Goldman Sachs Raise Pound Sterling / Euro Forecasts

- Written by: Gary Howes

Image © Adobe Stock

Goldman Sachs have raised their forecasts for the British Pound against the Euro following a strong start to 2022 for the UK currency.

The Wall Street investment bank says its clients held a negative sentiment on Pound Sterling in the latter part of 2021, amidst weakening global growth, intensifying inflation pressures and disruptive moves in front-end rates.

But, "we argued that this GBP bearishness looked overdone," says Zach Pandl, Co-head of FX Strategy at Goldman Sachs in New York.

Pandl and his team were especially wary of a view held by other analysts and market participants that interest rate rises at the Bank of England - the first of which was delivered on December 16 - would be a negative for the currency.

Furthermore, Goldman Sachs finds currency markets have of late primarily traded along the lines of a more optimistic global growth outlook, "which benefits Sterling more than most".

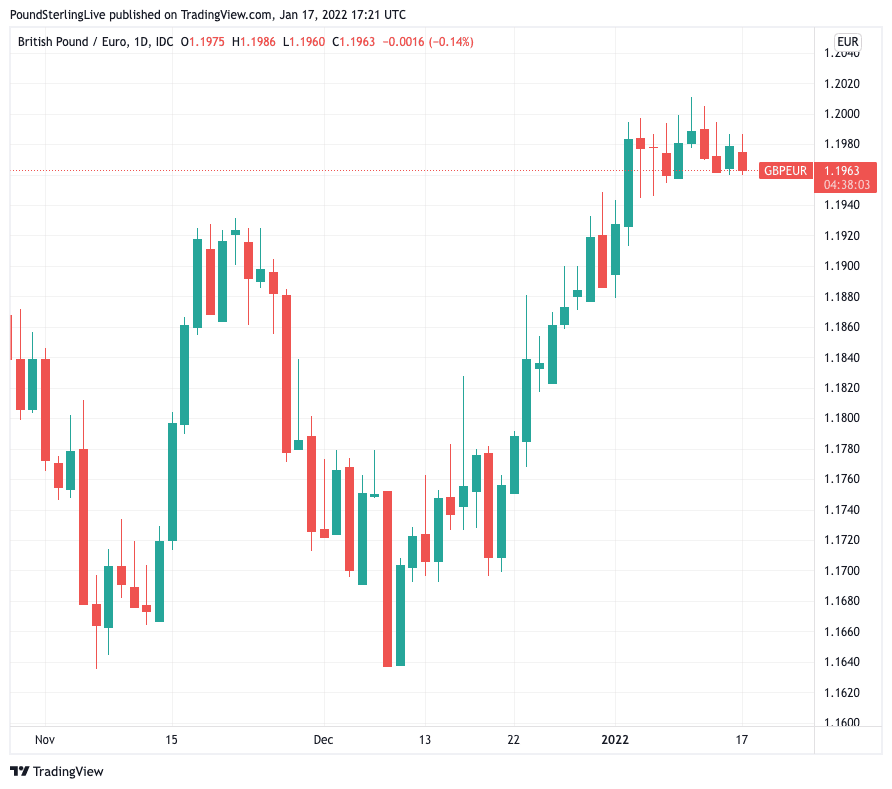

Above: GBP/EUR since November, showing the December-January rally.

- Reference rates at publication:

GBP to EUR: 1.1963 - High street bank rates (indicative): 1.1640 - 1.1730

- Payment specialist rates (indicative: 1.1855 - 1.1900

- Find out more about specialist rates and service, here

- Set up an exchange rate alert, here

The end of 2021 saw the outbreak of the Omicron variant of Covid-19 which lead to concerns global growth would slow.

But, the global Omicron wave has since proven less severe for a global population that has now largely been exposed to previous variants and vaccines.

Also aiding the Pound in 2022 is the decidedly "more aggressive policy" stance adopted by the U.S. Federal Reserve, according to Goldman Sachs.

Analysts say the more proactive Fed will guide markets to anticipate a more proactive approach to fighting inflation by other major central banks, the Bank of England included.

"It is also worth noting that the Fed’s apparent preference for earlier balance sheet action makes the BoE’s own runoff plans less idiosyncratic, which we thought could have held back GBP’s response to policy action," says Pandl.

The Bank of England set out in August 2021 the conditions that must be met for it to begin quantitive tightening: once Bank Rate is hiked to 0.5% it will stop reinvesting the proceeds of maturing bonds that it owns, leading to a steady depletion of its holdings.

And when Bank Rate reaches 1.0% the Bank will consider selling some of its gilts back to the market.

This quantitative tightening meant that the need to push interest rates higher is lessened as monetary tightening can be achieved by both raising rates and shrinking the balance sheet.

This in turn lead investors to price in a lower end-point to the rate hiking cycle in the UK than elsewhere.

This dynamic might have contributed to Sterling's soft second half to 2021.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

But, the Fed has now also started talking about the need to engage in quantitative tightening, as per the December FOMC minutes, with tightening potentially coming before year-end.

The Bank of England, and its currency, are therefore no longer outliers in this regard.

On the matter of politics, Goldman Sachs says the recent woes facing Prime Minister Boris Johnson could in fact prove supportive of Sterling's outlook.

"Recent political events could support the currency by shifting the focus towards domestic concerns and pushing the government towards a more accommodating position in Brexit talks, or at least fuelling market expectations in that direction," says Pandl.

They note recent discussions on the Northern Ireland protocol have "taken a somewhat friendlier tone, and incoming questions about Article 16 have died down".

Goldman Sachs economists see a very low likelihood of the UK triggering Article 16 of the Northern Ireland protocol in order to override laws it holds to be damaging to country's place in the United Kingdom.

"Given these considerations, we are revising our EUR/GBP forecasts to 0.83, 0.84 and 0.85 in 3, 6 and 12 months (from a flat path at 0.86 previously)," says Pandl.

This gives a Pound to Euro exchange rate profile of 1.2050, 1.19 and 1.1765, up form a flat 1.1630 previously.