GBP/USD Rate Flattened by Another Strong U.S. Inflation Print

- Written by: Gary Howes

Image © Adobe Images

The U.S. Dollar surged after U.S. inflation was stronger than was expected in March, lowering the odds of a June rate cut at the Federal Reserve to less than 50%.

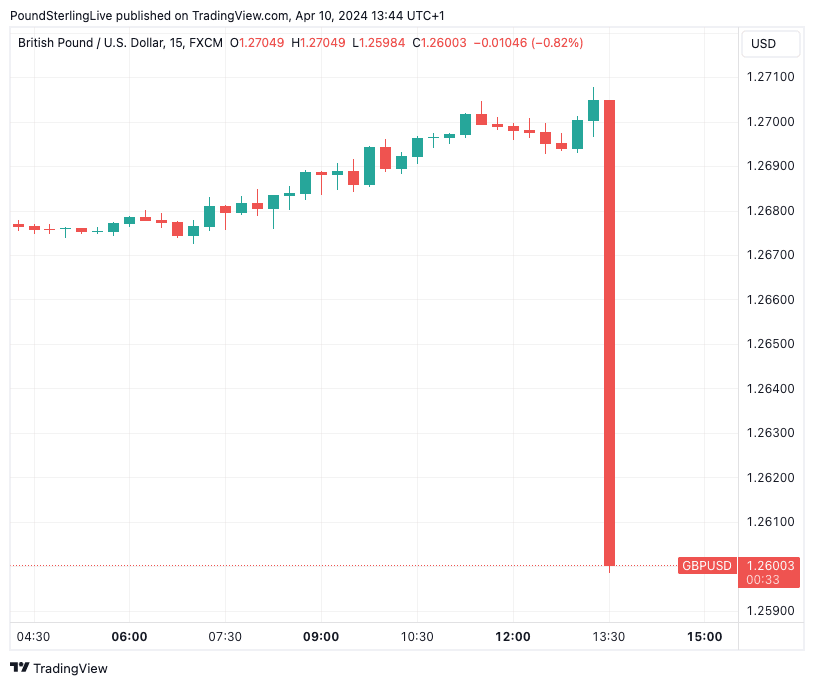

The Pound to Dollar exchange rate dropped by over two-thirds of a per cent in the 15-minute window following news U.S. inflation increased 3.5% year-on-year in March from 3.2% in February, exceeding market expectations for a 3.4% print.

The all-important core measure of inflation rose 3.8% y/y, unchanged on February and above expectations for 3.7%.

Above: There was a strong FX market reaction to the inflation numbers.

According to the BLS, the increase in inflation was driven primarily by an increase in energy prices and shelter costs. These are the latest set of monthly inflation figures that confirm the process of disinflation underway in the U.S. during 2023 has stalled and is now reversing, resulting in diminishing odds of a Fed rate cut in June.

The market headed into the release seeing a 50% chance of a move in June, with a total of approximately 70 basis points of cuts priced for the entire year. The rise in U.S. yields and the Dollar confirm the odds have diminished further following this inflation print.

"Markets seems to have reduced the probability of a cut in June significantly and even a July cut now seems much less probably than prior to the released," says Knut A. Magnussen, an economist at DNB Markets.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

