Euro-to-Dollar Conversion in the Week Ahead: Slight Bias to the Upside

- Short-term chart indicating possible recovery

- Caution required as signals mixed, however

- Euro to be driven by inflation data; Dollar by Fed feedback

The Euro ended last week on a bearish note against the U.S. Dollar, trading back down at 1.1335, and at the start of the week ahead we see forces evenly balanced.

There is little evidence to suggest a greater likelihood of a move in one direction over another, although, having said that, if pushed, we see a very marginal bias to expecting more upside.

EUR/USD fell at the end of last week as safe-haven flows supported the Dollar.

These came after comments from China criticised the U.S. for its combatitive trade policy suggesting relations going into the G20 summit at the end of this week - an event in which much store for a breakthrough in relations has been put - remain tense.

The single currency, meanwhile, weakened last week after lax data continued to show a slowdown in the Euro-area.

Both these drivers are unlikely to endure, however, giving us cause to be, ever so cautiously, optimistic, about EUR/USD.

The U.S. is unlikely to want to exacerbated trade tensions with China, both for the negative feedback it could have on the US economy, and because the administration wants to avoid a strong Dollar.

In the Eurozone a major reason for the slowdown in Q3 was the rising cost of crude oil, which fed through into lower GDP. Oil peaked in October, however, and has since lost over 20% of its value. Q4 should look a lot better for growth as lower oil prices and a weaker Euro start to ‘turn the tables’ on recent poor growth.

From a technical perspective, the medium-term trend looks very bearish (with one proviso) but the short-term trend is still arguably just about hanging onto its bullish claim.

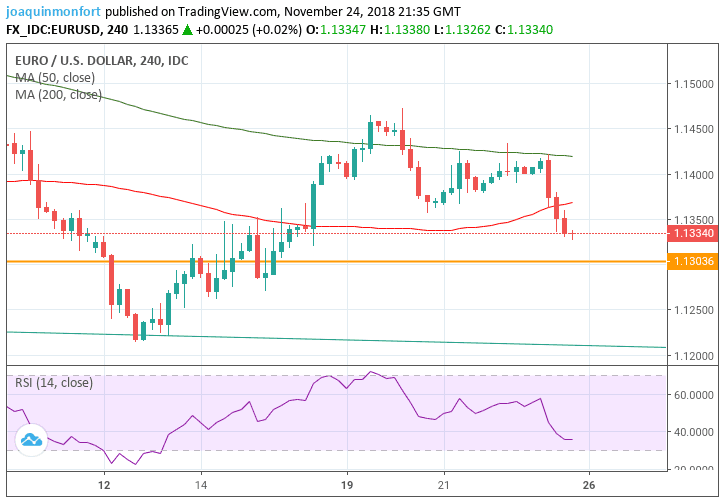

The 4hr chart is the best medium to assess the direction of the short-term trend, and looking at it we notice the uptrending sequence of peaks and troughs which began at the November 12 lows continues to argue for an intact uptrend.

Given the old saying 'the trend is your friend’ this suggests a continuation of the trend higher.

Additionally, the recent decline from the November 20 highs, though forceful, has not yet met the minimum criteria for indicating the birth of a new downtrend, which is two or more lower highs and lower lows. Indeed, it has probably only formed a corrective ABC pattern, which now looks finished, suggesting the possibility of a resumption higher.

We, therefore, see a marginal bias to the short-term uptrend resuming and taking the exchange rate back up to the November 20 highs at circa 1.1470.

This is even more likely given the breakthrough in Brexit negotiations achieved over the weekend with both the sides saying they are ready to ‘sign on the dotted line’.

Longer term, signals are decidedly mixed and it's difficult to determine a clear bias one way or another.

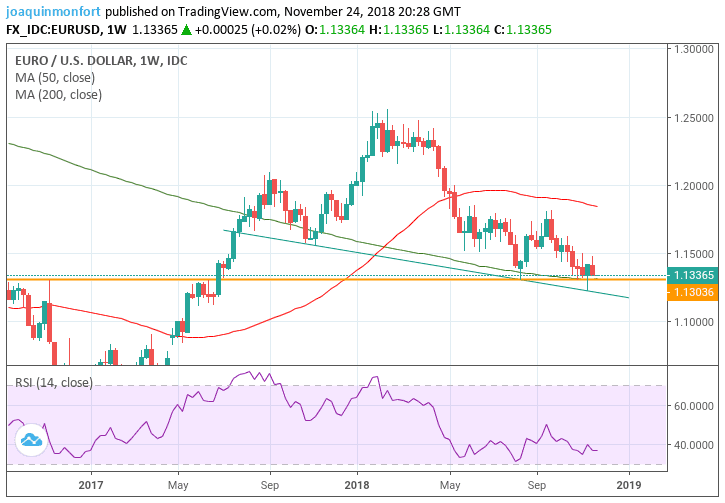

Although the weekly chart is showing a bearish head and shoulders topping pattern, momentum is not supporting more downside, and is instead converging bullishly with price action, which suggests caution should be exercised by over exhuberant bears.

