Dollar Seen Finding Support as Sterling's Brexit Bounce Abates and ECB Looms Over the Euro

- Written by: James Skinner

Image © Adobe Images

- USD arrests October decline as GBP and EUR soften.

- GBP's Brexit bounce abates, EUR softens in sympathy.

- Softer GBP and EUR offer wounded USD index respite.

- UBS sees technical support for USD index up ahead.

- TD Securities sees ECB's lean on EUR lifting the USD.

The Dollar arrested a week long decline Tuesday as the rally in Sterling and gentle climb of the Euro both petered out, providing the U.S. unit a moment of respite, although the UBS currency desk sees the greenback finding support in the days ahead while TD Securities is tipping a recovery.

Investors had sold the Dollar by the bucket load since Thursday, 10 October, the day before President Donald Trump claimed to have reached a deal that addresses some of the issues at play in the trade war with China. That agreement, said this Tuesday to be solidifying, offered hope that further damage to the global economy can be avoided while Brexit developments have since given more grounds for dumping the safe-haven Dollar.

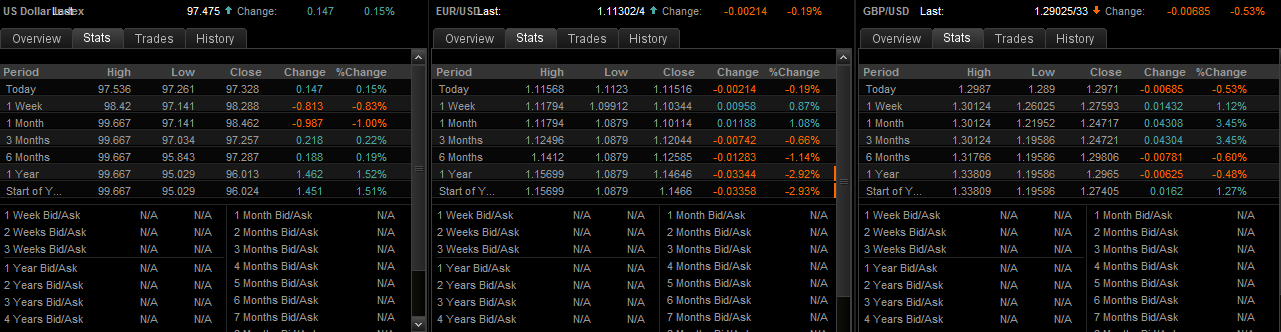

Pound Sterling's fortune has turned for the better in recent weeks and with it, the Euro's also but to a lesser extent, which has been significant for the greenback because the two European currencies account for nearly two thirds of the Dollar index. The Dollar index measures the U.S. currency's performance against a basket of its most frequently traded rivals, although the Euro accounts for a substantial 50.1% of the benchmark and Pound Sterling a meaningful 11.9%.

"USD has support between 97.40-97.03 on the USD Index (DXY). There is a cluster of supports close to current levels. A break of this support zone would be a bearish signal, but with both momentum and trending extended, it will be difficult. The 200-dma at 97.40, the 61.8% retracement of the uptrend from June 2019 at 97.30, the Aug. 23 low at 97.17, and the Aug. 9 low at 97.03," says Marco Meola, an FX salesperson at UBS.

Above: Dollar Index shown at daily intervals.

"We remarked in our note yesterday that the USD has started to look oversold and that we are hesitant to continue chasing the weakness from here. Much of the weakness this month has been driven by GBP and EUR, off the back of Brexit developments," says Mazen Issa, a strategist at TD Securities. "We argued that evidence of a sequential improvement in global growth will be needed to turn us optimistic on the EUR beyond a tactical horizon."

Members of the UK parliament will vote Tuesday evening on whether to back the agreement struck between Prime Minister Boris Johnson and the European Union last week, and speculation suggests he might have the numbers to get the accord through a divided and fractious House of Commons.

The pact is billed by Johnson as a "new deal" that will "get Brexit done", but the reality is the proposal amounts to merely a tweaked version of his predecessor's three times rejected treaty, and parliament's approval of it would only open a new chapter in a long saga that could still mar politics for years to come.

