Pound-to-Dollar Rate Forecast for the Week Ahead

- GBP/USD closes in on its 2018 highs as uptrend pushes relentlessly higher

- The main release for the US Dollar is Retail Sales on Monday

- The principle data release for the Pound is labour market stats on Tuesday

© kasto, Adobe Stock

The Pound starts the new week on a solid footing against the US Dollar with 1 GBP buying 1.4251 on the inter-bank market, ensuring competitive retail providers of currency are being offered towards 1.4120 which is more-or-less the best rate for Dollar buyers since late January.

The GBP/USD pair ended the previous week on a strong note trading near its 2018 highs at 1.4235 which should stoke further positive momentum and we note the pair to be in a concerted uptrend and is currently probing and threatening the January highs at 1.4345 but is still a cent short.

To confidently forecast a continuation of the uptrend I would however want to first see a break above the January highs for confirmation.

Such a break, however, would probably lead to a continuation up to the next target at 1.4500, which is an important symbolic and psychological level where I would expect increased supply to dampen the exchange rate due to many traders closing their positions and taking profit.

The weekly chart above shows why the pair has struggled to break above the highs set in January. Note how the 200-week moving average (MA) is successfully capping further gains- and yet, nevertheless, we still see a break above 1.4345 now confirming the 200-week cleared, and the opening up of the bull trend higher to 1.4500.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

Data and Events to Watch for the Dollar

The US data calendar is largely peppered with second-tier releases, but Retail Sales is expected to bounce back from a negative level by rising 0.4% in March when it is released on Monday at 13.30 GMT.

Also out on Monday afternoon is the NAHB house price index which is forecast to rise a point to 71 in April from 70 in the previous period.

Other housing data includes New Housing Starts out on Tuesday at 13.30, which is expected to show a strong rebound of 1.0% from the -7.0% registered in February.

Industrial Production in March is expected to show a 0.3% rise when it is released at 14.15 on Tuesday.

The New York Fed and Philadelphia Fed manufacturing surveys out on Monday and Friday respectively, are forecast to show rises slight declines to 19.8 and 21.2 respectively in March.

Additionally, the Fed will publish its regular Beige Book, which is an economic update, on Wednesday at 19.00.

The Dollar may also be impacted by geopolitical factors, including the possibility of heightened tensions between the US and Russia, played out via the Syria conflict.

Trade relations between the US and China have no improved since China's Xi Jinping's made concessions but the issue remains a live risk to the stability of financial markets.

Data and Events to watch for the Pound

A big week in terms of data for the UK in the coming week with labour market, inflation and retail sales numbers all on tap.

The Pound has enjoyed a strong start to 2018 as concerns and uncertainties relating to Brexit fade. As a result, analyst Viraj Patel at ING Bank N.V. believes Sterling will now start to pay more attention to data. "It appears that we’re back to good old-fashioned UK data watching to determine the short-term direction for the currency," says the analyst. "The week ahead shouldn’t disappoint here given the array of key data releases to watch out for."

On Tuesday, April 17 we have labour market data with markets looking for employment to increase by 13.3K in the quarter to March.

The Unemployment rate is forecast to stick at 4.3%.

Most important for the Pound will be wage data; as it is wage data that the Bank of England will be watching when it comes to raising intent rates with the rule of thumb being that higher wages should prompt interest rate wages which are in turn supportive of Sterling.

The average earnings index, with bonuses, is forecast to have risen 3% in February. If this number is missed, expect the Pound to struggle.

"We think signs of firming wage growth next week may seal the deal for a May BoE rate hike," says Patel.

If unemployment stays at 4.3%, however, some analysts estimate this is not sufficiently low to have an inflationary effect on wages, since the level below which that would be expected to occur - known as NAIRU - is now 4.25%.

"The UK job report will be closely watched. Last month the unemployment rate jumped to 4.3%, above the most recent NAIRU-estimate by Bank of England of 4.25%. Bank of England projects a relatively sharp increase in wage growth this year? Why should wage growth pick up materially, if unemployment is above NAIRU?," questions Andreas Steno Larsen, senior strategist at Nordea Bank.

Inflation data on Wednesday, April 18 will also be key with economists forecasting the headline CPI rate to be at 2.7%, unchanged from the previous month.

