Euro-to-US Dollar: Forecast, News and Events for the Next Five Days

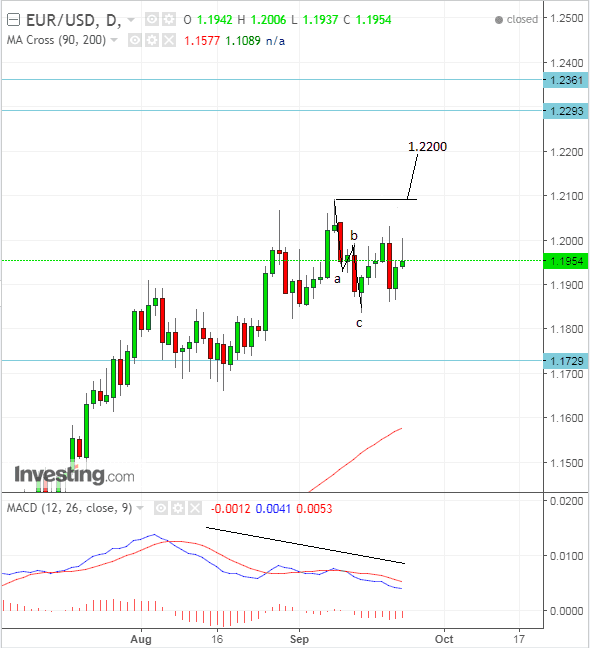

The Euro-to-US Dollar pair is stubbornly clinging onto the 1.2000 ledge despite attempts by Dollar bulls to unseat it; and the pair enters the new trading week in the midst of a still-intact if mature uptrend.

Eventually we see more upside as the established trend extends after a period of consolidation and profit-taking.

Our base case is for a break above the 1.2094 highs confirming an extension to a target at 1.2200.

This comes despite signs the trend is tired, such as provided by the MACD which is diverging from the exchange rate, which means it is falling when the exchange rate keeps making higher highs.

This is a sign of waning upside momentum.

Yet the pair continues to make higher highs and higher lows, which only a break below the a-b-c three wave correction lower would reverse at this stage - which means a move below 1.1837.

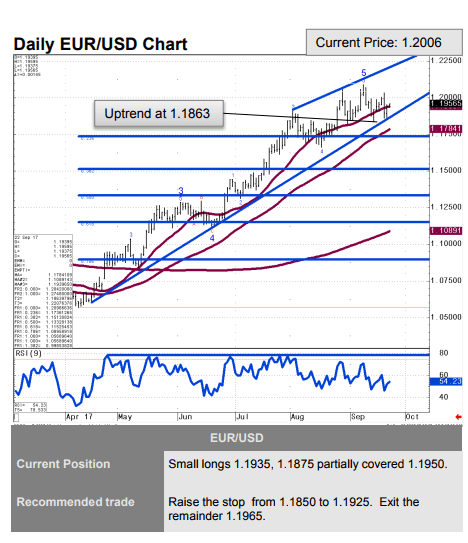

Within the whole uptrend-downtrend debate a key level, according to Lloyds Commercial Banking’s Robin Wilkins, is 1.1850 which because it has ‘held’ continues to frustrate bears with the possibility of a recovery move back up into the 1.21-23 zone.

However, Wilkins is on balance short-term bearish, saying the pair is probably in the process of topping and will then correct back more deeply to 1.15-17 region.

Interestingly, longer-term he sees a recovery, once again, with an eventual target at 1.35.

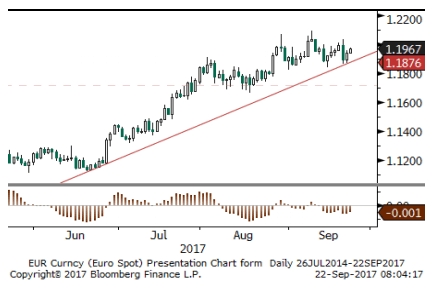

Commerzbank’s Karen Jones also notes the mid 1.18 level (1.1863 in their case) as a key protagonist, as it is where the 5-month uptrend line rests and a break below that trend line would signal deeper corrections.

Like Lloyds, however, they accept that as long as the trendline holds there is a chance of a rebound to the 1.23s.

“EUR/USD continues to hold over the 5 month uptrend at 1.1863. While this holds we remain unable to rule out an extension to the 50% retracement from the move down from the 2014 high at 1.2168 and the 1.2372 200 month ma, but if seen, that is expected to hold,” Said Jones.

Overall, however, she sees a good chance of the trendline eventually being broken and a move lower:

“It should be noted that we consider this to be the end phase of the bull trend. It should also be noted that we consider the chance of a trend break as high,” said Jones.

