EUR/USD Recovers 1.12 Handle after GDP and German Inflation Data Offer Glimpse of Recovery

- Written by: James Skinner

Image © Adobe Images

- EURUSD advances after GDP and German CPI surprise on upside.

- GDP shows economy rebounding from trough as GER inflation rises.

- Both offer hope to beleaguered EUR bulls, Soc Gen says buy EURUSD.

The Euro advanced steadily against most rivals Tuesday after official data revealed a faster than anticipated pickup in the Eurozone economy during the first quarter, encouraging speculation suggesting the worst of continental economic slowdown is now in the past.

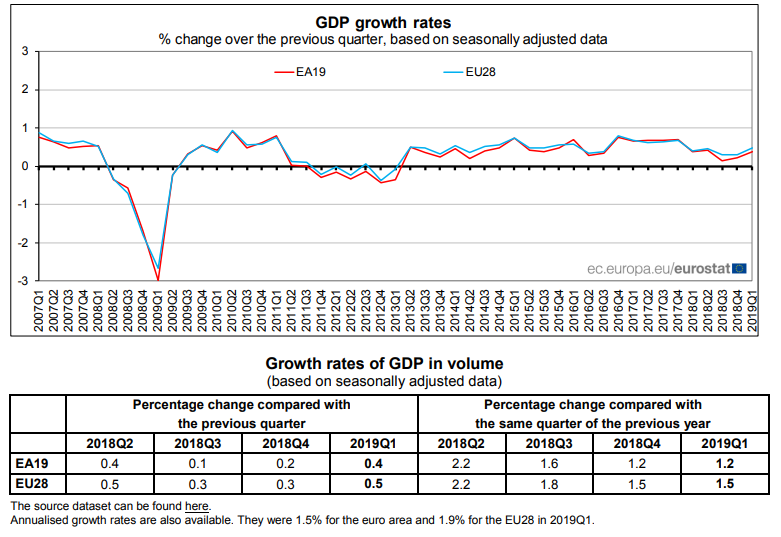

Eurozone GDP growth came in at 0.4% for the opening quarter, up from 0.2% previously and ahead of the consensus for growth of only 0.3%. This ensured the annualised rate of economic growth held steady at 1.2% when it had been expected to decline.

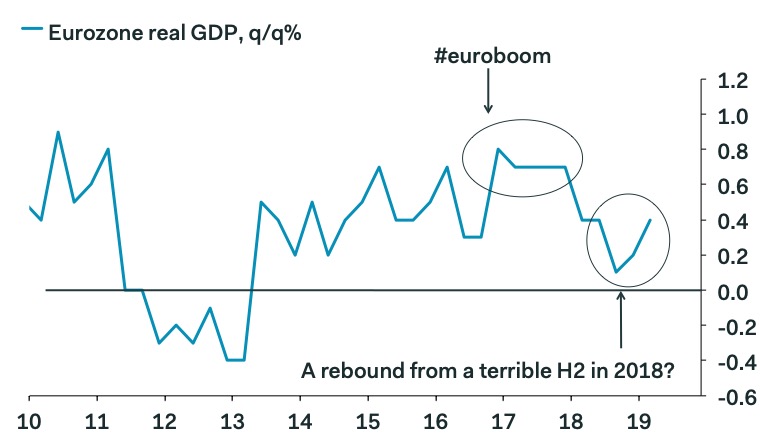

"The improvement in euro-zone growth implies that both Germany and Italy put in better performances in Q1, after contracting in the second half of last year, as we expected. The expenditure breakdowns of the national data that have already been published suggest that domestic demand is likely to have been the key driver of euro-zone growth in Q1," says Jack Allen of Capital Economics.

A breakdown of the different contributions to GDP growth will not be available until late in May but the domestic side of the Eurozone economy has held firm during recent quarters, with much of the weakness in growth emanating from the industrial sector that was hurt by a slowdown in China and other factors.

Tuesday's data follows a March upturn in the Chinese industrial sector that's led some economists to anticipate that a European recovery could soon follow along behind it. The jury is still out on whether Tuesday's boost is entirely a domestic phenomenon or if its something more than that.

Above: Eurozone and EU growth rates. Source: Eurostat.

"We only get one number in the advance report, but the French and Spanish numbers earlier this morning had already signalled that the economy did much better than implied by the surveys in Q1, and this headline confirms this," says Claus Vistesen, chief Eurozone economist at Pantheon Macroeconomics. "In addition, these data also make a mockery of the key survey data, which still appear to be too, sensitive to the slowdown in manufacturing."

Currency markets care about the GDP data because it reflects rising and falling demand within an economy, which has a direct bearing on consumer price inflation, which is itself important for questions around interest rates. And interest rates themselves are a raison d'être for most moves in exchange rates.

The Eurozone economy has been weakening ever since early 2018 although the the third quarter marked a step-change in the deceleration, with growth then reaching levels of 0.1% and 0.2% that are typically associated with economic stagnation and recession risks.

