EUR/USD: Peak USD Behind us says BNP Paribas

- Written by: Gary Howes

- USD very richly valued

- EUR at record undervaluations

- ECB, Fed divergence to boost EUR/USD

Image © Adobe Stock

Peak Dollar strength has passed and the Euro will show bullish traits in the medium-term shows new research from French banking giant BNP Paribas.

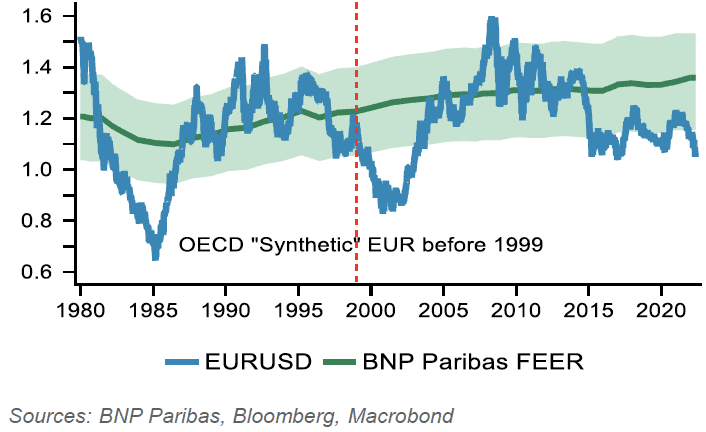

In a regular monthly currency briefing analysts say the Dollar "may be close to its peak" and it now trades "very rich" relative to its long-term fair value as captured by the BNP Paribas FEER model.

"We expect this valuation gap to narrow as central banks outside the US begin their tightening cycles while the Fed's tightening cycle matures," says Alexander Jekov, FX Strategist at BNP Paribas in London.

Above: BNP Paribas' FEER model shows EUR/USD is undervalued.

Further analysis from BNP Paribas finds the Dollar has tended to peak around the time of the start of a Federal Reserve hiking cycle.

The findings come in the same week the Dollar rallied to new multi-year highs, propelled by the promise of further 50 basis point rate hikes at the Federal Reserve and a washout in global stock markets.

Fears of a global growth slowdown meanwhile provides the traditionally supportive backdrop the counter-cyclical Dollar tends to rally in.

The Euro to Dollar exchange rate has accordingly fallen to a low at 1.0475 and does now appear to be stabilising at levels in between 1.05 and 1.06.

But these could be the lows if BNP Paribas is correct.

"We project a broad decline in the USD with EURUSD and AUDUSD rising to 1.14 and 0.80 respectively by the year end and USDJPY declining to 120," says Jeckov.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The Euro is meanwhile considered to be a bullish prospect in the medium term, suggesting a protracted run of losses will soon fizzle out.

"While the EUR has faced broad downward pressure over the past month, much of the downtrend in EURUSD could have been flow-related, with over two-thirds of the move occurring in the periods around market fixings," says Parisha Saimbi, FX Strategist at BNP Paribas.

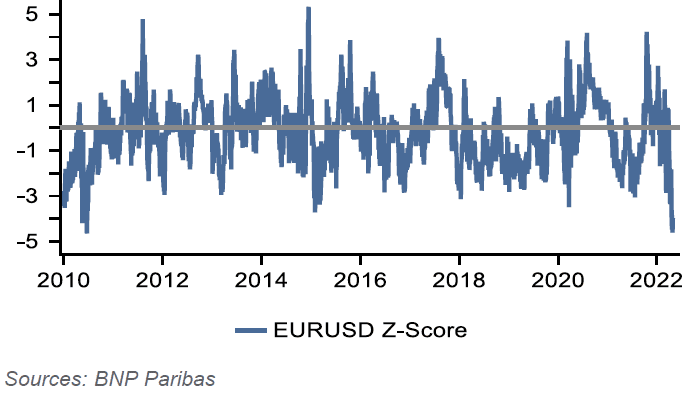

BNP Paribas's custom STEER model meanwhile finds the largest undervaluation in EUR/USD spot since the model's inception. (Set your FX rate alert here).

Economists across the spectrum are now attuned to the prospect of rate hikes coming from the European Central Bank, with signs that a move in July becoming increasingly clear.

The ECB has long favoured ultra-low rates but surging inflation has forced a rethink and members of the Governing Council are increasingly of the view rates should return to above 0%.

This normalisation would provide some interest rate support to the Euro, which has long been lacking.

BNP Paribas now expects the ECB to raise rates earlier than previously envisaged and see a first hike in September, although a move in July is a close call.

They now expect 175bp cumulative tightening through to end-2023 (50bp more than they previously thought).

"With the ECB on course to normalise policy, extreme cheap valuations and extended short positioning in EURUSD (both tactically and structurally in our view), we continue to view the medium-term trend as to the upside. We forecast a rise in EURUSD to 1.14 by the end of 2022 and 1.20 by the end of 2023," says Saimbi.