Canadian Dollar Forecast: CIBC say "Wings Clipped" for Remainder of 2021

- Written by: Gary Howes

- GBP/CAD forecast to reach 1.82

- EUR/CAD forecast to reach 1.54

- USD/CAD forecast to reach 1.29

Image © Adobe Stock

- GBP/CAD reference rates at publication:

- Spot: 1.7085

- Bank transfer rates (indicative guide): 1.6487-1.6607

- Money transfer specialist rates (indicative): 1.6930-1.6965

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Canadian Dollar remains 2021's best G10 performer, however analysts at Canadian lender CIBC say the top might just be in.

In a monthly foreign exchange research briefing CIBC's Capital Markets division say they are holding onto a call for the Canadian Dollar to weaken into the end of the year on a combination of easing oil prices and an increasingly hawkish U.S. Federal Reserve.

In a note headlined "Loonie's wings clipped over rest of year", Senior Economist Katherine Judge says most of the key forces behind the trend of Canadian Dollar outperformance "don’t look to have staying power".

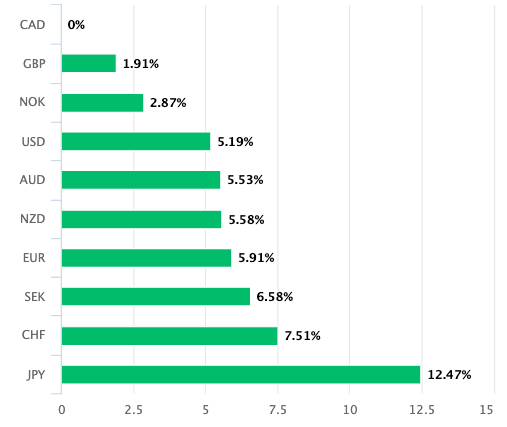

Above: The Canadian Dollar is 2021's top performing major currency.

The call comes as the Canadian Dollar begins to give back some of its 2021 gains against a host of currencies with the Pound-to-Canadian Dollar having clawed back 1.0% over the past month to retake 1.80.

The currency has also lost ground to the Euro and Swedish Krona and the Dollar is now only 0.40% down on a one-month timeframe.

CIBC recognise that the strength of the first half of 2021 does however mean they will have to temper previous expectations for weakness over coming months.

That 'less negative' view also rests with the firmer ranges occupied by oil prices this year.

Canada earns considerable sums via the export of crude from its oil sands and the lift to oil prices and commodities in general during the past year has boosted the country's oil earnings.

But the single most decisive factor for the decline anticipated by CIBC is the U.S. Federal Reserve which must commence its journey from being an ultra accommodative central bank to one that must raise interest rates once more.

The U.S. economy is recovering rapidly from the Covid-19 crisis, helped by extraordinary government fiscal support.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

This is in turn resulting in rising inflation and a rapidly improving labour market - as per June 03's jobs data releases - which suggests the Fed can no longer stubbornly justify keeping policy generous for an indefinite period.

"With enough job gains in the books, we see US central bankers announcing an impending tapering for early 2022," says Judge.

'Tapering' refers to diminishing the size of the Fed's quantitative easing programme, a necessary step ahead of interest rate hikes.

"At some point this year, we’re also likely to see the “dot” forecast begin to pull forward the timing of the first rate hike," says Judge.

This will in turn push the Dollar higher and create a push back against the Canadian Dollar.

A central pillar of Canadian Dollar support has meanwhile been the Bank of Canada (BoC) which last month announced it would taper its own quantitative easing programme.

But this story is arguably now factored into the price of the Canadian currency already according to CIBC's estimations, particularly with little else of interest on the policy front likely to come out of the BoC for the reminder of the year.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

With little lift likely to come from the BoC and the Fed to become an outright headwind, Canadian Dollar bulls will be left searching for other sources of support.

Oil prices might not offer any solace as CIBC's commodity analysts reckon the commodity rally will ultimately lose steam over coming months.

"The loonie will also have its wings clipped as the resource price rally loses steam in 2022," says Judge. "The OPEC+ countries have remained a bit more reticent than we expected in terms of unleashing supply, and Iran’s status is not yet clear."

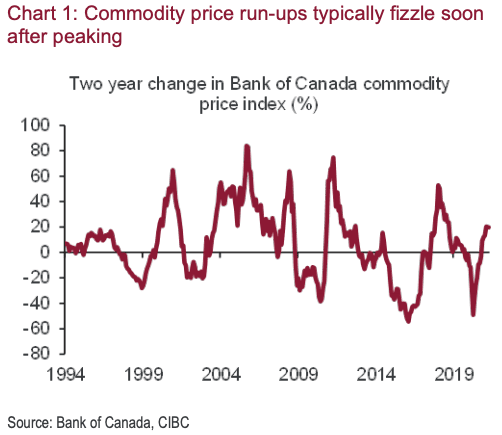

Above image courtesy of CIBC.

CIBC still expect supply to come on board from these countries to prevent a further, sustained crude appreciation in the next couple of years.

Other Canadian exports such as metals and wood products are also expected also hit their peaks at various points in the next 12 months, given a moderation in global growth and US homebuilding by 2023.

"History shows that most commodity price run ups are short lived. The return of international travel, where Canada runs a large services trade deficit, will also weigh on the loonie, as part of an overall move that swings Canada’s current account surplus back into deficit," says Judge.

The Pound-to-Canadian Dollar exchange rate is forecast at 1.75 by the end of September 2021, 1.76 by year-end, 1.80 the end of March 2022 and 1.82 in one year from now.

The Euro-to-Canadian Dollar exchange rate is forecast at 1.49, 1.50, 1.52 and 1.54 over the same timeframes.

The U.S. Dollar-to-Canadian Dollar exchange rate is forecast at 1.23, 1.25, 1.27 and 1.29 in the above timeframes.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}