GDP Wows, and Pound Sterling Recovers Against Euro and Dollar

- Written by: Gary Howes

Image: Dave Collier, sourced: Flickr, licensing: CC 2.0.

The British Pound has rallied against the Euro, Dollar and other currencies after UK economic growth rebounded strongly in the first quarter.

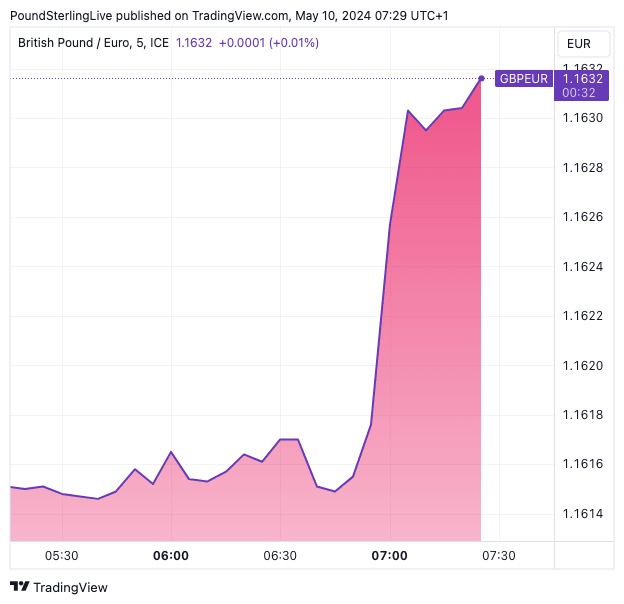

The Pound to Euro exchange rate rallied to 1.1630 after the ONS said UK GDP rose 0.6% quarter-on-quarter in the first quarter of 2024, outstripping consensus expectations for 0.4%.

"Wow. Big beat for the UK econony. I am feeling more comfortable about my growth estimate of 1.2% for 2024 vs consensus at 0.4%," says Simon French, an economist at Panmure Gordon.

The final two quarters of 2023 registered negative growth, meaning the UK had entered a recession. But today's update confirms the recession was shallow and short-lived. Year-on-year growth stood at 0.2% in Q1, which was more than the consensus estimate for a flat 0%.

Above: GBP/EUR showing the post-GDP release reaction. Track GBP with your own custom rate alerts. Set Up Here

According to money market pricing, these data surprises have pushed back the chances of June rate cut from 45% to 40%, which explains the recovery by Sterling. The Pound to Dollar exchange rate has risen back above 1.25 to quote at 1.2540 at the time of writing, suggesting markets might be ready to put a floor under the recent Bank of England-inspired weakness.

"The UK is clearly entering a more optimistic period. The government will be hoping to take advantage of this in the lead up to the general election, however, there are still factors, such as productivity and manufacturing struggles, that will weigh on economic growth for some time," says Richard Carter, head of fixed interest research at Quilter Cheviot.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Much of the growth was driven by a rise in consumer spending, which picked up by 0.2% q/q, confirming the ongoing falls in inflation are having an impact.

Encouragingly, total business investment recorded another sizeable gain at 1.4% q/q, which is the right kind of growth as it can help boost productivity in the economy.

Net trade - which was a particularly noticeable drag in Q4 - was helped by a sharp fall in imports, which boosted GDP growth by 0.4ppts.

Although the British Pound is stronger in response to these data, we see limited upside potential ahead of next week's labour market data release and the following week's inflation print.

Although June rate cut bets have receded following today's GDP print, the two upcoming inflation and wage releases will ultimately determine whether the Bank of England proceeds with an interest rate cut in June.

Undershoots in these data prints would firmly suggest a June cut, which could potentially weigh on the Pound.

"The economy is still fairly weak. Even so, all the early indicators suggest that GDP growth rose robustly in April as well. At the margin, this may mean the Bank of England doesn’t need to rush to cut interest rates. But the timing of the first interest rate cut will ultimately be determined by the next inflation and labour market releases," says Ruth Gregory, Deputy Chief UK Economist at Capital Economics.