Euro-Dollar Risks Sub-parity Levels and ECB Could Hike If Middle East Tensions Send Oil Prices Soaring

- Written by: Gary Howes

Image © Adobe Images

The European Central Bank could be forced to raise interest rates again in 2024 should Middle East tensions escalate and energy prices spike, but analysts warn hikes would result in a weaker Euro.

The Euro to Dollar exchange rate dipped to 1.0610 following news that Israel launched a series of attacks on Iran in the early hours of Friday.

The Israeli response marks an escalation in Middle East tensions, but the Euro has steadily recovered losses and is at $1.0650 because these attacks were well signposted. Furthermore, Iran appears keen to downplay the attacks, in a sign it is not ready for an escalation. A senior Iranian official tells Reuters news agency "Iran has no plan for immediate retaliation against Israel."

"The key questions for markets relate to the scale of the attack and the damage caused, and the likelihood of retaliation. Iranian state media appears to be playing down the attack and flight restrictions imposed overnight have been lifted," says Neil Shearing, Group Chief Economist at Capital Economics.

Looking ahead, analysts warn that any major escalation from here could result in a weaker Euro-Dollar exchange rate.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

According to Bank of America analysis, any major regional escalation would bring even more intense energy shocks, which would have significant repercussions for the Eurozone economy and ECB.

It says a recession could stretch into 2025, but inflation could bring another 1-2 ECB hikes in 2024.

"Cuts would then have to go faster and further (possibly below 1%) in 2025. Fragmentation risks could even require the ECB to activate its Transmission Protection Instrument (TPI) on a regional scale. The broader the escalation, the larger the potential energy shock to the Euro area via oil and natural gas prices," says Ruben Segura-Cayuela, Europe Economist at Bank of America.

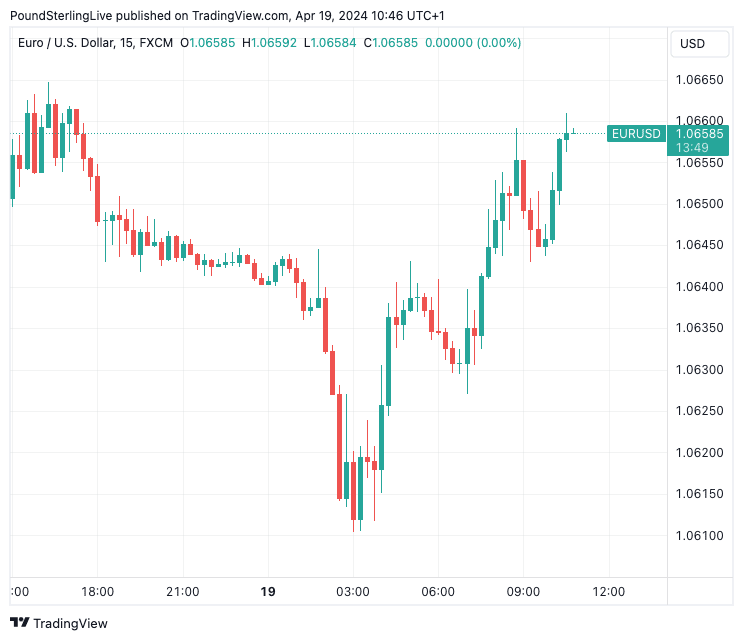

Above: EUR/USD at 15-minute intervals showing the dip and recovery that followed Israeli strikes on Iran. Track EUR/USD with your own custom rate alerts. Set Up Here

In response to the overnight Israeli attack on Iran, analysts at ING say escalation that results in substantially higher energy prices "could lead to a more structural bearish stance on EUR/USD."

The typical rule of thumb says higher rates should result in a stronger currency. But ING FX Strategist Francesco Pesole says if the Middle East situation spirals into a fully-fledged conflict, and there is a major correction in equities and big commodities rally, "then a potential delay in ECB easing plans would hardly do much to support the euro".

If the ECB is hiking, so too will the Federal Reserve, which could further inflame the Dollar rally, putting all the major G10 currencies under pressure.

Athanasios Vamvakidis, a strategist at Bank of America, says if recent geopolitical risks escalate and energy prices increase further, "inflation could increase under some worst-case scenarios, with risk-off, stagflation and no Fed cuts, or even hikes pushing EURUSD below parity."

Looking at less severe scenarios, ongoing bilateral escalations involving Iran could still result in "synthetic" oil and gas prices rising 40% and 20% above the base case for this year and next, according to Bank of America.

"That could be enough for a recession in 2H24. But the ECB would be more concerned about inflation. Cuts would be delayed and hikes discussed, at least this year. Come 2025, cuts would follow to 1.5% or lower at a brisk pace as inflation would be heading to (temporarily even below) zero," says Segura-Cayuela.

Under a relatively contained escalation scenario that leaves oil and gas prices relatively close to current future curves, the ECB would cut three times in 2024 but would be more cautious on the pace of cuts in 2025, albeit still reaching a 2.0% terminal rate by the end of next year.

For now, Bank of America holds a base-case forecast for EUR/USD to remain at 1.07 in Q2, with a "very gradual" appreciation to 1.10 in Q3 and 1.12 in Q4. (This is a downgrade from 1.12 and 1.15 respectively).