Pound-to-South African Rand: Forecast, News and Data for the Remainder of the Week

There is no real change from our previous technical forecast for the Rand which has pulled back marginally over the last week but is still in an established uptrend which is expected to continue.

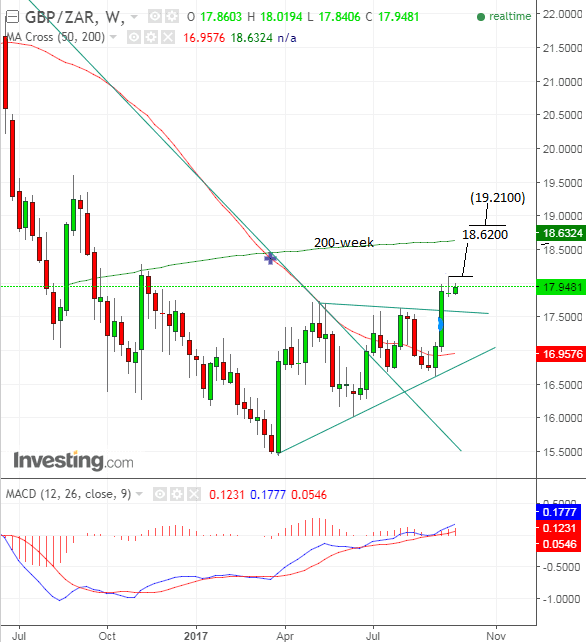

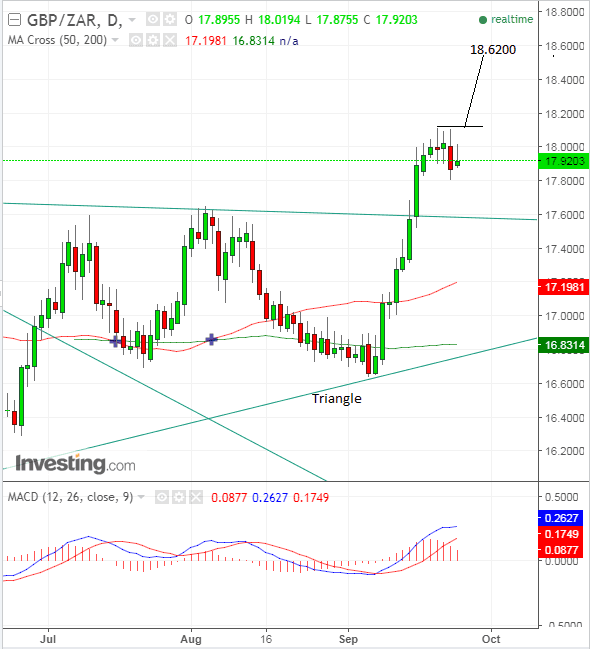

The exchange rate broke out of a triangle clearly visible on the weekly chart, on September 15, and is still rising towards the next target, calculated by taking 61.8% of the height of the triangle and extrapolating it from the level of the breakout.

There are two upside targets, actually, the first is situated at the level of the 200-week moving average at 18.62 where the exchange rate is expected to encounter tough selling pressure, and the second at the ‘official’ minimum target for the breakout at 19.21.

The 200-week moving average (MA) is a strong level of support and resistance which would be expected to limit upside, lead to a sideways consolidation and possibly even to a reversal and a move back down.

If the pair manages to break above the MA, however, by surpassing the 18.675 level, then it could confirm a clear break above the moving average and an extension up to the next target at 19.21.

The MACD momentum indicator is fairly progressive and above the zero-line which means it is in bullish territory.

News, Events and Data For the Rand in the Remainder of the Week

Data in the week ahead for the Rand includes Factory Gate prices, or PPI, which are out on Thursday at 9.30 BST, and expected to show a rise of 4.05% in August, compared to 3.6% a year ago. On a monthly basis prices are forecast to rise by 0.25% from 0.5% in July.

Balance of Trade data is out at 12.00 on Friday, September 29, and is estimated to show a 3.2bn trade surplus in August versus the 8.9bn of July. A higher result may support the rand as it will show increased demand for the currency.

Private Sector Credit and Money Supply M3 are also both out on Friday at 6.00.

News, Events and Data For the Pound in the Remainder of the Week

The fourth round of EU-UK Brexit negotiations commence on Monday, September 25.

The talks follow Prime Minister May’s Florence speech, with its 2-year transition and chief EU negotiator Michel Barnier’s moderately positive reaction to the speech, seems to be biased to supporting rather than undermining Sterling.

Negotiators are set to brief the press on the outcome of this round of talks on Thursday and the key for currency markets will be whether Barnier indicates he believes progress is being made.

The worst possible outcome for Sterling would be a disruptive Brexit - where negotiations fail to deliver a credible trading relationship between the EU and UK when the UK exits the Union in March 2019.

The first round of talks that see legacy issues and the practicalities of the exit dealt with must be cleared before talk of the trading relationship begins.

Also ahead, speeches by Bank Of England’s Mark Carney on Thursday and Ben Broadbent on Friday could provide potential focal points for Sterling traders.

The current market view is that the BOE is embarking on a tightening cycle with analysts now even pencilling in the likelihood of a November rate hike; and the speeches need to be read in light of that more hawkish backdrop.

Markets presently assign an 80% chance of a November rate rise.

Clearly an increase in hawkishness via stronger confirmation of a November rate move by either speechmaker would lead to fresh gains for the Pound, which is positively correlated to interest rates.

Data-wise, the next most significant release could be the Current Account for Q2, at 9.30 BST on Wednesday, September 27, which is forecast to show a slight reduction in the deficit to -15.8bn from -16bn in Q1.

A deeper contraction could help the Pound.

At the same time as the Current Account data is released Business Investment data will also be released for Q2 and will offer a further insight into the strength and resilience of the economy.