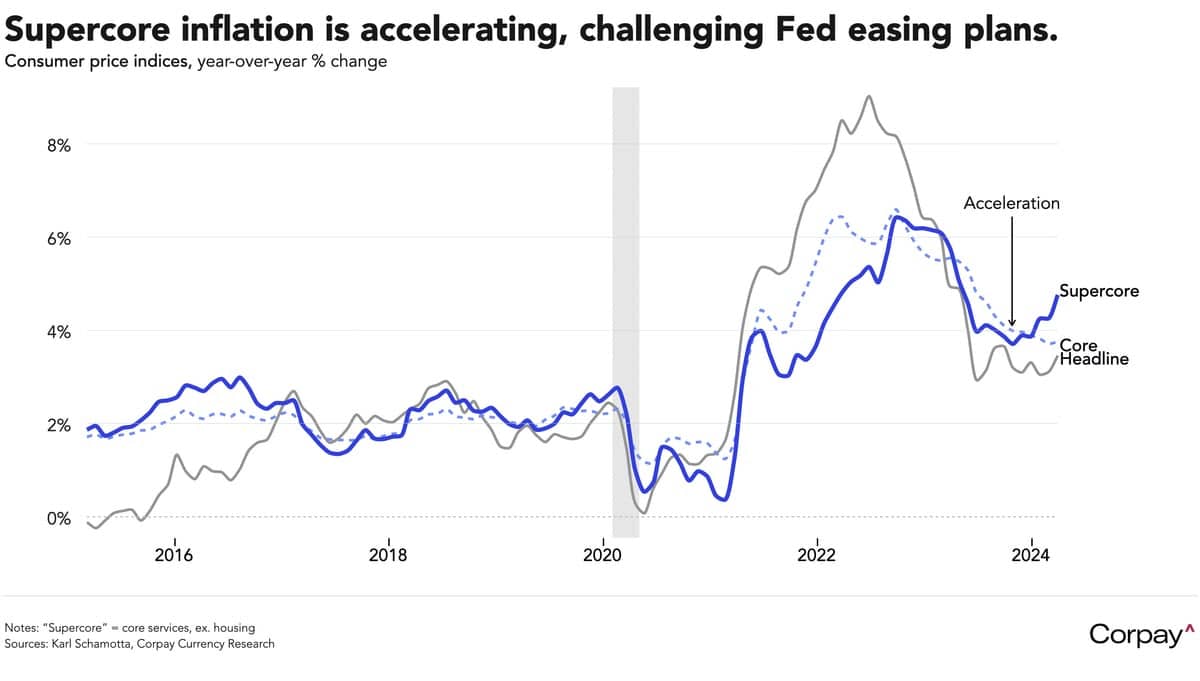

"Today’s data suggests that the underlying inflation trend remains far stronger than markets and Fed officials had previously anticipated, implying that a pivot toward easier policy could be delayed for several months, at the least," says Karl Schamotta, Chief Market Strategist at Corpay.

Schamotta's estimates of the so-called 'supercore' measure, which captures core services minus housing, rose 3.8% relative to a year prior, up from 4.3% in February; "far too hot for the Federal Reserve’s comfort".

Ali Jaffery, an economist at CIBC Bank, says these data means the risk of higher and persistent underlying inflation is the Fed’s number one priority once again, even though inflation is not that far above target.

"The big question for the FOMC is what is behind this pickup in inflation to start 2024. Powell seems to be believe residual seasonality is playing a big role and that still seems plausible. But it is now very hard to also discount the risk that firm demand in the economy is keeping services prices elevated with solid consumer spending and a jobs market that just keeps on giving. That will keep the Fed on hold until the dust settles," he explains.

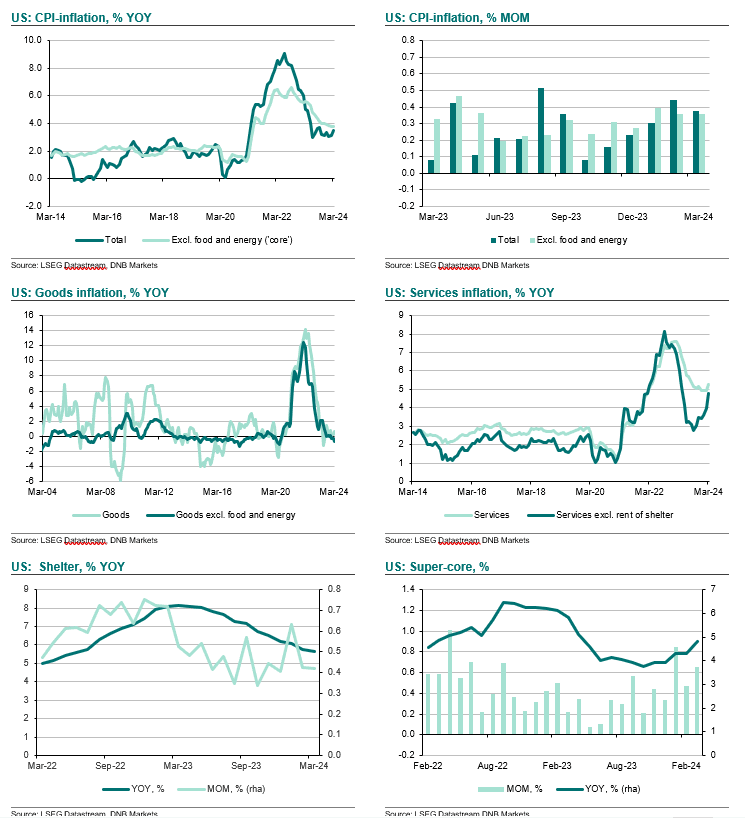

The above suite of U.S. inflation charts are courtesy of DNB Markets.

Dr. Christoph Balz, Senior Economist at Commerzbank, says core inflation, which excludes volatile energy and food prices - and is thus decisive for the underlying trend - signals that inflationary pressure is rising.

Core inflation has amounted to 0.4% in each of the last three months. During this period, prices have risen at an annual rate of 4.5%.

"This is mainly due to core services prices which rose by 0.5% in March. Fed Chairman Powell divides these core services into housing and other services. Rent increases remained stubbornly high in March and price pressure increased further for other services, which are likely to reflect the significant rise in wages in particular," says Balz.