U.S. Dollar Remains King as American Economy Stands Tall and Growth Momentum Wanes Overseas

- Written by: James Skinner

- USD roars back to life with advances against all majors Thursday.

- GBP and SEK the weakest although EUR, NZD & AUD also soften.

- Amid fresh signs of economic divergence between U.S. and others.

- U.S. economy is standing tall while others falter and headwinds loom.

- Fed's Kaplan says no rate cuts over coronavirus or for the 2020 year.

- But markets were still betting on Fed cuts, with rate stability elsewhere.

- Fed pricing liable to reverse as other central banks get reality checked.

Image © Adobe Images

- GBP/USD Spot rate: 1.2924, down 0.03% today

- Indicative bank rates for transfers: 1.2582-1.2673

- Transfer specialist indicative rates: 1.2741-1.2819 >> Get your quote now

The Dollar advanced against all most rivals early on Friday and could now be set for more gains as investors return their attention to the disparity between growth in an exceptionalist U.S. economy and that observed elsewhere in the world.

Most major currencies ceded ground to a stronger Dollar ahead of the weekend, although losses have been particularly notable for a Brexit-battered Pound, the Swedish Krona and the Euro, while Canada's Dollar was the only major to give anything like a good account of itself to the steadily advancing greenback.

Driving price action is renewed divergence between the U.S. and other economies, with the U.S. proving resilient in the face of multiple headwinds and continuing to stand tall relative to others including those of the UK and Eurozone, which are once again faltering.

"The dollar remains very well bid and we have just seen some key levels breaking down for the euro and pound. There’s just been a whole heap of heavy dollar pressure that’s pent up and finally today we are seeing the dam burst," says Mark Wilson, chief market analyst at Markets.com. "Sterling drops have traditionally been a decent fade play but with dollar strength dominating this is not a Brexit headline type event you can easily discount. EURUSD broke down at key support on 1.0990 to take out the 2020 low - knock enough times and the whole rotten structure comes crashing down. The loss of this support zone opens up a fresh move to 1.0940."

Above: Euro-to-Dollar rate shown at daily intervals.

"Anything below 1.0990 keeps the bears in charge," Wilson says, of the EUR/USD rate. "Meanwhile, USDJPY continues to push up to retake the 110 handle, which seems only a matter of time."

The Dollar received an extra shot in the arm Thursday after Federal Open Market Committee member Robert Kaplan, who's widely described as a 'neutral' voter and therefore neither a 'dove' nor 'hawk', said his own economic outlook has firmed in recent weeks and that he's now looking for GDP growth of 2.25%.

Kaplan also said the economic fallout from coronavirus is not likely to necessitate a monetary policy response in the U.S. and that he sees the Fed Funds rate range remaining at its current 1.5%-to-1.75% all year. That's one less hand likely to favour a cut in time for the March 18 and April 29 decisions.

"The US dollar is at it again, but at it in slow-motion as it pushes to new local highs in several places without showing much momentum," says John Hardy, head of FX strategy at Saxo Bank. "EURUSD nominally broke lower yesterday by posting a new 19-day and 49-day low close, although the obvious focus is on the 1.1000 level and a more convincing break."

The boon for the Dollar and rub for other currencies is that markets are positioned for at least one Federal Reserve (Fed) rate cut this year that at least looks to be becoming less likely. If it was ever even a prospect in the first place.

Meanwhile, investors have priced-out from other major economy money markets much of the earlier implied chance of cuts being delivered overseas. This potentially leaves other currencies especially vulnerable to economic underperformance because bad growth numbers might prompt fresh speculation about rate cuts in places like the UK, Canada, Australia and New Zealand.

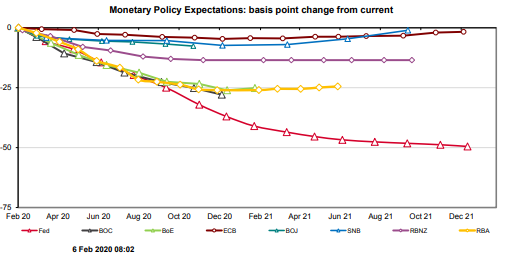

Above: Westpac graph detailing overnight-index-swap market expectations for rate cuts at major central banks.

"Coronavirus is already questioning one of our basic assumptions for 2020. It remains unpredictable but global growth is certainly going to suffer a hit. Taking an optimistic view, the hit to economic growth, if there is no notable escalation of the virus outside of mainland China, is still set to lower the growth rate in China this year from a consensus of around 6.0% to possibly 5.4% (calendar year growth)," says Derek Halpenny, head of research, global markets EMEA and international securities at MUFG. "At the start of the year we assumed that the global macro backdrop for 2020 was going to shift a little more favourably for the Rest of the World versus the US."

Favourable Dollar dynamics are being reinforced on an almost daily basis of late by continued exhibitions of U.S. economic exceptionalism, with the latest being the Institute for Supply Management (ISM) services PMI that blew away the consensus on Wednesday just days after the sister survey of the no-longer-ailing manufacturing sector surprised sharply on the upside. And those figures came hard on the heels official data that showed the economy growing by a steady 2.1% on an annualised basis in the final quarter.

U.S. GDP growth was more than twice that of the Eurozone last quarter and almost four times the 0.6% rate seen in the UK for the 12 months to the end of November, but markets continue to price-in more rate cuts from the Federal Reserve and little other policy action from elsewere.

"USDCHF also broke higher yesterday and GBPUSD has broken lower as of this writing. Among other USD pairs within the G10, USDCAD is poised right at resistance and NZDUSD is close to an important breakdown level as well," Hardy writes in a note to clients Thursday.

Above: USD/CAD rate shown at daily intervals.

“US has a smaller direct trade exposure to China than many others. An impressive array of key US data have been reassuringly upbeat too, including ISM surveys, ADP payrolls and durable orders,” says Richard Franulovich, head of FX strategy at Westpac. “There doesn’t appear to be much in the way of further [Dollar Index] upside, we revise up upside target from 98.0-98.5 to 99.0 on 1mth horizon; US data surprise indices are at cycle lows and OIS markets price in an (excessive?) 45% probability of an FOMC cut by 29 April.”

Lopsided wagers by investors against the Fed's guidance, and in favour of outlooks uttered elsewhere in the world might be enough to support the Dollar in any market but the fact that it exists at a time when the U.S. economy is motoring along at a healthy pace while others struggle simply serves to cement in place already deeply disadvantageous interest rate differentials relative to other currencies. And that divergence could grow larger still as the coronavirus bites other more exposed economies.

There's a near two percent difference between comparable interest rates in the U.S., Eurozone and some non-Euro countries on the continent while the gap between Fed rates and those elsewhere in the major currency universe reaches is as high as 100 basis points in the case of the UK and Australia. Those differentials matter in the bond market so can be alluring for yield-hungry investors. And they also make betting against the greenback a costly affair.

"The shaky risk backdrop is also challenging our bearish USD view, with CNH and KRW standing out as victims in the Asia EM while JPY benefits in the G10 space," says George Davis, chief technical strategist at RBC Capital Markets.

Above: RBC Capital Markets Dollar Index chart with technical analysis overlayed.