Pound Sterling: Inflation Surprise Sees Rate Cut Hopes Fade

- Written by: Gary Howes

Image © Adobe Images

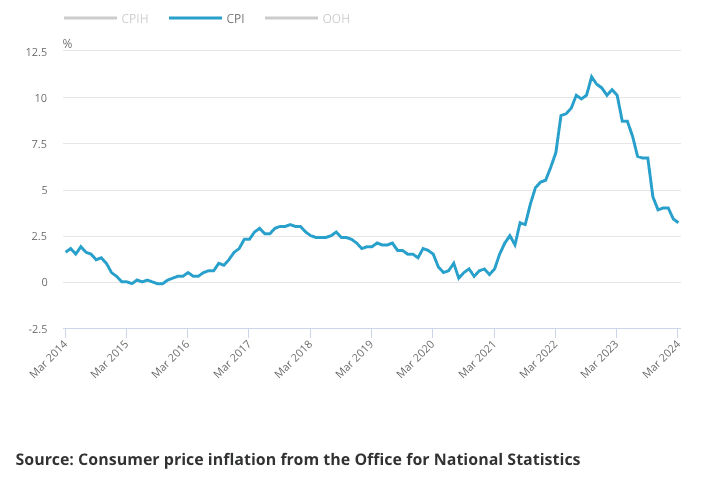

The British Pound has received a boost after the latest UK inflation print exceeded expectations and shifted the odds in favour of an August interest rate cut.

The Pound to Euro exchange rate rallied to 1.1735 in the minutes following news headline CPI inflation in the UK rose 3.2% year-on-year in March, down from February's 3.4% but beating market expectations for 3.1%.

The all-important core CPI inflation rate rose 4.2% y/y said the ONS, down from 4.5%, but beating market expectations for 4.1%. Services inflation eased slightly from 6.1% to 6.0%. This level is still too high to be consistent with an imminent rate cut from the Bank of England.

"Services CPI – which is what the Bank of England is mostly looking at – only slowed from 6.1% to 6.0%, against consensus and the BoE itself projections for 5.8%," says Francesco Pesole, FX Strategist at ING Bank. "Along with yesterday’s stickier-than-expected wage figures, it is looking increasingly likely that the first rate BoE cut will only come in August."

The Pound to Dollar exchange rate rose to 1.2468, from 1.2410 ahead of the release, amidst the retreat in rate cut expectations.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Markets had favoured June as the start date for the rate cutting cycle, but some members of the Bank's Monetary Policy Committee recently signalled they would prefer to cut in August. These figures will give this camp of policy setters a stronger hand in upcoming deliberations.

"Quarter point cut in UK interest rates not fully priced in by financial markets until late this year. Today’s inflation and yesterday’s wage data is making investors more cautious about rate cuts," says Andrew Sentance, a former member of the Bank of England's MPC.

Also complicating matters for the Bank of England are expectations that the Federal Reserve will only cut interest rates once in 2024. The Bank of England and other central banks would prefer to move in tandem with the Fed to minimise any potential currency weakness. A weaker Pound-Dollar rate would boost import costs, which is particularly unwelcome given ongoing rises in global oil and gas prices.

For the Pound, what matters is how market expectations for the timing and quantum of rate cut expectations evolve. Tuesday's above-consensus wage data and today's upside inflation surprise will mean a cut in May is off the table.

April's inflation print will determine whether the kick-off is in June or August. Economists expect headline CPI to fall to below the Bank of England's 2.0% target next month owing to the significant base effects of April's fall in household energy bills.

This could provide the cover for the Bank to cut rates by 25 basis points in June, but all signs point to inflation picking up from 2.0% over the coming months, owing to elevated services and core inflation.

Above: GBP/EUR in the minutes following the inflation print. Track GBP/EUR with your own custom rate alerts. Set Up Here

Strong wage and an above-consensus inflation print next month could swing the Bank into preferring an August hike, which would be supportive of the Pound, particularly against the Euro in the event the European Central Bank cuts rates in June.

However, analysts at DNB, the Nordic bank, say they estimate the Bank won't cut rates until November.

"Inflation has fallen markedly and is likely to fall even further. Elevated wage growth and a tight labour market could delay the first rate cut until November and reduce the overall number of cuts," says Knut A. Magnussen, an analyst at DNB Markets. "Wage growth has started to fall but remains too high to be consistent with the inflation target."