow the same economic paths.

In the near term, range-bound trading in GBP/EUR is likely to persist. But some analysts say a breakout higher is on the cards as divergence will eventually emerge with the Bank of England cutting interest rates at a more gradual pace than the ECB.

Above: GBP/EUR at daily intervals. Track GBP/EUR with your own custom rate alerts. Set Up Here

The smaller-than-expected fall in UK inflation "raises the risk that inflation will follow the trend in the US and soon stall," says Ruth Gregory, Deputy Chief UK Economist at Capital Economics.

"The chances of interest rates being cut for the first time in June are now a bit slimmer," she adds. The European Central Bank has meanwhile signalled it is on course to cut rates in June.

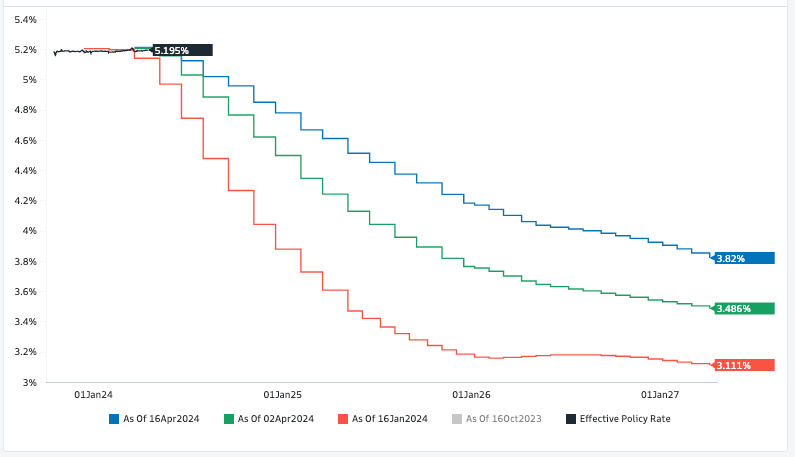

Markets have meanwhile lowered expectations for the number of UK rate cuts in 2024 owing to the sharp repricing in rate cut expectations in the United States on account of signs U.S. inflation is accelerating once more.

Markets are now pricing in just 40bp of rate cuts from the Bank of England by year-end; even September is no longer fully priced. Rewind to just two weeks ago and the market was saying a June rate cut was likely, with August fully priced.

"Based on a late-moving Bank of England compared to the European Central Bank, we stick to our robust outlook for the pound sterling," says David Alexander Meier, an analyst at Julius Baer.

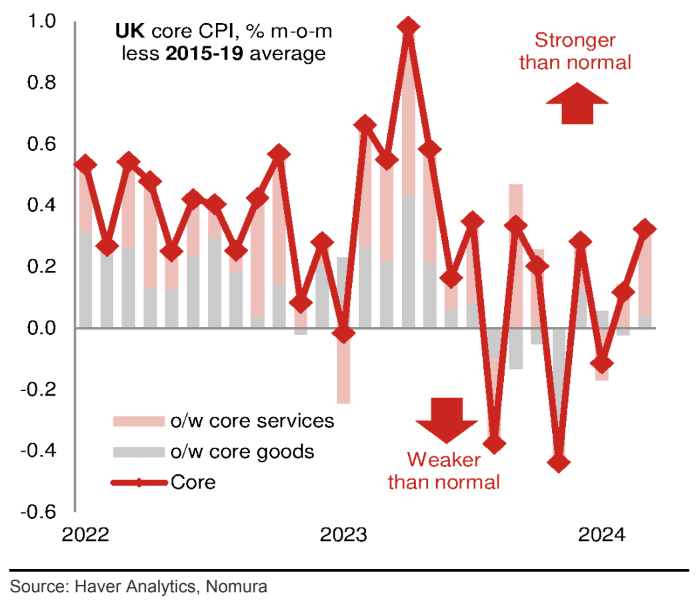

Above: "Another month of above-normal core price momentum" - Nomura.

Although the UK's headline inflation rate will fall to 2.0% in next month's report, strong core inflation will mean it rises back above the 2.0% target in the coming months. Market participants expect this will prompt the Bank of England to maintain a cautious approach to cutting rates.

While the recent repricing in expectations has not boosted the Pound vs. the Dollar, it offers the UK currency support on some important crosses. In fact, when screened over the past week, the Pound is third to the Dollar and Franc in the top-performer stakes in the G10.

Michael Pfister, an analyst at Commerzbank, says there is an assumption that inflation risks in the UK are rising again and that the Bank of England, like the Fed, will respond with a "high for longer" stance on interest rates.

"Although the core rate is likely to fall towards 3-3.5% year-on-year in the coming months, the data do not suggest much more at the moment. And until that changes, the market is likely to remain cautious on rate cut expectations and tend to follow the Fed's lead," says Pfister. He adds that this is one reason to "remain cautiously optimistic on the pound."

Above: Bets for rate cuts have been slashed during 2024, helping support the Pound. Image: Goldman Sachs.

Economists at investment bank Nomura have revised their expected path for UK interest rates following the inflation release, saying they now see fewer cuts on the horizon.

Previously, economists had expected a cut at every meeting between August 2024 and February 2025. They retain the view that the Bank will begin easing in August this year, with further 25bp cuts in November 2024 and at each Monetary Policy meeting in 2025 (February, May, August, November). Previously the bank was expected to cut at each meeting after August.

The ECB is expected to cut rates at a faster pace, starting in June and then in July and September.

"We forecast there will be more downward pressure on EUR/GBP from a monetary policy-divergence perspective. Furthermore, the rise in crude oil prices have affected the terms of trade less in the UK than that of the euro area. Overall, we maintain a relatively positive bias on GBP vs. EUR," says Yusuke Miyairi, a foreign exchange strategist at Nomura.