Australian Dollar on the Move after RBA Wavers on Guidance

- Written by: James Skinner

- GBP/AUD slides as AUD/USD attempts comeback

- After RBA wavers on QE & interest rate guidance

- QE could end in Feb, rates may rise before 2024

Above: Governor Philip Lowe. Photo: O'Neill Photographics/Goldman Sachs. Source: RBA on Flickr, reproduced with permission from the RBA press office.

The Pound to Australian Dollar exchange rate tumbled as the antipodean currency outperformed major counterparts on Tuesday following a subtle but meaningful change in monetary policy guidance from the Reserve Bank of Australia (RBA).

Australia’s Dollar was higher and still climbing against all major currencies in the G10 contingent in Europe on Tuesday after the RBA appeared to tweak its guidance relating to the Bank’s quantitative easing programme and official cash rate.

The benchmark for borrowing costs was left unchanged at 0.10% while the RBA said it would continue to buy A$4BN of Australian government bonds per week until at least the middle of February 2022, although its statement made clear that anything could happen after this point.

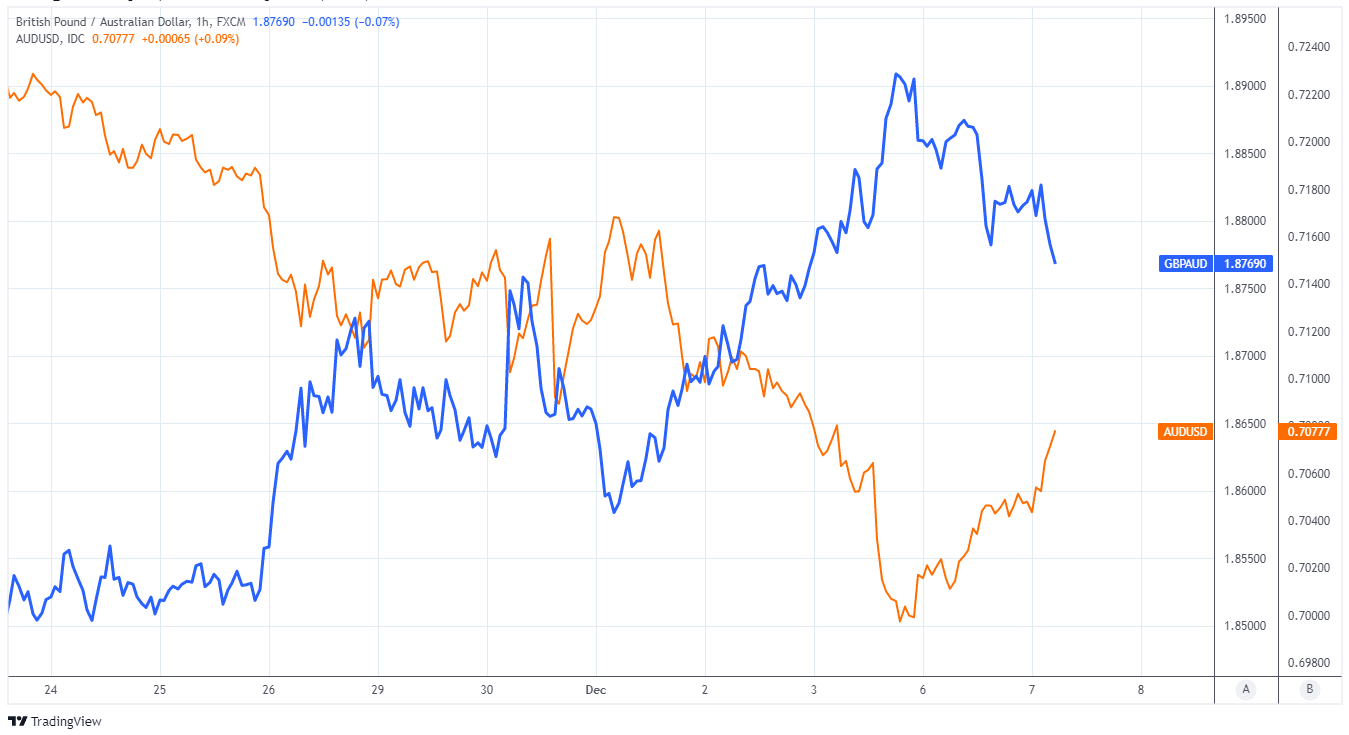

Notably, the RBA said that at its next meeting in February policymakers will “consider the bond purchase programme,” taking into account at the time the actions of other central banks in the interim, market functioning and progress toward its own objectives in relation to employment and inflation.

Above: Selected excerpts from December’s Reserve Bank of Australia monetary policy decision.

- GBP/AUD reference rates at publication:

Spot: 1.8725 - High street bank rates (indicative band): 1.8070-1.8200

- Payment specialist rates (indicative band): 1.8556-1.8630

- Find out about specialist rates, here

- Set up an exchange rate alert, here

- Book your ideal rate, here

“We think there is a growing chance the RBA will opt to end QE at its February meeting. But a lot can happen between now and then so we will keep an open mind on this question for now,” says David Plank, head of Australian economics at ANZ.

In addition the RBA omitted the assessment from November’s statement that it would likely take until the end of 2023 for its inflation target to be sustainably achieved, which is a prerequisite for any eventual decision to lift the cash rate from its current historic low of 0.10%.

“Put another way, it makes it crystal clear that the RBA’s forward guidance on the cash rate is state based and not calendar based (as has sometimes caused some confusion within the commentariat),” says Gareth Aird, head of Australian economics at Commonwealth Bank of Australia.