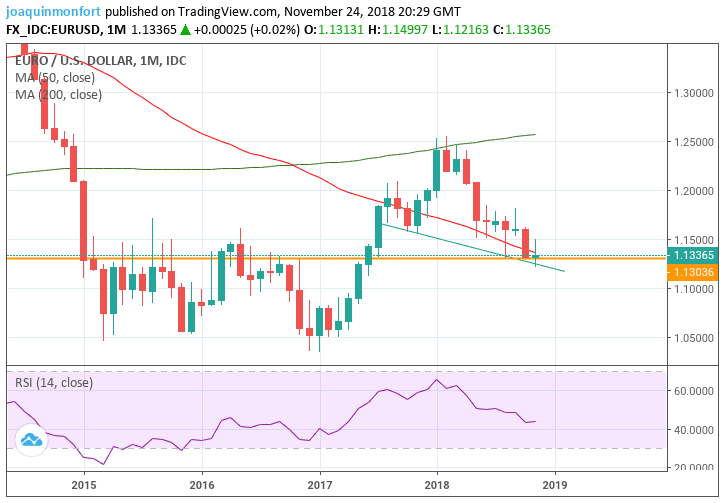

The monthly chart is also quite concerning, after the break below the August lows at 1.1301. Yet, at the same time, follow through to the downside has been so disappointing it brings into question the bearishness of the break.

Thus overall despite bearish signs we remain marginally bullish in the short-term.

Those with international payments in EUR-USD should note at the present time high-street banks are charging a rate in the 1.0950-1.1050 region, independent specialists are providing rates in the 1.1241-1.1260 region. Those looking to make payments are advised to speak to independent specialists to both secure a competitive rate that delivers substantially more currency while also looking at how to protect against a potentially adverse move in Sterling over coming weeks.

The Euro: What to Watch

The most important release for the Euro in the coming week is probably Eurozone inflation for November, out on Friday, November 30, at 11.00 GMT.

Economist forecast headline inflation to rise by 2.1% from 2.2% previously and core inflation to come out at 1.1% the same as in October. A deeper-than-expected slow down inflation growth that would be detrimental to the Euro.

Higher inflation increases pressure on the European Central Bank (ECB) to raise interest rates and this tends to appreciate the local currency. Higher interest rates attract and keep greater inflows of foreign capital, drawn buy the promise of higher returns.

Monday could also be an important day for the Euro. Four leading members of the European Central Banks governing council are scheduled to speak then.

These include Peter Praet, the ECB's chief economist at 10.00, Ewald Nowotny at 13.00, Benoit Coeure at 13.30 and Mario Draghi, the ECB's president at 15.00.

Given recent run of poor economic data including lower GDP growth in Q3 and and falling PMI’s, analysts will be scrutinising what the ECB officials say in great detail in order to determine whether it is likely the ECB decides to change it's monetary policy guidance.

If any of the speakers say that the ECB needs to delay reducing stimulus or increasing the negative deposit rate, which it is currently expected to do after the end of the summer in 2019, it will cause weakness for the Euro.

There is also a possibility they may discuss introducing a new tranche of another type of stimulus called targeted term refinancing operations also known as TLTROs, which are a form of liquidity injection offered to banks in the form of discounted loans.

If there is a chance of TLTROs being reintroduced the Euro will probably fall as it will be a defacto admission the ECB is not yet ready to withdraw stimulus.

The US Dollar: What to Watch

One major driver of the Dollar in the week a head is likely to be news filtering out from the G20 summit in Buenos Aires which starts on Thursday the 29th and ends on Saturday the 1st. Of crucial importance will be whether China and the US can improve trade relations.

A major concern for the markets are whether the US goes ahead with increased trade tariffs set to automatically kick in on January the 1st 2019 when duties on $250bn US imports from China will rise from 10% to 25%.

From an FX perspective the likely repercussions of higher tariffs or a worsening trade relationship is a rise in the Dollar because it benefits from safe-haven flows during times of geopolitical woe.

The release of the minutes of the US Federal Reserve’s (Fed) last monetary policy meeting on Thursday, November 29, at 20.00 has a risk of impacting on the Dollar.

Recent commentary from several members of the Fed’s Open Markets Committee (FOMC) has indicated they are less likely to increase interest rates as much as had previously been expected, seeing risks to the outlook which we're not there earlier in the year.

One of these is the recent steep sell-off in the US stock market and another is the sharply declining housing market.

If the minutes from the last meeting provide more clarity on the outlook for interest rates and backup the assertion they may remain low, the Dollar could suffer on Thursday. On the contrary, if the minutes present a more optimistic view, and suggest the Fed will go ahead with increasing interest rates the Dollar could rally.

Higher interest rates, or the expectation thereof, are usually supportive of a currency because they attract and retain greater inflows of foreign capital, drawn by the promise of higher returns.

Third quarter GDP data on Wednesday (14.30) could also impact on US currency even though it's is only the second estimate.The data is expected to show growth rising by an annualised 3.5% in Q3, will be lower than the first estimate of 4.2%. GDP growth is positively correlated to the dollar therefore a better estimate would support the currency and vice versa for a worse one.

New home sales are also out on Wednesday (16.00) and expected to show rebound of 4.5% in October after declining -5.5% in the previous month. Clearly whether or not they do may have a bearing on the actions of the Federal Reserve and therefore the Dollar.

The other standout release for the Dollar in the coming week is Personal Consumption Expenditure (PCE), which is the favoured gauge of the Fed when determining inflationary pressures in the economy.

The headline PCE index is forecast to show a slight rise to 2.1% from 2.0% in the previous month whilst core PCE is forecast to fall to 1.9% from 2.0% previously.