Pound-to-Euro Exchange Rate: Friday's Close Critical to Determining Whether Recovery is Still Alive

Theresa May, UK Prime Minister; Donald Tusk, President of the European Council in Salzburg, Austria. Image Copyright: European Union

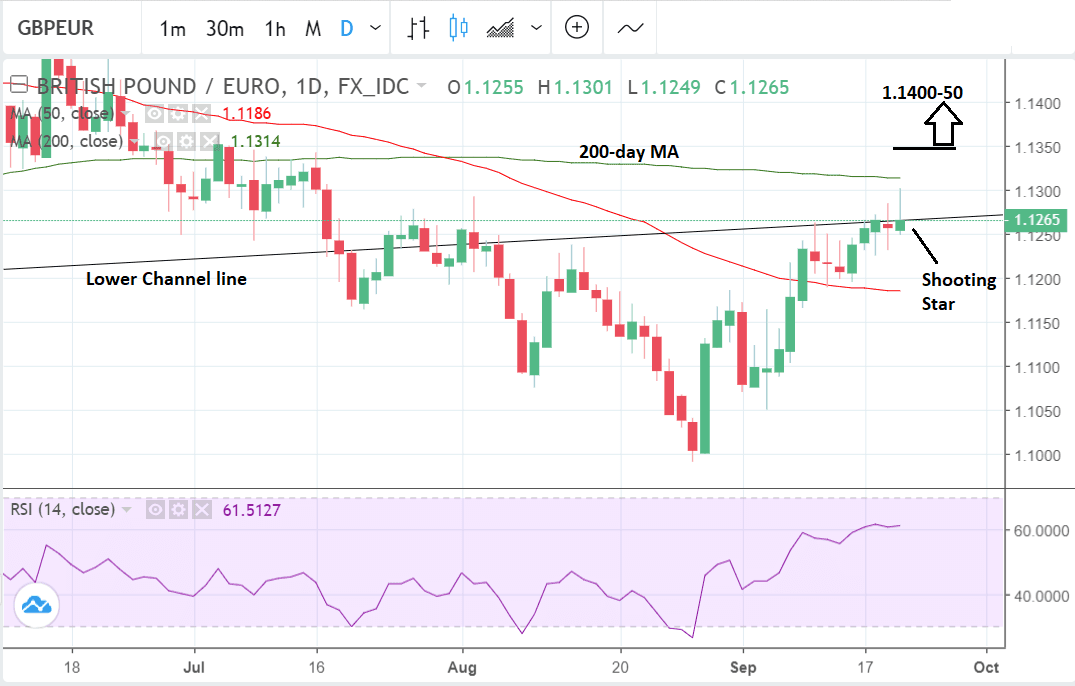

- 'Down-day' is required to confirm a bearish reversal

- Shine taken off Sterling's advance by E.U. rejection of May's Brexit plans

- GBP/EUR enters a tough resistance zone on the charts

- Break above 1.1350 would open door into new territory

More strong economic data, and the market's sanguine interpretation of the ongoing Brexit negotiation dramas has helped the Pound Sterling to a new two-month high at 1.1301 against the Euro in the past 24 hours.

However, the pair has since retraced the gains ahead of the weekend is quoted at 1.1255; suggesting to us that there is indeed significant selling interest north of 1.13. The decline coincides with the E.U.'s apparent rejection of U.K. Prime Minister Theresa May's Brexit plans following the conclusion of the Salzburg summit.

The recovering pair has nevertheless notched up a 2.0% gain on the Euro over the course of the past month.

The main driver of Sterling's recovery is a more promising outlook for Brexit negotiations: even though Theresa May's Chequers plan is dead, investors believe she will deliver something European leaders can accept at the extraordinary summit set for November.

Tub-thumping retail sales and inflation statistics for August have also helped.

While the established short-term trend is still bullish, we do note that the rejection of 1.13 and decline back down to the mid-1.12s has seen the exchange rate form a bearish 'shooting star' Japanese candlestick pattern.

Such a chart formation could bode ill in the short-term.

However, the fact the candle is green, and therefore 'positive' detracts from its bearishness.

A 'down-day' is required to confirm a bearish reversal so much still depends on Friday's activity.

The exchange rate is now in the heart of a formidable resistance zone composed of two major moving averages and the floor of the previous long-term channel, however, and these are likely to curb upside.

Longer-term timeframes meanwhile show the 1.1301 highs touching the 50-week moving average (MA), which is a formidable obstacle.

This might well help explain Sterling's failure here over recent hours.

The pair has also reached the level of the lower channel line currently in the 1.1260s.

This too is likely to present a barrier to further upside as - like the MA - it will probably attract short-term traders wishing to short the pair in anticipation of a pull-back.

The daily chart also shows the 200-day MA, not much higher at 1.1314 and this too is another level for the pair to get over before it can safely continue rising.

To confirm a break above the clustered resistance zone we would ideally like to see a move above 1.1350, with that opening the way to an initial target between 1.1400-50.

Such a break back into the long-term range/channel would have enormous bullish implications for the pair - as would a break above the 200-day MA - so expect upside to potentially start to accelerate once 'out of the woods'.

The sort of fundamental news required to cause such a breakthrough, however, is likely to be so positive for Sterling that further upside will be expected.

Advertisement

Lock in Sterling's September recovery: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Why the Pound Believes a Brexit Withdrawal Agreement is Still Possible

The Pound's September rally against the Euro appears to also have failed at around the same time European leaders at the Salzburg summit confirmed the U.K.'s current Brexit proposals are unacceptable.

The prospect of a 'no deal' Brexit remains alive following a clear souring in relations between the U.K. and Europe, something that could well keep Sterling gains in check going forward.

European Council President Donald Tusk says E.U. leaders agree May's Chequers plan for Brexit "will not work" because "it risks undermining the single market".

European Council President Donald Tusk says EU leaders agree Theresa May's Chequers plan for #Brexit "will not work" because "it risks undermining the single market" https://t.co/UpHoAK94GG pic.twitter.com/H5FPZPUNN9

— BBC Breaking News (@BBCBreaking) September 20, 2018

The Irish border remains the flashpoint between the U.K. and E.U. as the issue forms a proxy battle over trade relations with the E.U. seen ti be defending their precious single market.

However, May reminds the E.U. that the U.K. also has a single market to defend and they are not willing to see the province of Northern Ireland operated from the rest of the U.K.

European leaders have given May time to rework her plans and we expect May to shift her approach over coming weeks.

That the Pound is still within touching distance of September highs tells us markets are holding out hope for progress.

Indeed, May told reports following the Salzburg summit that she has a plan:

"We both agree that there can be no withdrawal agreement with no legally operative backstop. But that backstop cannot divide the UK into two customs territories, and we will be bringing forward our own proposals shortly."

After criticism of her Chequers plan by EU leaders, Theresa May stands by her #Brexit proposals as "the only serious and credible" option - but admits there's "lots of hard work to be done" to reach a deal https://t.co/7frZv4l8qo pic.twitter.com/FhjLv7j4VU

— BBC Breaking News (@BBCBreaking) September 20, 2018

While there is a lot of work to be done, May argues that a deal can be done if the E.U. shows political will.

However, May reminds us that the U.K. is prepared to walk away from the table.

"We are preparing for no deal, so that if we get to the position where it is not possible to reach a deal, then the British people can be confident that we we will have done what is necessary to ensure we make a success of leaving the European Union regardless of the terms we do so."

Have the chances of a no deal gone up? The Pound is the perfect barometer for 'no deal' probabilities, and in their opinion, a deal is more likely than not.

Advertisement

Lock in Sterling's September recovery: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here