Pound vs Australian Dollar Forecast: Westpac See a Little More Upside, but Longer-Term we see 2.0 is a Possibility

Australian bank Westpac have updated clients with their predictions for the GBP/AUD exchange rate suggesting Sterling can go a little higher.

The Pound-to-Australian Dollar exchange rate has been tipped to extend further before sliding back once more.

Analyst Sean Callow at Westpac in Sydney says Sterling can go higher against the Australian Dollar largely on expectations for an interest rate rise at the Bank of England in 2017.

The GBP/AUD exchange rate has risen from levels around 1.62 in mid-August to a high at 1.7168 achievd on September 22 with much of the gains being realised after the BoE surprised markets by communicating an interest rate rise might occur as early as November 2017.

The conversion is presently at 1.7065.

Higher interest rates lead to a stronger currency as they attract more foreign capital inflows, so the Pound is forecast to follow interest rates higher.

"In coming weeks, expectations of higher UK rates and debate over the pace of tightening should maintain a degree of support for Sterling. But with a 2 November BoE hike already almost 70% priced in, there is a limit to further GBP outperformance," said Westpac's FX Strategist, Sean Callow.

As such, Westpac forecast the GBP/AUD to extend to around 1.72-1.73, but then return to recent ranges.

Pound Undervalued Against the Australian Dollar

As mentioned, interest rates are an important driver of the Pound, and of course, the Australian Dollar.

More specifically the difference in interest rates on offer in Australia and the UK matter as capital will flow to where the better return is offered.

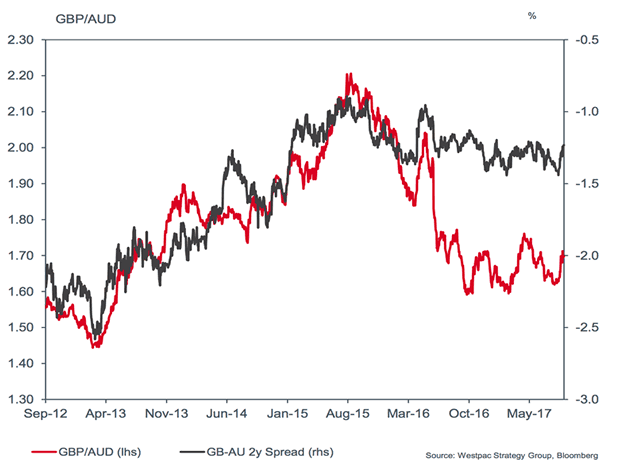

The following graph encapsulates the concept:

The GBP/AUD tends to follow the yield differential between Australian and UK two-year bonds (which are ultimately influenced by central bank policy, hence why moves at the BoE and RBA matter).

What is striking is that since March 2016 the relationship between GBP/AUD and the bond yield has broken down.

This suggests there is a political premium weighing on the GBP/AUD exchange rate - Brexit.

"The relationship between GBP/AUD and 2 year swap spreads has not been reliable for much of the past 5 years. The divergence has been particularly pronounced in the wake of the Brexit vote in June 2016," say Callow.

But we can't get away from the fact that Pound Sterling is well below where it should be. It should rather be trading towards 2.00.

If Brexit were removed from the equation then Sterling could move substantially higher.

Therefore, longer-term bigger gains might be realised and if Brexit negotiations proceed at a steady pace and more clarity is delivered, we see no reason why GBP/AUD can't return towards 2.0 over coming months.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.