Calling Sterling's reaction to this is tricky as the traditional rule of thumb is higher inflation = a positive reaction in the

Pound as it should mean the Bank of England will need to deliver more interest rates. This should still be true.

However, falling inflation also means the squeeze on consumers is fading as pay growth starts to finally creep ahead of inflation - and this is good for the economy. And what is good for the economy is good for the Pound.

The inflation data could, therefore, offer a win-win for Sterling.

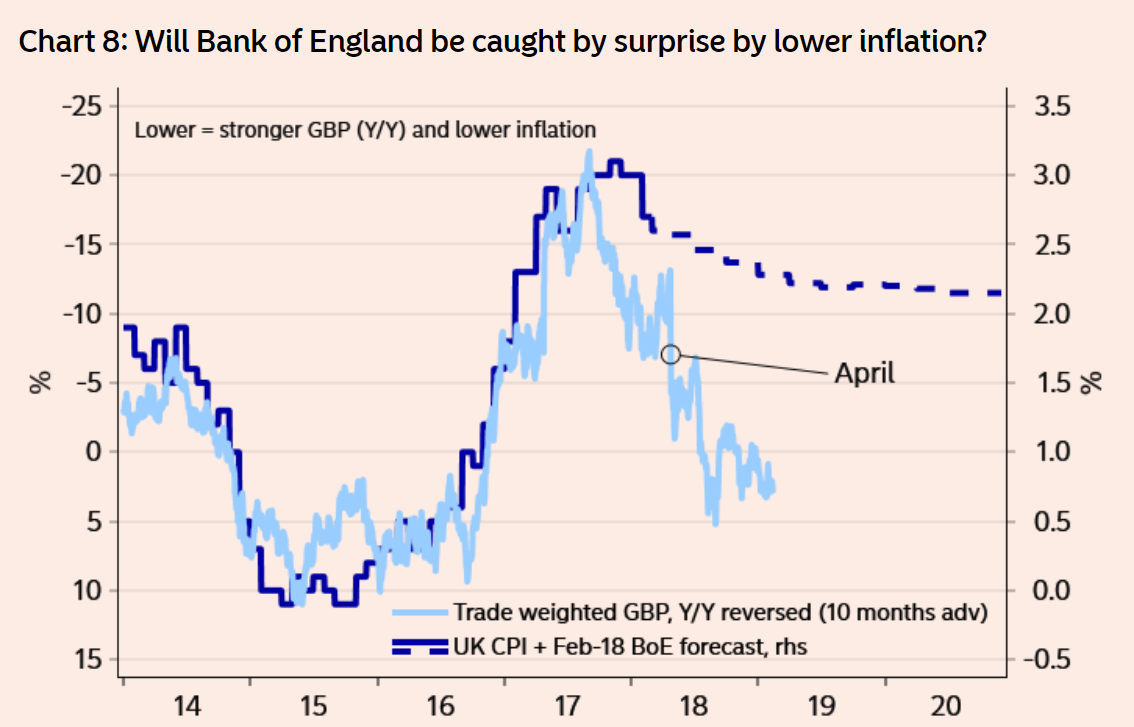

Nordea's Larsen sees a material chance of inflation undershooting expectations as the effect of the previously cheapPound wears off.

"Remember how everyone was caught by surprise when inflation exploded in the UK during 2017 as a result of the massive weakening of the GBP. Will everyone be equally surprised now that the currency effects will start to fade out of the UK CPI? We tend to think so," says the strategist, hinting at a bearish outcome for Sterling.

"We don’t buy into the current market pricing of Bank of England and while a hike in May seems settled, there is no big reason to expect Bank of England to hike anytime soon thereafter. Therefore, we are also very sceptical about the fundamentals behind the recent GBP strengthening," says Larsen.

Finally, markets will be watching retail sales on Thursday, April 19 with economists forecasting a reading of -0.5% thanks to the inclement weather seen in March.

"Retail sales figures (Thursday) should reveal that the heavy snowfall in March hit the sector hard, with sales volumes contracting sharply on the month says Liam Peach, an economist with Capital Economics.

We, therefore, reckon markets are likely to discount seasonality into this month's data and instead look for next month's data for direction.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.