South African Rand Resilient in Global Risk Rout as Charts Flag Consolidation

- Written by: James Skinner

- ZAR outperforms major commodity FX in risk-off market

- Gains over CAD, AUD, NZD et al while global stocks slide

- Even after SA retail sales miss as charts flag consolidation

- ZAR seen sideways near 13.9388 ahead of further gains

Image © Pound Sterling Live

The Rand outperformed a range of major currencies in the midweek session even as global stocks came undone and stability returned to major economy bond markets, although technical analysts studying the charts say a period of consolidation could be ahead in light of the South African currency’s barnstorming 2021 rally.

South Africa’s Rand ceded ground to the U.S. Dollar on Wednesday although less so than the Canadian, New Zealand and Australian Dollar, leading the Rand to advance on an intraday basis against all the commodity currencies within major developed economy spheres despite widespread risk aversion in global markets.

Developed world stock markets tumbled on Wednesday and still had trouble stabilising even after bond yields topped out and their prices recovered from earlier lows, making for exactly the kind of international environment that has typically pulled a rug out from under the Rand in the past.

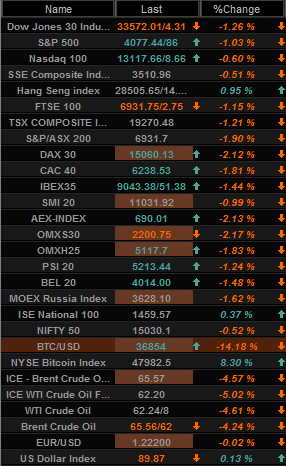

Above: Selected global market quotes and intraday performances. Source: Netdania Markets.

"USD/ZAR’s descent seems to have paused above the 2011-2021 uptrend line at 13.9388," says Axel Rudolph, a senior technical analyst at Commerzbank.

"Positive RSI divergence points to further sideways trading above the 13.9544/19.9388 zone being seen," says Rudolph.

USD/ZAR’s 2021 decline has taken it to within inches of the 13.9388 level which forms the backbone of an upward sloping trendline running from near its 2011 lows, a fall beneath which would open the door to declines as far as the July 2019 low at 13.8148 in the weeks and months ahead, according to Commerzbank’s Rudolph.

"Much further down sits the January 2019 low at 13.2338. We will stick to our longer term bearish outlook while the cross stays below the late March high at 15.1004,” Rudolph writes in a review of the South African Rand’s charts this week.

The South African Rand showed remarkable resilience on Wednesday even after a mixed bag of economic figures in which retail sales surprised on the downside for March, while inflation came in higher than anticipated for April.

Above: USD/ZAR shown at monthly intervals with Fibonacci retracements of 2018 uptrend, 2011 trendline and GBP/ZAR.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“Measured on a quarter-on-quarter seasonally adjusted basis (qqsa) however, sales were up 1.5% in March, therefore the trade sector should still make a positive contribution to the quarter’s GDP outcome,” says Lara Hodes, an economist at Investec.

South African inflation rose from an annualised 3.2% to 4.4% in April, above the 4.3% anticipated by consensus, although Investec economists say this was mostly the result of statistical base effects.

Nonetheless, they’ve also warned that rising price pressures could keep the Rand from further gains in the months ahead as they would be likely to eat into to the returns paid by South African government bonds.

“With the repo rate at 3.5% South Africa will see material negative real interest rates, which will severely eat into momentum for further rand strength, and so instead we continue to believe that there is now an underpin of weakness coming through for the domestic currency,” says Annabel Bishop, chief economist at Investec.

“However, the rand is not expected to see sudden, substantial weakness and instead may just gradually tick weaker to the R14.50/USD mark this quarter,” says Bishop.

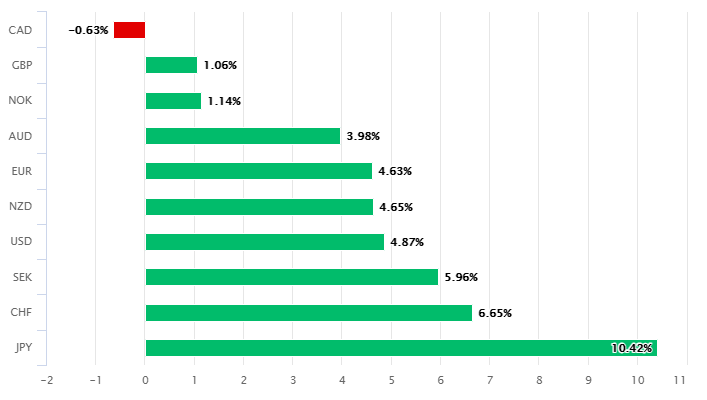

Above: South African Rand’s performance against major currencies in 2021.

USD/ZAR has spent much of the last week consolidating above 13.9388 and might be unlikely to disrupt this pattern of trading at least until after Thursday’s South African Reserve Bank (SARB) policy decision.

Governor Lesetja Kganyago sets out the SARB’s latest decision around 14:00 London time however, with consensus looking for the cash rate to remain unchanged at 3.5%, the market’s attention will be on the governor’s assessment of the current economy and prospects for sustainably achieving the midpoint of the 3%-to-6% inflation target.

Last time out the SARB revised up forecasts for inflation and GDP growth in 2021 while tweaking lower its estimate of the 'output gap,' which describes the space between the prevailing level of economic output and the level that is necessary to sustain the bank's inflation target.

The latter was revised down across the forecast horizon while the SARB included in the assumptions underlying its policy decision a 2021 bout of strength in both nominal as well as real terms South African Rand exchange rates in what was a not so subtle hint about its asking of the currency market.

“This week, S&P is due to give SA a country review, on Friday evening post market close, but with no negative outlook, a downgrade is not expected, and S&P is likely to also adopt a wait and see approach to fiscal consolidation in SA as Moody’s and Fitch appear to be doing,” Investec’s Bishop says.