"Full-year growth will slow significantly this year, to just over 1.0%, but that’s primarily due to a weaker statistical carry-over effect from a slow finish to 2018. The growth profile in the first half of the year should be significantly better than in the second half of last year, and today’s data provide strong evidence to that point," Vistesen adds.

Above: Eurozone GDP growth trend. Source: Pantheon Macroeconomics.

A flurry of other positive economic figures also emerged from the Eurozone Tuesday including a lower bloc-wide unemployment rate as well as higher-than-anticipated inflation figures for several key regions in Germany, which were released ahead of the national numbers that's due around 13:00 Tuesday.

Markets are sensitive to changes in Eurozone inflation numbers because its a sustainable return of the Eurozone consumer price index to the target of "close to but below 2%" that could trigger a European Central Bank (ECB) rate hike, although there aren't many economists who're forecasting either of those things to happen any time soon.

"The most that $EURUSD's moved on German North Rhine CPI data ever maybe (came in 1% MoM vs 0.4% prior). 4 other regions before have MoM figures in 0.7%-0.9% as well. Full German CPI data out at 13:00 BST - markets are looking for 0.5% MoM... all may not be lost for $EUR bulls," says Viraj Patel, a strategist at Arkera.

Interest rate decisions are normally only taken in relation to the outlook for inflation but impact currencies through the push and pull influence they exert over capital flows and due to the opportunity they provide short-term speculators.

The European Central Bank's current official line on the subject is that all of its interest rates will remain at their current record lows until "at least through the end of 2019" and markets are pricing-in little chance of a change until well into 2020, although that could easily change in the months ahead, with positive implications for the Euro.

AboveL Euro-to-Dollar rate shown at daily intervals.

The Euro-to-Dollar rate was quoted 0.23% higher at 1.1210 following the release Tuesday, after extending an earlier gain, but it's down -2.1% for 2019, while the Euro-to-Pound rate was -0.22% lower at 0.8629 and has fallen -4.1% this year.

"Almost everyone I know is gloomy about the Eurozone economy, thinks the ECB is out of ammunition, thinks easier fiscal policy is politically impossible and would like a short-covering rally to sell into. A good time to try a long EUR/USD trade," says Kit Juckes, chief FX strategist at Societe Generale, in a note to clients Tuesday.

Juckes told Societe Generale clients on Monday to buy the Euro-to-Dollar rate in anticipation of a recovery above the 1.16 level over the coming months as concerns about a more protracted slowdown in the economy prove unfounded. He says pessimism toward the Euro area economy has gone far enough.

His view is at odds with those of technical analysts, who focus mainly on chart studies of momentum and trends rather than the underlying mechanics of an economy and currency in the manner that Jukes most often does.

"EUR/USD continues to rebound from 1.1110, the May 2017 low. The rebound has so far been tepid but we would allow for a test of the 20 day ma at 1.1233. Intraday Elliott wave counts are negative. Support at 1.1110 is regarded as the break down point to 2019-2019 support line (connects the lows) at 1.1059, the 1.0963 TD support and the 1.0814/78.6% retracement," says Karen Jones, head of technical analysis at Commerzbank.

Above: Euro-to-Dollar rate shown at weekly intervals.

Damage done to the Chinese economy by President Donald Trump's trade war hurt the German and Eurozone economies last year and so too did one-off factors impacting the car manufacturing industry.

Meanwhile, economists have since flagged the Brexit process and prospect of a U.S. tariff fight with the EU as the latest to weigh on sentiment among companies and growth prospects across the bloc.

However, with the Eurozone having been able to expand in spite of the above concerns, the outlook for the Euro-to-Dollar rate could now be turning for the better following a period of lacklustre trading that saw it break beneath the floor of a seven-month trading range last week.

This could also have adverse implications for the Dollar in broad terms too.

This is because financial markets are currently focused on differences in the trajectories of major economies because economic growth differentials are often a reasonable predictor of the gap between yields on short-term bonds of two countries. Yields have significant influence over exchange rates because international capital tends to flow in the direction where the outlook for relative returns is most favourable.

Growth differentials impact the bond market because of what the various economic numbers might mean for central bank interest rate policies across the world. Consensus still suggests the U.S. economy will slow sharply in 2019, ending the Federal Reserve rate hiking cycle in the process, and that a pick-up in growth across other parts of the world will put interest rate rises back on the table in Europe and elsewhere.

Such an outcome would be a death knell for the 2018-2019 Dollar rally that has helped keep the Euro-to-Dollar pair and many other exchange rates under the thumb during recent months, only the 2019 story up until Tuesday had not quite panned out in the way the market had imagined it would.

The European Central Bank (ECB) kicked in March, the anticipated date of an initial interest rate rise from record lows out into the long grass of 2020. Meanwhile, U.S. GDP data for the first quarter was far stronger than many economists had dared to imagine.

However, with the Dollar having been bid higher for the entire month leading up to the GDP release, it's since suffered a period of profit-taking, although the rest of the 2019 year is now still to play for as far as both currencies are concerned.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement