The Euro-to-Dollar Rate Rallies...but ECB Minutes Vindicate A Bearish Market

- Written by: James Skinner

- EUR/USD rallies into and after open of U.S. session.

- Move coincides with turn higher in global bond yields.

- But comes hard on heels of minutes from ECB meeting.

- Minutes reveal misplaced nature of optimism on outlook.

- Vindicate a bearish market for pricing-in further easing.

© European Central Bank, reproduced under CC licensing

- EUR/USD Spot rate: 1.0817 up +0.06% today

- Indicative bank rates for transfers: 1.0504-1.0580

- Transfer specialist indicative rates: 1.0722-1.0787 >> Find Out More About This Rate

The Euro-to-Dollar rate rallied Thursday as major economy bond yields lifted off earlier lows, although the move came soon after minutes of the latest European Central Bank (ECB) meeting appeared to vindicate the market for its recently bearish view on the outlook.

Europe’s single currency was climbing rapidly alongside U.S., German and other bond yields after the North American trading session got underway, drawing a line beneath earlier losses in both asset classes that were thought to be the result of coronavirus-related risk aversion among investors.

Price action coincides with horse-trading in the European Council over the next seven-year budget of the European Union, with multiple national leaders having rejected proposals for an increase in expenditure over the next multiannual-financial framework that will cover a period of time in which the bloc has one less member to be concerned with.

It’s not clear what triggered the move in the bond market and Euro-to-Dollar exchange rate although by many accounts, both sets of upward moves are the result of foolhardy choices by market participants.

“We see extremely limited scope for EUR appreciation over the coming 12 months. EURUSD parity appears the more likely outcome than any EUR appreciation over the next year,” says Stephen Gallo, European head of FX strategy at BMO Capital Markets. “We currently expect EURUSD to pause in the 1.05-1.08 range during the run-up to mid-year as investors assess the relative performance of economic data, prospects for Fed easing, and US political risks.”

Above: Euro-to-Dollar rate shown alongside 2-year U.S.(red) and German (blue) bond yields. 15-minute intervals.

The Euro had declined with bond yields as investors flocked to safe-haven assets, while shunning the now-unpopular Japanese Yen, for coronavirus-related reasons and was trading near its intraday lows when minutes of the January European Central Bank meeting were released to the market.

ECB President Christine Lagarde spoke with optimism about the outlook for the Eurozone economy in her first outing of 2020 last month which, when combined with other factors, was taken to mean that further interest rate cuts and additional quantitative easing could be ruled out and a slow but steady economic recovery considered to be a prospect.

But Thursday’s minutes suggest that optimism will have been washed away by the coronavirus that’s escaped China and is threatening to extend the global slowdown that wounded the Euro and lifted the Dollar in 2019 and 2018.

“In particular, the results of forward-looking manufacturing surveys appeared to have stabilised,” the minutes say. “It was felt to be important to acknowledge these positive signs and care should be taken to avoid being too slow to change the risk assessment. It was noted that the automobile sector remained a concern and that there were also deeper structural factors affecting this industry that needed to be monitored closely.”

Above: Euro-to-Dollar rate shown at 4-hour intervals.

“Minutes of the January meeting put initial optimism into perspective. When the European Central Bank meets again in three weeks, the macro environment will be even more challenging,” says Carsten Brzeski, chief economist at ING Germany. "Even though we would expect the ECB to look through the short-term impact from any adverse external developments, January's optimism will be hard to maintain at the March meeting. It has happened too often in the recent past that initial short-term or one-off factors quickly morphed into more structural problems for the eurozone economy."

China's economy has been brought to a standstill since late January by a combination of public fears over the infection spreading there and government measures to contain it, both of which are severely disrupting multinational consumer electronics and automotive firms' supply chains.

The rub for the Euro is that many of those automotive firms are headquartered in Germany. And Germany as well as the Eurozone were badly wounded in the 2018-2020 trade fight between the U.S. and China because of their close trade relationship with the world's second largest economy.

“We note that our European economists now expect a 10bp ECB rate cut in Q2. This adds further fuel to our already-bearish EUR views. We see scope for EURUSD 1.0650 and EURCHF 1.05 on a 3-month horizon. Softening euro area inflation expectations already hint in this direction,” says Shahab Jalinoos, head of FX strategy at Credit Suisse in an early February note to clients.

Above: Euro-to-Dollar rate shown at daily intervals.

The trade war experience indicates that Germany and the Eurozone could also be burned badly in the fallout from coronavirus. Hubei province, which is the epicentre of the outbreak, told companies on Wednesday not to resume their operations until at least March 10.

Hubei has been described as “China’s Detroit” because it's a car manufacturing hub and a key provider of parts to multinational supply chains across the globe. But Hubei residents have been under a draconian lockdown since late January, which could soon be felt by already troubled German carmakers.

Any fresh downturn in Germany or the broader Eurozone would simply encourage markets to continue betting the ECB cuts its interest rate even further below zero in the months ahead. And even if a rate cut doesn’t materialise, slower Eurozone growth would still be bad for the Euro-to-Dollar rate.

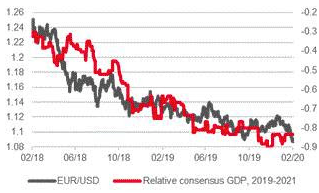

"EUR/USD has tracked the steady downgrading of Eurozone growth forecasts relative to the US during the last two years. The 2020 consensus has remained solid at 1.8% for the US and steady at 1% for the Eurozone, but if either of those moves in the next few years, it will be the Eurozone one," says Kit Juckes, chief FX strategist at Societe Generale, in a note to clients last week. "In real terms, the euro is at levels seen in early 2017 and 2000-2001."

Above: Societe Generale graph showing EUR/USD relationship with relative U.S. and Eurozone growth consensus.