Under the terms of the agreement, the UK leaves the EU on October 31 as far as the official record states but will be a de facto member without voting rights in practice until the end of a standstill period of 'transition' or 'implementation', during which attempts will be made to negotiate the future relationship.

Nonetheless, and crucially for markets, the threat of a Pound-punishing 'no deal' Brexit that requires a World Trade Organization (WTO) terms business relationship has been neutralised by opposition shenanigans in parliament and could yet be averted for years more if Johnson's accord is ratified into law.

"We think the tactical bounce has largely run its course, particularly as the ECB reminds the market why the EUR remains the funder of choice. The market is also priced for a Fed cut next week (which we agree with). Less obvious is the optionality presented by Powell for future policy shifts," says TD's Issa.

Above: Pound-to-Dollar rate shown at daily intervals alongside Euro-to-Dollar rate.

The Euro, with its fragile and China-exposed economy, not to mention central bank that's all but run out of bullets to fight the nascent downturn with, has also been a beneficiary of the parliament's success in preventing a 'no deal' Brexit. Europe is less exposed to the UK economy than the Brexiting economy is to trade with its European neighbour, but the Eurozone is less able to cope with as well as recover from economic crises, and is a much larger and therefore slower vehicle to turn.

That's significant for the Dollar index because of the single currency's large weighting in the benchmark, although TD Securities says the Euro rally seen since the beginning of October now looks to have run its course. Many say the same thing about Pound Sterling, with the British currency in need of further Brexit progress if it is to sustainably cross over the 1.30 rubicon.

The Pound may yet enjoy an additional boost if Boris Johnson succeeds in parliament on Tuesday, potentially taking the Euro higher with it, but TD Securities tips the Federal Reserve (Fed) and European Central Bank (ECB) as being most key to the outlook for the Dollar beyond the very short-term. And the terrain of the current relative interest rate landscape still favours the Dollar, according to the Toronto-headquartered investment bank, with the Euro tipped to bear the brunt of any adjustment.

"While we do not think that Powell will be quick to completely close the door to support the economy with more cuts, we think it is far more likely they he (and the Committee) opt to wait and see how the data unfolds after delivering 75bps of cuts and trade talks have pivoted towards a more positive footing. This could serve as the basis for a tactical turnaround in the USD," Issa says.

Above: Performance statistics for Dollar Index (left), EUR/USD (centre) and GBP/USD (right side). Source: Netdania.

U.S. economic data has continued to incite further wagers by the market that the Fed will cut its interest rate again at the end of October, making for a third consecutive rate cut. The move is almost fully priced into the market, with more cuts eyed for 2020 too, while Vice Chair Richard Clarida did little to discourage the notion last Friday that the bank might be minded to indulge those wagers.

Clarida told a Chartered Financial Analyst (CFA) Institute conference last week that "muted inflation pressures", weak global growth and signs of a slowdown in the domestic economy were behind the July and September decisions to cut rates, before saying the Federal Open Market Committee will continue to make decisions on a meeting-by-meeting basis. The Dollar sold off afterward.

American factories are struggling badly after a year and a half of trade war with China and economists are increasingly concerned that a downturn in the manufacturing industry could soon spillover into the rest of the economy, leading to slower growth and undermining the outlook for inflation. Industrial production fell in September, the Philadelphia Federal Reserve manufacturing index tanked and housing starts underwhelmed, official figures revealed last week.

Those numbers came hard on the heels of a retail sales report that revealed a surprise fall in store spending last month, all of which have helped undermine to undermine greenback, although the Eurozone economy is worse fettle and the Fed still has the developed world's highest interest rate even after the two cuts announced so far. TD Securities is betting this will be enough to revive the Dollar index over the coming weeks.

"We also find that a DXY-weighted HFFV suggests that the index is about 1.5% cheap; a threshold that has typically signaled a halt to the slide. This nicely coincides with the technical backdrop; the daily RSI is in oversold territory and the 200-day moving-average sits near spot. We think the EUR is likely to bear the brunt of the USD adjustment," Issa says.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement