Pound Sterling Falls Against Euro & Dollar After Bank of England Readies for a June Rate Cut

- Written by: Gary Howes

File image of Andrew Bailey, credit: Bank of England.

The British Pound fell after another member of the Bank of England's rate-setting committee voted to cut interest rates, and fresh guidance raised the odds of a June start date.

Dave Ramsden voted alongside Swati Dhingra to cut interest rates immediately, a sign that the Bank's Monetary Policy Committee (MPC) is starting to err towards lower interest rates.

But, the statement issued by the Bank was largely unchanged from that issued in March, which signals lingering caution. "Monetary policy needs to be restrictive for an extended period of time until the risk of inflation becoming embedded above the 2% target dissipates," it said.

Therefore, we don't expect a June rate hike to be fully 'priced in' as a result of today's decision, which limits the downside potential in the Pound, particularly against the Euro. However, the two inflation reports that are due before the June 20 policy update will almost certainly settle the question.

The Pound to Euro exchange rate fell to 1.1605 in the wake of the decision, putting it near the previous day's lows. The Pound to Dollar exchange rate fell to 1.2450, its lowest level in two weeks.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

In a press conference following the decision, Bailey sent a rather 'dovish' signal, saying it’s likely they will have to cut Bank Rate and that rates may fall more sharply than the market currently expects.

The Pound's softness can also be explained by the Bank's latest set of economic forecasts: growth was revised higher, but inflation forecasts were lowered, which signals it thinks it is winning the battle against inflation.

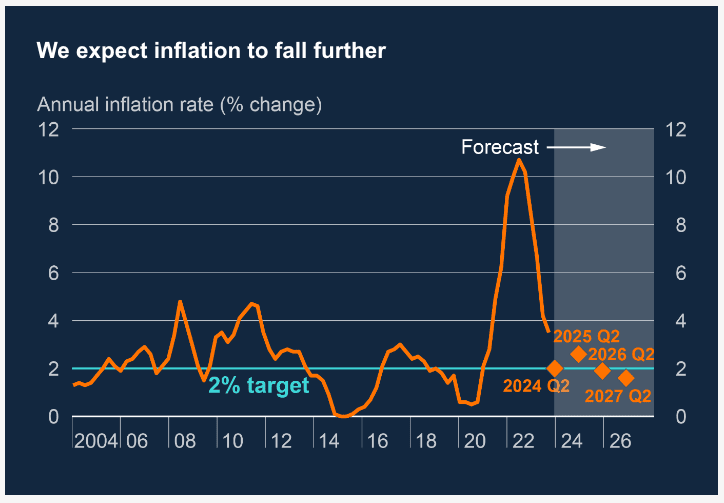

The Bank now forecasts inflation to read at 2% for the second quarter before moving up to 2.6% in a year’s time (previously, it had expected inflation to rebound to 3.0%). Inflation then falls back to 1.9% in 2026. These signals forecast to the Bank that interest rates are currently too high.

Image: Bank of England

By selling the Pound, the market says it has interpreted the Ramsden vote cut and the downgrade to forecasts as signs the Bank will cut interest rates in June.

Nevertheless, market pricing shows the odds of a June rate hike remains at roughly 50/50 following the Bank's May update, hinting at a lingering concern that upcoming inflation numbers won't provide the Bank with the incentive to pull the trigger on rate cuts.

This uncertainty will limit GBP downside in the coming days.

"June/August still a coin toss for the first rate cut. MPR appears to be weighing up contrasting data on headline CPI progress - and concerns over the persistence of services inflation," says Simon French, an economist at Panmure Gordon.

Although the Bank's forecasts signal inflation is trending lower, there remain concerns that inflation in the services sector of the economy remains too high, currently at 6.0% y/y. If services inflation doesn't come down, headline inflation will potentially remain above 2.0% and ultimately prevent it from falling back to 2.0% sustainably.

Because services inflation is largely a function of high wages, the Bank continues to place emphasis on upcoming job and wage reports.

If this month's ONS release undershoots expectations, we would expect a June hike to become more likely, which would weigh on the Pound. But, a strong report would almost certainly knock the timing of such a hike into August.

This can support Sterling.

"We think some soft inflation and wages data may be enough to prompt it to cut rates at the next meeting in June, if not at the following meeting in August," says Paul Dales, Chief UK Economist at Capital Economics.