Pound Sterling "Fails to Fly" on News UK Wages Grow 2.2%

- Written by: James Skinner

The British Pound is mixed in mid-week trade following the release of the latest much-watched UK labour market statistics.

The latest labour market figures from the Office for National Statistics continues to show a mixed picture with unemployment staying near record lows and wages creeping higher at a rate well below inflation.

The good news is the average earnings index - which includes bonuses - beat analyst expectations for 2.1% with a reading of 2.2% while the unemployment rate remains at 4.3% after unemployment fell by 52,000 in the three months to August to 1.4 million.

This leaves the jobless rate unchanged at 4.3% from the previous quarter - still at the joint lowest level since 1975 - but the claimant count did rise by 1.7K people, where a rise of 1K was forecast.

The data confirms while the unemployment rate remains at levels not seen since the mid 1970’s, pay growth has only picked up modestly in response to what appears to be an increasingly 'tight' labour market - i.e. one where job vacancies are becoming harder to fill owing to the shrinking supply of job seekers.

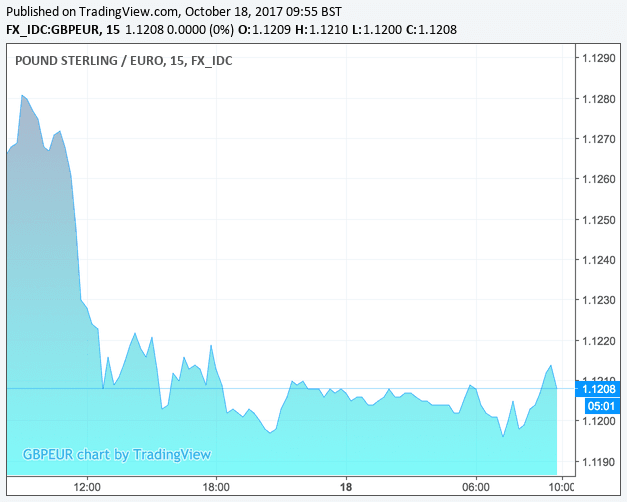

Sterling's reaction indicates the data is consistent with what traders were expecting: the Pound-to-Euro exchange rate is seen trading at 1.1218, up 0.1% while the Pound-to-Dollar trades at 1.3184, down 0.06%.

“Sterling fails to fly, it looks like the rally off the October lows has faded away,” says Chris Beauchamp, Chief Market Analyst at IG, “it’s not been a great week for Sterling bulls. First inflation comes in as expected, disappointing those hoping for a bounce in prices, and then the wage gap stays firmly in place.”

Above: Wage data fails to lift the GBP/EUR exchange rate out of its recent slump.

For the Pound it is the wage growth data that matters as the Bank of England will consider strong wage growth of being indicative of inflationary pressures building, which would in turn prompt further Pound-supportive interest rate rises.

Wage growth is also key when it comes to ensuring demand in the UK economy remains high which in turn keeps growth at robust levels.

But, UK consumers are under pressure.

“Coupled with the yesterday’s increase in the UK CPI to 3% Y-o-Y, real wages continue to fall and are turning more and more negative,” says Krpata Patel, a foreign exchange strategist at ING Group. "With Governor Carney’s speech yesterday being perceived as not overly committal towards the November rate hike, today’s data should add towards GBP negativity, particularly with the fading hopes for sufficient progress on Brexit talks with the EU this week."

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Five Major Reasons Why UK Workers Aren't Seeing Pay Rises

Senior UK Economist at Berenberg Bank, Kallum Pickering has issued an analysis of today’s UK employment data that helps explain why UK wages aren't rising despite unemployment continuing to fall.

"In the UK, just like in the US, Germany and some other countries, unemployment has fallen back to levels consistent with the market’s and the central bank’s estimate of “full employment” (seen around 4.5%).

"In the UK, all key measures of labour market tightness; the unemployment rate, job vacancies, and workers who are economically inactive but want a job, are at levels consistent with record labour market tightness.

"Nevertheless, in contrast to perceived “Phillips curve” wisdom of a clear inverse relationship between unemployment and wage growth, the tightening of the labour market has not gone along with a pronounced acceleration in wage inflation."

Pickering outines five major reasons for this persistent wage moderation:

(1) workers seem prepared to accept lower wage growth in exchange for job security;

(2) the demise of the traditional employment trends has altered wage setting behaviour;

(3) with increasing globalisation national labour markets are becoming less relevant for domestic wage inflation over time;

(4) increasing rates of female participation and of older workers raises total labour supply; and

(5) increased competition from new types of capital – think robotics - can weigh on wages.

"One further point on the UK: the long-term risks to potential growth coming from Brexit present further downside risks to wage growth. In our base case, Brexit will reduce UK trend growth to 1.8% from 2.2%. The negative effects on real wage growth could be of a similar magnitude in the long run," says Pickering.

Bank of England Won't be 'Chomping at the Bit' to Raise Rates Again in 2018

To be sure, a November interest rate rise is all but in the price of the Pound. What the currency requires to move higher are indications that further rate rises in 2018 are a strong possibility.

Only strong domestically-generated inflation - the kind caused by growing wages - would really prompt a further shift towards higher rates at the Bank.

The Pound fell sharply over the course of Tuesday after Bank of England governor Mark Carney and MPC members Tenreyro and Ramsden left markets holding an empty bag at the end of a parliamentary testimony on monetary policy.

"With a relatively healthy headline Unemployment rate at 4.3%, investors are understandably concerned about the widening gap between the 3% Inflation levels and 2.2% wage growth. The uplift will be little relief for the Bank of England, as only yesterday Mr Carney once again conceded a weak Pound and growing Inflation as a need to look at interest rates soon," says Alex Lydall, Head of Dealing at Foenix Partners.