Marine Le Pen can Still Win it and Usher in the End of the Euro

One of Germany's most prominent financial services institution has reported clients remain wary of Marine Le Pen winning the upcoming French elections and are therefore eager to hear of the potential financial repercussions of such an outcome.

A note issued by Commerzbank, the day after Gert Wilders was defeated in the Dutch elections, suggests that investor nerves of a Le Pen remain legitimate, despite polls continuing to suggest Le Pen stands little chance of winning.

“Even after the defeat handed out to Geert Wilders in the Dutch election, it is far from certain that Le Pen will fail,” says Dr Jörg Krämer at Commerzbank in Frankfurt. “Her voter base is highly motivated, and it is also unclear whether conservative voters would really vote for former socialist Macron in the run-off.”

Polling ahead of the election are quite consistent in suggesting Le Pen remains engaged in a tight fight in the first ballot with independent candidate Emmanuel Macron.

Both currently polling a vote share around 25%.

But it is of course the second round that matters - Le Pen commands about 38% of the vote which is well behind Macron, with 62%. Le Pen’s chances would be no better (42% of votes) if she were to compete against Francois Fillon,

But, Krämer believes many market participants are nervous because both British eurosceptics and Donald Trump were successful in getting across the line despite the fact that opinion pollsters did not predict it.

“Consequently, many investors want to know what would happen if Le Pen were to win the election,” says Krämer.

Could Le Pen Call an EU Referendum?

In short, yes.

If the pollsters are wrong again and a huge section of French society are too shy to admit support for Le Pen, could she call an EU referendum having won?

Le Pen has said she would like to negotiate fundamental change of the EU in

order to expand France’s scope in monetary, financial, security and immigration policy and wishes to hold a referendum on the outcome of these negotiations.

But, the French president alone does not have the power to call a referendum.

A referendum can only be called in accordance with Article 11 of the French constitution which says a referendum can only come from:

(1) the government,

(2) the two chambers of parliament or

(3) a fifth of the representatives of both chambers and 10% of the electorate.

“Le Pen would probably take the latter approach, since a victory in the presidential elections would probably give her party enough seats in the National Assembly to control more than 20% of the seats in both chambers of parliament. Alternatively, she could appoint a prime minister who proposes a referendum as their first official action,” says Krämer.

Commerzbank believe that Le Pen would ultimately get her referendum despite all the legal hurdles.

“After all, she has spoken out in favour of a referendum on EU membership during her election campaign. A Le Pen victory in the presidential election would thus effectively be a vote in favour of a referendum. The other parties cannot ignore this fact, especially as the EU also has little support on the left fringes of the party spectrum,” says Krämer.

How Would the French Vote in a Referendum?

Of course getting the go-ahead for a referendum is one thing, but what about the outcome?

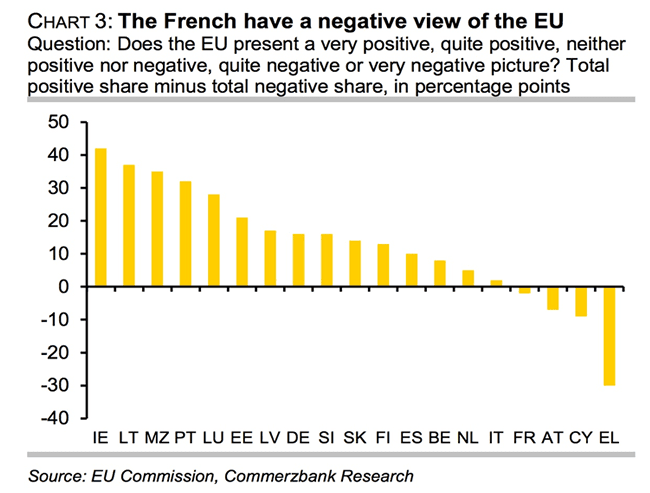

Commerzbank find it worrying that polls conducted by the EU Commission suggest that more French people have a negative than positive view of the EU, which is only the case in Greece, Cyprus and Austria.

“Should a majority vote in favour of France leaving the EU, and thus also the Monetary Union, a Frexit would be signed and sealed. It would not require a further vote in parliament,” says Krämer.

Financial Market Implications: End of the Euro?

How would the markets react if Le Pen were to be elected, contrary to expectations?

Commerzbank’s view is that we would be looking at a scenario far worse than Brexit:

- This would not just be about leaving the EU, as the case with Brexit, where the negative effects can be contained by a free trade agreement with the EU.

- France’s exit from the EU would also mean its exit from the Monetary Union and the reintroduction of a national currency, which would probably trigger economic chaos. Moreover, with France being a key pillar of EMU, this would almost certainly spell the end of the single currency.

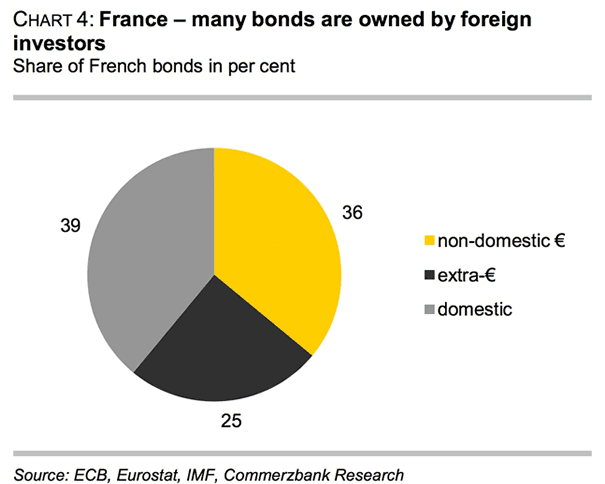

- Many foreign investors – who it should be noted, hold around 60% of French government bonds – would likely trigger a capital flight, especially as France would be unlikely to repay its government bonds in euros but in its own, probably softer currency.

- A collapse in French asset prices would also put the French banking system under substantial stress, especially as foreign investors would be likely to withdraw their deposits at French banks.

- Concerns about the stability of the banking system would soon grow and prompt domestic savers to clear their accounts. In such a crisis, the government would presumably have no choice but to close the banks temporarily and introduce capital controls.

Importers would then only supply against prepayment and production chains would be at risk of disruption.

The French economy would plunge into a serious crisis and the other countries in the monetary union would also be endangered.

Since exit from monetary union would cause so much chaos, Commerzbank reiterate their view that they do not expect the French electorate to make Le Pen their next president.

But a Frexit would still be nagging doubts about the stability of the rest of the Eurozone if one of its key members left.

Commerzbank believe Increasing numbers would begin to see no future for the union and populist parties could gain more support and set their sights on leaving the Eurozone too.

"In the long-term, EMU would probably not survive without France," says Krämer.