GBP/CAD Week Ahead Forecast: It's Flipping

- Written by: Gary Howes

Image © Adobe Stock

The Pound's outlook against the Canadian Dollar has undergone a significant shift in fortunes, potentially tilting from an upside bias to a downside bias in the space of just two days.

The next two daily closes will be crucial for the broader outlook as the scale of Friday's fall was significant: the Pound to Canadian Dollar exchange rate fell 0.67% to close at the 200 day moving average (DMA) at 1.70; this was the largest one-day decline since March 21.

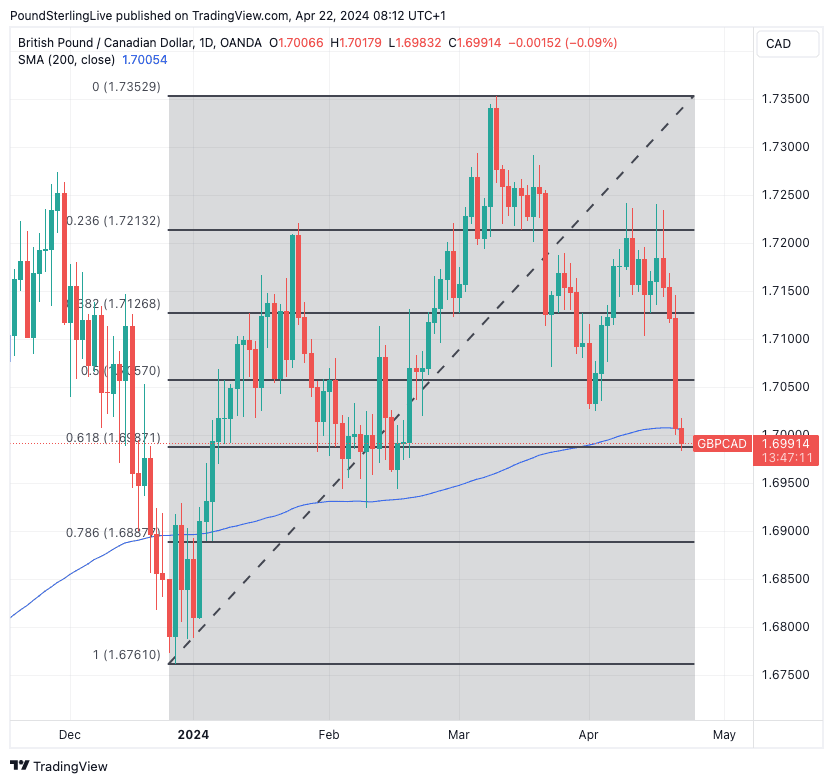

Selling pressure on GBP/CAD has since extended in the Monday session, taking the market below the 200 DMA. We also note it is now about to test the 61.8% Fibonacci retracement level of the 2024 rally, which is located close to the 200 DMA at 1.6987.

Above: GBP/CAD at daily intervals with the 200 DMA and Fibonacci retracement levels indicated. Track GBP/CAD with your own custom rate alerts. Set Up Here

Thus, we are watching a key technical moment in GBP/CAD and the next day or two will be crucial: a series of decisive closes below 1.70 will confirm the trend has flipped from Pound appreciation to Canadian Dollar appreciation and a test of the 78.6% Fibonacci level at 1.6906 becomes likely ahead of the 2024 low at 1.6761.

GBP/CAD's decline reflects the widespread weakness in Sterling that followed from last Friday's Dave Ramsden speech, in which the Bank of England Monetary Policy Committee member appeared to shift his weight behind a June interest rate cut.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

Ramsden voted to keep interest rates unchanged last month, but he now says risks to the UK's inflation profile are tilted to the downside; he now sees the likely "scenario where inflation stays close to the 2% target over the whole forecast period."

Ramsden's comments follow those of Bank of England Governor Andrew Bailey, also made in Washington, that this week's above-consensus inflation reading is of little concern.

Bailey said earlier this month that the Bank could begin cutting interest rates before inflation has fallen to the 2.0% target and not risk raising inflation rates. This repricing in Bank of England policy expectations could ensure the Pound stays on the backfoot in the coming days.

"The main trigger for the pound sell-off at the end of last week were dovish comments from BoE Deputy Governor David Ramsden who delivered a speech in Washington on Friday," says Lee Hardman, Senior Currency Analyst at MUFG Bank Ltd. "The comments follow on from dovish comments delivered by BoE Governor Bailey after the last MPC meeting just over a month ago in which he emphasised that rate cuts are “ in play” at all our meetings."

Money markets now reflect 50/50 odds of a June rate cut; "the dovish shift in BoE rate cut expectations is beginning to have more of a negative impact on the pound in the near-term," says Hardman.