The Rand was Hurt by Q1 Economic Contraction but Bank of America is Eyeing Opportunity in South Africa

- Written by: James Skinner

© Goroden Kkoff, Adobe Stock

© Goroden Kkoff, Adobe Stock

- ZAR hits rocks, underperforms rivals, after GDP falls sharply in Q1.

- Weakening economy keeps focus on Moody's credit rating, reforms.

- But Bank of America says ZAR/RUB is one rate that can still do well.

The Rand was on its back foot against major counterparts Tuesday and might remain on the defensive for a while yet but there's at least one rival that it's set to prosper against, according to Bank of America analysts, who're telling clients to buy the South African currency and sell the Russian Rouble.

South Africa's Rand was burnt Tuesday as traders jettisoned it by the bucketload, despite a more stable environment for other emerging market currencies that comes amid market bets the U.S. Federal Reserve (Fed) will cut its interest rate before the year is out. That would be balm for the souls of emerging market currencies.

Underperformance in Rand exchange rates comes after first-quarter GDP data showed the economy contracting sharply. GDP fell by 3.2%, more than reversing the 1.4% expansion seen in final months of 2018, when markets had looked for South Africa's fragile economy to shrink by only 1.7%.

"GDP collapsed in the first quarter of this year, dragged down by the sharp contraction of industrial production, of -10% qqsaa, and lower consumer spending and fixed investment. Worryingly, a contraction in GDP in the first quarter of every year has become the norm in South Africa," says Annabel Bishop, chief economist at Investec Bank.

Above: USD/ZAR rate shown at 4-hour intervals alongside Pound-to-Rand rate (aqua green/blue).

Local analysts describe the data as worrying no doubt as it comes at a time when the South African government needs every cent of tax revenue it can get and for the economy to grow in order to avoid an automatic increase in the national debt ratio.

Moody's, the last rating agency to have South Africa as an 'investment grade' credit prospect, is unlikely to respond kindly to tax revenues that fall radically short of Treasury forecasts or to debt ratio that rises as a result of economic contraction and poor revenue collection.

Losing the Moody's rating would mean many international investors, particular those that benchmark to the Citi World Government Bond index, are automatically forced into selling their South African government bonds.

This would force government funding costs higher by lifting bond yields and drive the Rand into the ground in the process as investors seek to swap capital back into their domestic currencies.

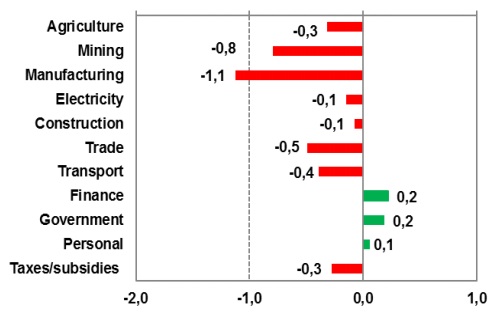

Above: Contributions to South African GDP growth in first-quarter of 2019. Source: Stats SA.

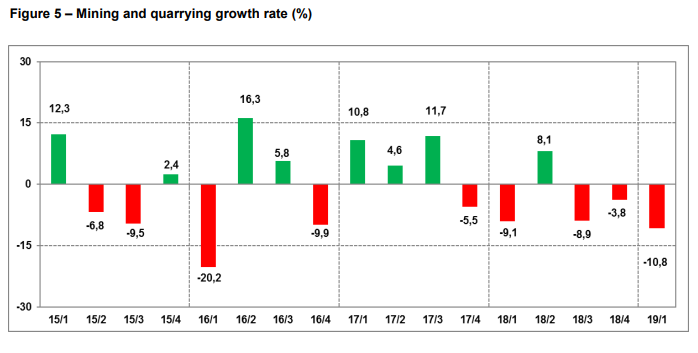

"With GDP growth at such low levels due to the drop in competitiveness SA faced over this decade, and substantial drop in the ease of doing business, the highly volatile smaller components such as mining and agriculture, now have a more significant impact than they did over a decade ago," Bishop adds.

Above: South African mining production growth rates. Source: Stats SA.

Moody's will review its rating in November. Until then, President Cyril Ramaphosa and his newly-minted cabinet will be under pressure to reduce spending and put right a series of troubled state-owned enterprises. Without reforms to ailing state-owned companies the rating is sure to go.

The government has so-far refused fresh financial support for South African Airways, presumably out of fear over what Moody's might think, even though it could mean bankruptcy for the firm and the loss of jobs.

However, that's not an option when it comes to the troubled utility provider Eskom, which has ZAR 350 bn of government guaranteed debt. This particular company has the government caught between a rock and a hard place.

Tuesday's growth disappointment is a headache the South African leadership and Rand could really do without. However, none of this necessarily means the Rand won't do well against the Rouble over the coming months.

Above: ZAR/RUB rate shown at daily intervals alongside Brent oil price.

"Our technical indicators point to further risk-off, and oil trades remain crowded long positions vulnerable to a correction," says David Hauner at Bank of America. "While we worry about Iran, near term the trade war/growth risks may have the upper hand: RUB is crowded, while ZAR is shorted."

Hauner says that concerns about the health of the global economy risk forcing oil prices into a more protracted downward correction at a time when many investors have bet heavily on gains this year.

His idea is that with further declines over the coming months, those investors will be forced into exiting their bets by selling oil, which could drive prices even lower and hurt the Russian Rouble as much of the European nation's export revenue comes from oil.

The Brent oil price is still up by 15.2% for 2019 but it's also fallen by 11.9% during the week to Tuesday, leaving futures contracts trading at $61.75 per barrel. Meanwhile, the Rand is one of the most neglected emerging market currencies and could be due some respite from selling given the market's evolving view of the Dollar.

Markets have turned against the U.S. Dollar in recent days as investors bet with increasing amounts that the Federal Reserve will soon cut its interest rate. Lower U.S. interest rates and a weaker Dollar would be positive for most emerging market currencies, but maybe not the Rouble if oil prices are collapsing at the same time.

Above: Russian stock market alongside Brent oil price (black).

"Against this backdrop, crude oil and related assets stand out with still crowded positioning," Hauner writes, in a recent note to clients. "Our Real Money Tracker also shows that OFZs [Russian government bonds] are the biggest overweight in local bonds, and the same holds true for Russian equities."

It's not just a decline in export revenues that would hurt Russian Rouble, however, as investors previously drawn to the country by the 2019 rally in oil prices could also feel compelled to pack up and move on.

Such a thing might see Russian government bonds as well as stock market shares sold en masse, with investors dumping the Rouble in tandem in order to buy back their domestic currencies.

Even with a generally weak Rand, such 'outflows' could still be enough to see the ZAR/RUB rate rise notably. The Russian MOEX stock index is itself up by 14% for 2019 and it's so-far barely responded to the recent decline in oil prices despite having a high weighting toward oil producers.

Hauner forecasts a 6% increase, from 4.38 to 4.63, in the ZAR/RUB rate over the coming months and has advocated that Bank of America institutional clients bet accordingly.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement