Pound-Rand Exchange Rate Eyes Another Weekly Advance, Moodys Decision Forms Key Focus

- Written by: Gary Howes

Image © Adobe Images

- GBP/ZAR spot rate at publication: 20.09

- Bank transfer rates (indicative guide): 17.50-18.00

- Transfer specialist rates (indicative): 18.30-19.00

- Get a specialist rate quote, here

- Set up an exchange rate alert, here

The British Pound has scored two successive weekly gains on the South African Rand and the outcome of this week's trade will rest with a review by Moodys and the tone in global markets.

The Rand is on the back foot at the time of writing in line with soft sentiment across global markets, a background that typically hampers the 'risk on' South African currency.

The Pound-to-Rand exchange rate was seen up a third of a percent down at 20.09, putting the UK currency on course for a potential fourth consecutive daily advance.

The Dollar-to-Rand exchange rate was meanwhile at 0.83% higher at 14.50 while the Euro-to-Rand rate was half a percent higher at 17.45.

"Risk is offered into the start of a quiet session with DXY bid against virtually all other majors. Gold and copper fall, partially driven by strength on the USD leg," says Bipan Rai, North America Head of FX Strategy at CIBC Capital Markets.

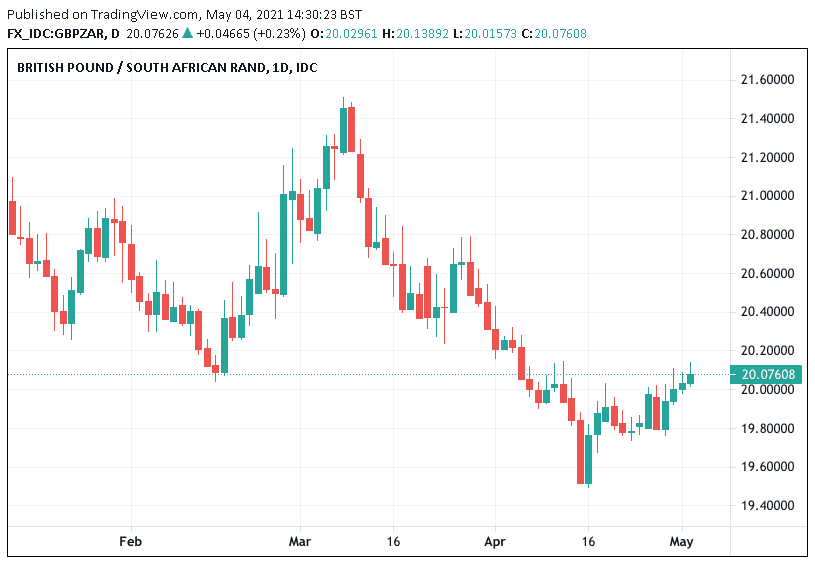

Above: GBP/ZAR has broken out of a short-term downtrend.

Should global markets and commodities struggle through the course of the coming week the Rand would be expected to lose further ground against the Pound, Euro and U.S. Dollar.

However the end of the week could well see focus turn squarely onto domestic fundamentals as one of the world's major ratings agencies assess the country's debt profile.

"This week's country review from Moody's holds significant risk to the ZAR," says Peter Stoneham, a Reuters market analyst.

Moody's will deliver their latest assessment on South African sovereign bonds following the close of markets on Friday.

They already class the bonds at 'junk' status, but further downgrades to the outlook could pose further headwinds for international investors looking to acquire or hold on to the asset.

Moody's downgraded the Government of South Africa's long-term foreign-currency and local-currency issuer ratings to Ba2 from Ba1 on November 20, 2020.

"The agency has South Africa on a negative outlook, which should bring a rating downgrade. However, there is a chance Moody's may push any downgrade down the road," says Stoneham.

The key driver behind the previous rating downgrade to Ba2 was the further expected weakening in South Africa's fiscal strength over the medium-term by Moodys.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Whereas the rating action earlier in 2020 reflected an erosion in the country's credit profile which predated the coronavirus crisis, the November 20 action reflected Moody's assessment of the impact of the pandemic shock, both directly on the debt burden and indirectly by intensifying the country's economic challenges and the social obstacles to reforms.

Any move by Moodys on the Rand could however ultimately prove short-lived in duration, given the Rand's ongoing sensitivity to global investor sentiment.

The Rand is one of 2020's best performing major currencies, particularly in the Emerging Market space and for now it appears this attachment to global drivers is likely to remain intact.

"Strong demand for commodities, notably metals, has insulated the ZAR from much of the risk aversion swings that have dogged emerging markets this year," says Stoneham.

The improved sentiment amongst global investors in 2020-2021 has seen strong demand for South African stocks and government bonds which offer a higher return than those offered by developed countries.

These assets have only shone brighter given the woes troubling Turkey, which is seen as a falling in a similar investment bracket for those seeking out Emerging Market returns.

But should Moody's offer a disappointing review on South African bonds, some of this attraction might fade and could combine with any deterioration in risk sentiment to whittle away at the currency's 2021 gains.