Swiss Franc Strength Explained

- Written by: Gary Howes

Image © Adobe Stock

Spot Market Rate at Publication:

GBP/CHF: 1.2679

The Swiss Franc has proven extraordinarily resilient when one looks at the performance of the Japanese Yen, its fellow so-called safe haven currency.

Safe haven currencies are supposed to underperform when stock markets are rising amidst improving investor sentiment, which is the broad theme of 2021.

Indeed, the S&P 500 - the global bellwether for investor sentiment - is back near all-time highs following its September blip.

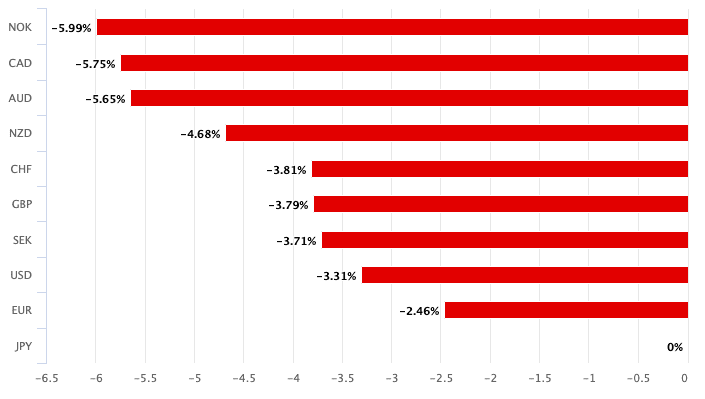

The Yen now screens as the worst performing G10 major of the past week, month and past year.

But, the Franc is seeing a more mixed performance and is actually screening as a middle-of-the-road performer for the past month.

It certainly has lost value over the course of the past year in sympathy with the Yen and the improved global backdrop, but the currency is showing a more robust performance over more recent timeframes.

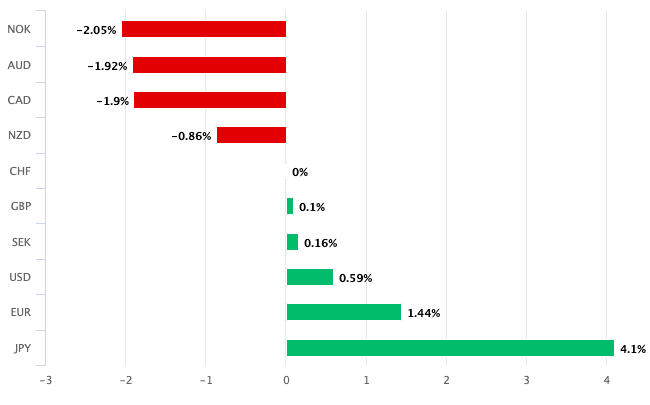

Above: The Franc is outperforming a host of peers on a one-month timeframe.

Indeed, this performance caught the attention of Marshall Gittler, Head of Investment Research at BD Swiss Holdings who has noted an "odd performance" in both the Yen and Franc over the past 48 hours.

"Most stock markets were up (Euro STOXX 50 +0.13%, S&P 500 +0.37%, NASDAQ -0.05%) but a strong “risk-off” move in the FX market as CHF and JPY were notable outperformers," says Gittler.

This performance suggests the relationship with risk and the Franc - and maybe even the Yen - could be shifting.

Some foreign exchange analysts say the reason for this shift is clear: investors are looking at central bank rate hike timing and the subsequent move in the yield paid on government bonds in the U.S., Europe, Switzerland and Japan.

"The rally in CHF and JPY was not due to risk sentiment but rather to the fall in short rates in the US, which makes low-yielding currencies more attractive," explains Gittler.

Above: The Yen screens as the biggest lower on a one-week, one-month and one-year horizon.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Yields on U.S. 2-year Treasuries have come off their highs of late as investors ease back on their expectations for higher interest rates at the U.S. Federal Reserve: the first rate hike is priced in for next May but the Fed will unlikely tolerate such pricing.

Meanwhile, the room for expectations for a rate hike at the Swiss National Bank and the Bank of Japan are so distant that there is scope for substantial movement forward.

With most global central banks now agitating to higher rates in view of surging inflation investors are asking why this cannot be true for the 'ultra loose' Swiss and Japanese central banks.

"I have my difficulties with terms such as 'risk-on/risk off' and 'safe haven currencies'," says Ulrich Leuchtmann, Head of FX and Commodity Research at Commerzbank.

Leuchtmann says these catch-all phrases cover the intricacies at play in the market and although JPY and CHF are always proclaimed as safe havens they have performed "in as different a way as imaginable".

Leuchtmann says the Franc's outperformance against the Yen - and indeed against other currencies - can be explained by what the European Central Bank might do in the future.

Investors have brought forward their expectations for a rate rise at the ECB from 2024 to as early as 2022.

"Because the market is pricing in a very rapid lift off for the ECB and as it can be assumed that the SNB will follow the ECB’s example," says Leuchtmann.

"However, nobody is seriously going to expect the Bank of Japan to implement any interest rate changes any time soon or any time late," says Leuchtmann.

The SNB would want follow the ECB’s example - albeit with a delay - when it comes to interest rate rises because it will want to shake its record for negative interest rates says Leuchtmann.

"It is not deaf to criticism and moaning about it. Only that following the 1.20 disaster in 2015 it had no other tools available to control inflation. If the ECB really were to start hiking interest rates rapidly next year (as the market currently expects) the SNB is likely to be in a rush to also normalise its interest rate policy – at least gradually," he adds.