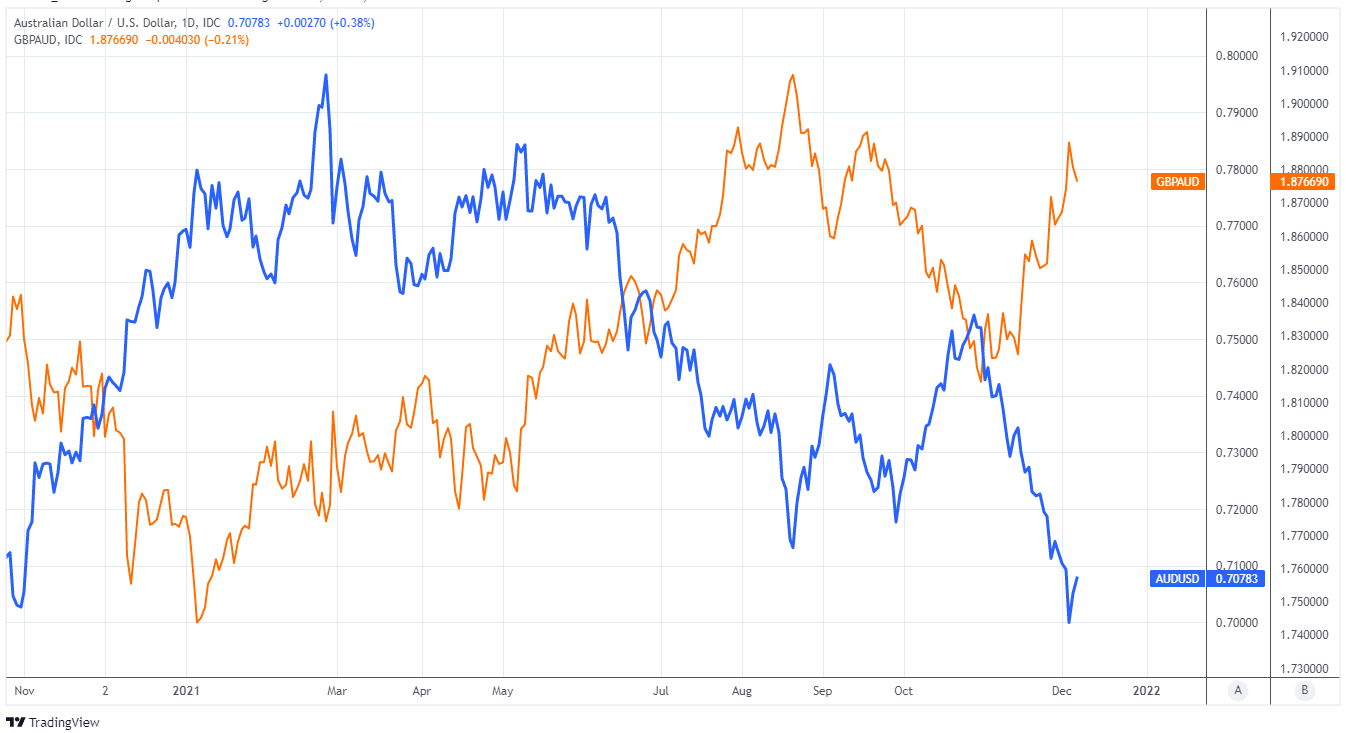

Above: Pound-Australian Dollar rate shown at hourly intervals alongside AUD/USD.

“For now we stick with our call for the RBA to taper to $A2bn per week at the February 2022 Board meeting, but note that it’s edging towards a line ball call between them announcing a further taper or exiting QE. As for the cash rate, we reiterate our central scenario that the RBA will commence normalising the cash rate in November 2022,” Aird said in a note following the release.

The language in reaction to the quantitative easing programme potentially creates scope for the RBA to announce either an immediate or scheduled end to its quantitative easing programme as soon as its next meeting.

Meanwhile, the change in guidance in relation to the cash rate could mean the RBA is no longer ruling out an interest rate rise before the end of 2023.

“That appears to have helped the A$ to push a little higher to 0.7071 after hitting one year plus lows below 0.70 on Friday night, and extreme oversold levels. Helped by better China trade data too, we would not be surprised to see the bounce extending a little further towards 0.71, but would be surprised to see it much above that level,” says Robert Rennie, head of financial market strategy at Westpac.

It likely matters to the RBA and is relevant in the currency market that by the time February’s policy decision comes around the Federal Reserve could be just weeks away from having completely curtailed its own quantitative easing programme.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

It’s also possible that at that time both the Bank of Canada and Bank of England will be on the cusp of raising their own interest rates having already packed away their own quantitative easing programmes.

“Any indication of an earlier end to bond purchases and shift to state based guidance from calendar based guidance could provide a boost to the AUD. The less-than-expected decline in Q3 GDP last week and the strength in the external sector should also help boost the AUD once global risk sentiment stabilizes,” said Ashish Agrawal, a Singapore based FX strategist at Barclays, writing in a note ahead of the RBA decision.

Australia’s Dollar remained among the worst performing major currencies for 2021 on Tuesday although it had stepped back from the brink of what was shaping up to be a major technical breakdown against the U.S. Dollar on the charts.

The Aussie has slipped through the rankings throughout the year after the RBA emerged as one of the most ‘dovish’ central banks in the G10 segment of major economies due to an almost decade-long struggle to lift inflation up to the midpoint of the two-to-three percent target band.

Central banks set interest rates with a view to keeping inflation close to predefined targets and although all monetary authorities in the developed world have struggled to generate sufficient levels of inflation in modern times, disinflationary pressures had been particularly pronounced in Australia.

Above: AUD/USD shown at daily intervals alongside Pound-Australian Dollar rate.