Pound-to-Rand Rate Forecast for the Week Ahead: Entering a Downtrend

- GBP/ZAR is in a short-term downtrend after breaking down below its longstanding range lows

- The main release for the Pound in the week ahead is Labour market data on Tuesday

- For the Rand the main release is retail sales

© Goodpics, Adobe Stock

The Pound buys 16.67 South African Rand at the time of writing on the inter-bank markets, a step lower than the 17s of previous weeks.

Sterling has given away recent strength amidst the Bank of England's reluctance to raise interest rates - higher interest rates are a major appreciator of the Pound as they are a draw to foreign investors looking for somewhere to park their money.

The Rand has meanwhile gained as analysts have started to doubt the sustainability of the Dollar's current rally; the Rand is highly negatively correlated to the Dollar so a fall in the US unit tends to be supportive for the South African currency.

From a technical perspective, a major change has occurred after the exchange rate broke down out of a range it was in previously.

Downside momentum is strong as can be seen on the MACD indicator in the lower pane, which has pushed below its zero-line.

The pair is now in a short-term downtrend as is clearly visible on the four-hour chart below which shows the new descending sequence of peaks and troughs.

This short-term downtrend is expected to extend, with a break below the 16.53 lows probably leading to a continuation lower to an initial target at 16.43 at the same level as the March lows.

ZAR: What to Watch

The Rand has recovered marginally after growing doubts about the sustainability of the Dollar's rally following lower-than-expected US inflation data.

A weaker Dollar has the opposite effect on the Rand because so much SA debt is denominated in Dollars or originates in the US, so a weaker Dollar reduces the cost burden of those repayments for many SA businesses.

Purely from a data perspective, the main influencing factors on the Rand in the week ahead are employment and retail sales data.

The unemployment rate in March is released on Tuesday, May 15 at 9.30 GMT and is forecast to stay at 4.2%; the claimant count is expected to rise by 7.5k.

Retail sales in March are forecast to rise by 4.3% compared to the previous year. Month-on-month retail sales rose by 1.8% in February.

GBP: What to Watch

Data is back to the forefront for Pound Sterling now that markets are trading the currency on expectations for future interest rate moves at the Bank of England. Indeed, we saw Sterling come under pressure on Thursday, May 10 after the Bank chose not to raise interest rates at their May policy event.

What we do know is that the Bank will only deliver a Sterling-supportive interest rate rise should UK data show signs of a strong recovery from a soft start to the year, and this week's data releases will, therefore, be key.

Tuesday, May 15

Foreign exchange markets will be eyeing labour market statistics for March and April at 09:30 AM B.S.T.

The claimant count for April is forecast to have risen to 7.5K from 11.6K previously, while the unemployment rate is forecast to stay unchanged at 4.2% in March.

The three-month-on-three-month change in employment will be key, but we are yet to see market forecasts for the outcome.

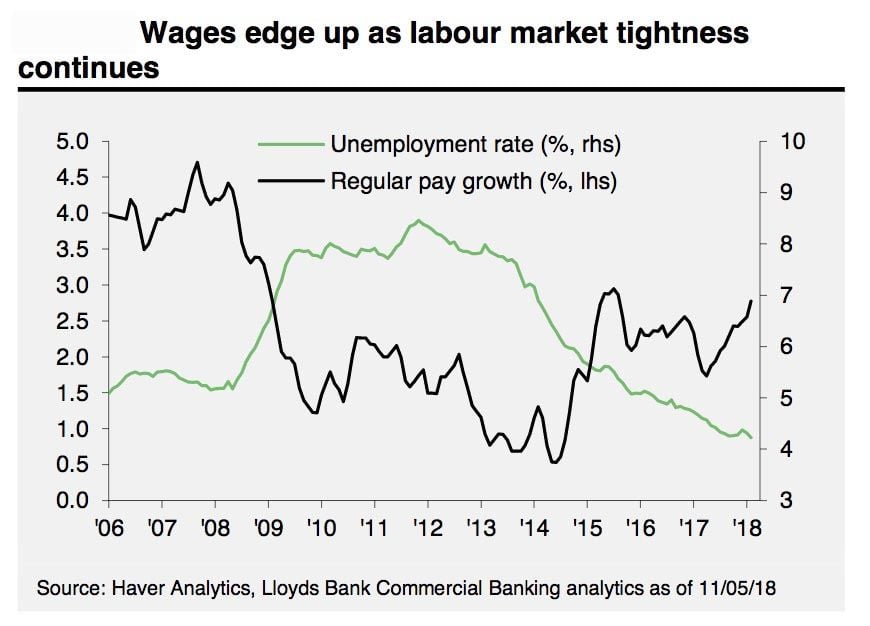

Analysts at Lloyds Bank Commercial Banking are looking for a rise in employment of 150K, saying "the employment gain for the three months to March will provide a measure of the underlying strength of the economy." A rise if 150K "would be a substantive increase for the quarter, consistent with the view that the slowdown in output was most likely temporary."

For Sterling the most important release of the day is, however, likely to be the wage data - the average earnings index + bonus for March is forecast to have registered growth of 2.6%, down from the previous month's 2.8%.

Should wages beat expectations we would expect Sterling to rally as it suggests there is a real risk of domestically-generated inflationary pressures rising in coming months. Such an observation would likely steer the Bank of England's hand towards delivering an interest rate rise in August.

At 10:00 AM Mark Carney and some of his lieutenants will be under the spotlight when they are questioned by the Treasury Select Committee in Westminster on their current guidance for interest rates and expectations for the UK economy.

Expect some criticism from MPs on the apparent U-turn performed by the Bank of England when they opted to not raise rates in May, despite having dropped some significant hints that such an outcome was likely over preceding months.

The Bank will no doubt point at the data. What could move markets is any strong hint on future rate prospects for the economy, so keep an eye on the newswires.

"The market now assigns a greater-than-even chance that the MPC will be on hold for the rest of the year. We are not so sure, because we look for GDP growth to rebound in coming quarters. We acknowledge the downside risks that

Brexit uncertainty imparts to the economic outlook, but we still forecast that the MPC will raise rates 25 bps at the August 2 policy meeting. After that rate hike, we then look for the MPC to remain on hold through the end of the year," say analysts at global investment bank Wells Fargo in their latest assessment on the future of UK interest rates.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.