News, Data and Events for the Dollar

Despite moribund inflation the Federal Reserve reiterated its plan to raise interest rates three times in 2017, at the September Fed meeting last week, leading to a slight recovery in the Dollar.

With 11 Fed speakers scheduled to speak this week, including key Fed personnel: Dudley on Monday, Yellen on Tuesday and Fischer on Thursday, the market is expecting them to reaffirm their view that another rate hike is warranted this year as they are unlikely to have changed their view so soon after the meeting; and any more concrete admissions of a hike will support the Dollar’s recovery.

Also relevant to the Fed is the release of its preferred gauge of inflation the Personal Consumption Expenditure metric on Friday, at 13.30.

Canadian investment bank TD securities expect a slight upwards surprise month-on-month of 0.2% rather than 0.1% from the consensus of economists.

Year-on-year PCE is stood at 1.4%. Ideally it needs to shift higher to warrant the Fed’s hawkish stance but whether that will happen now is debatable – as their view that inflation will catch up is more a medium-term expectation based on the tighter labour market.

There is much debate currently in the analyst community as to whether the Fed is right to just assume inflation will catch up and deserve the rate hike regime they are currently outlining.

There are those – including many Fed officials - who point to the extremely low level of unemployment as indicating wages must and will rise as employers find it increasingly difficult to source labour from the dwindling pool, which will eventually shunt up inflation.

However, the opposite argument is equally compelling, which is that globalisation, automation and the internet are longstanding changes to the global economy which have instituted a new inflation ‘paradigm’ leading to a lower new-normal rate of inflation internationally.

They also point to obstinate deflation in Japan against a backdrop of ferociously low unemployment, and a populace with an engrained work ethic.

In a recent note CIBC make an interesting point about how there is now a gulf between online and offline retail inflation, with offline actually in a deflationary spiral, compared to online which continues rising, and this highlights the discounting effect of the internet.

“A relatively new “Digital Price Index” compiled by Adobe suggests that, within the online space itself, prices have been falling quicker than elsewhere as big players vie for market share (Chart). In other words, the cheap online prices have been getting even cheaper,” said CIBC’s Andrew Grantham.

Back to the hard data outlook for the coming week and the other main releases are as follows, on a day by day basis:

Tuesday, September 26: S&P Case-Schiller House Price Index at 14.00 BST. Consumer Confidence at 15.00 and New Home Sales at 15.00.

Wednesday, September 27: Durable and Core Durable Goods at 13.30. Pending Home Sales at 15.00.

Thursday, September 28: GDP, second estimate of Q2.

Friday, September 29: PCE at 13.30. Chicago PMI at 14.45 and Michigan Consumer Sentiment at 15.00.

News, Events and Data for the Euro

Whilst the result of the German elections are being underplayed as unlikely to deliver a shock because the present incumbent Angela Merkel is likely to be reinstated we think there is still a chance of a shock surprise, especially given Germany has taken on the brunt of the migrant fallout from the Syrian conflict, having allowed in a million immigrants, and the election either will or will not reflect strains caused by this.

The main threat to the Euro is a massive surge in support for the far-right, anti-immigration, anti-EU, Afd party, although this seems unlikely according to analysts and early exit polls.

The most benign result for the Euro, according to CityIndex’s Ken Odulga, is for the two major parties Merkel’s CDU and Shultz’s SPDs to bridge the left-right divide and form a pro-EU, centre –round, coalition, which could work with France’s Macron in establishing the blueprint of deeper European integration.

“Considering that the business-friendly, fiscally conservative and centrist FDP lags the far-right Afd party, chances of Merkel’s ideal coalition occurring look slim, seemingly inching forward the case for a pairing with the SPD—the next strongest polling party after the CDU/CSU. Led by former European Parliament President Martin Schulz, the SPD’s star has faded, but it is still politically the strongest supporter of the most progressive pro-EU policies in the region,” said Odulga.

If Shultz rejects Merkel’s entreaties then the next most likely outcome is a union of her CDU party with their usual partners the business-friendly but right-leaning FDP and the Greens, although this coalition would not be seen as providing much stability so might lead to concern in financial markets.

“If Merkel calls the Schulz’s bluff and the SPD chooses to become the opposition, she is less likely to have enough votes with the FDP alone and may have to allow the Greens on board. This will introduce wider ideological differences between the three, but would not negate a tendency to be forced on board the Macron train. Before that of course, the risk of a longer-than-expected delay for the formation of a coalition would be higher, bringing the first direct risky consequences from the federal elections for stock markets,” said Odulga.

Whatever the end result coalition, however, Odulga sees a material risk the end result will be a pro-European coalition which could point to a deeper integration and therefore support the Euro.