Sell the South African Rand says Deutsche Bank

- Written by: James Skinner

Image © Comugnero Silvana, Adobe Stock

- ZAR slides as post-election honeymoon ends in weakness.

- Deutsche Bank says sell as Ramaphosa faces uphill climb.

- Setbacks and Eskom could see Moody's rating fears return.

The Rand has almost entirely retraced its post-election rally against a range of currencies but losses may now wrack up for longer due to a deteriorating international environment, and given President Cyril Ramaphosa must now deliver the reformist goods he's promised or risk the ire of the market.

South Africa's China-sensitive currency followed the Renmimbi lower on Friday as markets responded to signs the so-called trade war between the world's two largest economies will could become a more serious and protracted affair.

The USD/CNH rate has embarked upon a steep northward hike in recent weeks, rising 4%, in response to President Donald Trump's second major offensive in the trade war and took another leg higher in the Friday session.

The USD/ZAR rate has strong positive correlation with the USD/CNH rate, largely due to strong South African economic ties with China. In the last month the USD/ZAR rate has risen by 3% while USD/CNH has gained 4%.

This 'bearish' price action comes in the wake of last week's election, which saw the African National Congress emerge again as the nation's largest party, but the honeymoon period for the currency now appears to be over.

Deutsche Bank, one of the world's largest financial institutions, told clients this week they should sell the Rand because Ramaphosa now faces an uphill climb along a path could easily become littered with false dawns and disappointments.

"A solid victory by the ANC in last week's elections has driven a relief rally in ZAR on the belief it provides President Ramaphosa with a strong reform mandate. However, the fundamental backdrop remains weak as illustrated by unfavourable Balance of Payment dynamics, fiscal erosion and low growth, while Ramaphosa is unlikely to enjoy an unconstrained path to reform," says David Petitcolin, a strategist at Deutsche Bank.

Above: USD/ZAR rate shown at daily intervals, alongside USD/CNH rate (blue).

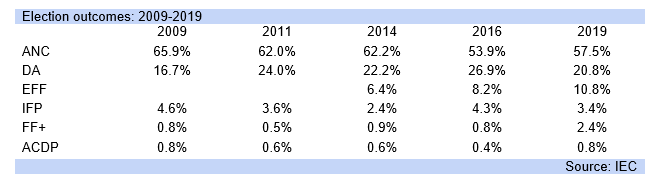

Ramaphosa's African National Congress won around 57.5% of the national vote, up from 53.9% in the 2016 municipal election but down from the 62.2% achieved in the general election of 2014.

The result was below the lofty 60% share of the vote that had been predicted by some opinion polls ahead of the ballot and has resulted in the loss of 19 parliamentary seats for the African National Congress.

But, nonetheless, markets have been pleased by the fact the radical Economic Freedom Fighters saw their vote share increase but only to a number that was at the lower end of the range predicted by polls.

The party has advocated a number of controversial policies, some of which might breach international human rights laws if implemented, including a much more radical version of the government's existing land expropriation policy.

"While the final election result overshot cautious market expectations, it still reveals a serious fall in support for the ANC since 2014 (62.1%) and is unlikely to provide Ramaphosa with the confidence to unleash unpopular reforms," says Petitcolin. ""Overall we think optimism will prove short-lived as the market quickly refocuses on deteriorating fundamentals."

Above: South African election results. Source: Investec Bank.

South Africa is under pressure to reduce its budget deficit and debt pile, both of which have risen to levels rating agencies find unnaceptable. The only major rating firm to still have South Africa at 'investment grade' is Moody's, but there's no guarantee that rating won't be cut later on.

Such a move would mean many international investors, particular those that benchmark to the Citi World Government Bond index, are automatically forced into selling their South African government bonds.

This would force government funding costs higher by lifting bond yields and drive the Rand into the ground in the process as investors seek to swap capital back into their domestic currencies. Around half of South African government debt is owned by foreigners.

The government is caught between a rock and a hard place because of the weak economy, which could be further damaged if the government was to drastically reduce its spending without managing to incentivise a pick-up in activity elsewhere.

Ramaphosa and his new cabinet will also need to manage the ailing national electricity monopoly that is Eskom. South African taxpayers are on the hook for ZAR 350 bn of the Eskom's debts, given guarantees made by previous leaders, and the company is now failing.

Above: Pound-to-Rand rate shown at daily intervals.

"We remain concerned over the sustainability of the country's energy supplier financial situation and the possibility of a fresh request for financial support," says Petitcolin. "The fact that the government had to provide ZAR5bn emergency funding after a loan from China failed to materialise last month illustrates the precariousness of the utility's finances."

Petitcolin says that rising financial stress at Eskom could easily see the market begin fretting again about a Moody's rating downgrade upon its next review in November 2019, which would hurt the Rand.

However, rather than recommending that clients of Deutsche Bank buy the USD/ZAR rate, he's suggested they sell the Rand against the Chilean Peso. But Investec Bank,one of South Africa's most renowned institutions, issued fresh forecasts for the USD/ZAR and Pound-to-Rand rates this week.

Annabel Bishop, chief economist at Investec, says it might be year-end before currency market becomes willing to support the Rand. Bishop forecasts the USD/ZAR rate will reach 13.90 by year-end, modestly below Friday's 14.39.

Meanwhile, the Pound-to-Rand rate is seen rising even further over the remainder of the year, from 18.33 Friday to 18.65 before the end of December.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement