Pound-New Zealand Dollar Looks Ready for a Bigger Move

- NZD profits from improved market sentiment

- GBP/NZD increasingly resembles a coiling spring

- But longer-term trend for GBP/NZD remains higher

- GBP/NZD post-covid 19 consensus forecast downloads ready for download at Global Reach

Image © Adobe Stock

- GBP/NZD market rate at time of writing: 2.0651

- Bank transfer rates (indicative): 1.9928-2.0073

- FX specialist rates (indicative): 2.0019-2.0465 >> more information

The New Zealand Dollar is moving higher on Thursday, April 23 courtesy of a broad based improvement in investor sentiment, however this sentiment will be tested as a slew of economic data releases are due over the course of the coming 24 hours.

Markets will today focus on flash PMI releases that will give an indication of just how severe the economic slowdown in Europe has become, while another round of U.S. job data due at 13:30 BST will likely determine the tone in markets ahead of the weekend.

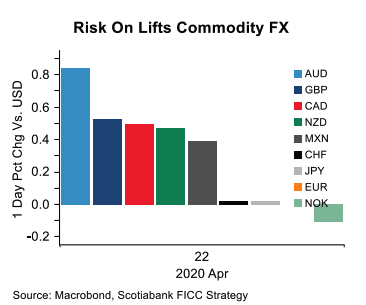

Stock markets are rallying once more courtesy of an improvement in oil market dynamics which suggest the negative shock triggered by a collapse in oil prices on Monday and Tuesday is starting to fade, which should allow other commodity classes and 'risk on' currencies such as the Kiwi Dollar to find support.

"The driver behind the improvement in risk appetite was the same which was responsible for the risk aversion in the last couple of days, and this is oil. With no clear catalyst behind the move, oil prices rebounded yesterday, with WTI and Brent gaining 37.66% and 5.38% respectively. The recovery continued during the Asian session today as well," says Charalambos Pissouros, Senior Market Analyst at JFD Group.

The New Zealand Dollar is currently taking direction from global conditions, tending to rise when markets rise and fall when they decline.

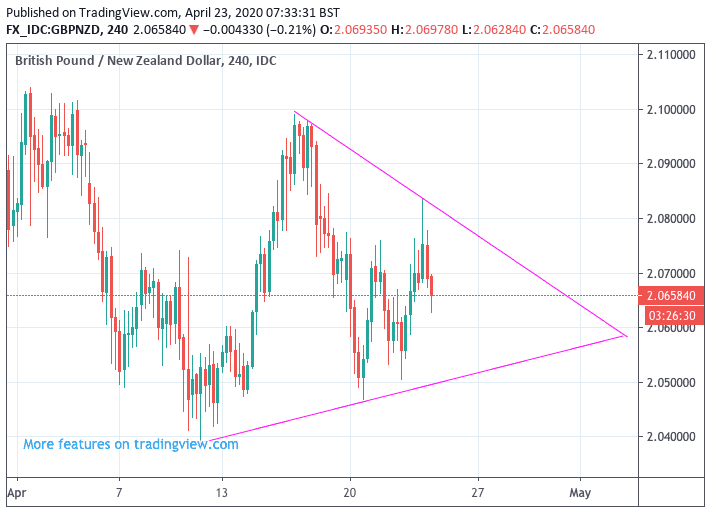

Turning to GBP/NZD dynamics in particular, the latest advance by the New Zealand Dollar means the Pound-to-New Zealand Dollar exchange rate has fallen back to 2.0652, which places it in the middle of a multi-day range and contributes to a rapidly contracting market range.

This could be symptomatic of a market that is stabilising, but from a technical perspective it is a little more interesting as we could describe this consolidation as a coiling spring that will at some point need to be released:

Above: The GBP/NZD four hour chart shows increased compression in the market

At some point the compression - highlighted by the converging purple trend lines in the above - becomes so intense that a break out is inevitable. We would expect such a breakout in the GBP/NZD exchange rate to occur over the course of coming days.

For those wanting a material change in this exchange rate's valuation, such an outcome will be welcomed. However we are unable to make any definitive calls as to whether any breakout will favour the Pound or New Zealand Dollar at this stage.

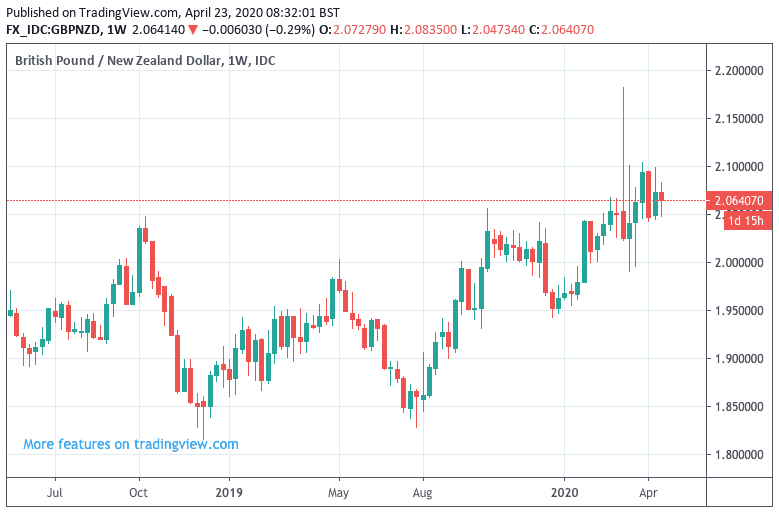

The broader multi-month trend in GBP/NZD is meanwhile one of appreciation, therefore over coming weeks we will look for Sterling's gradual move higher to reassert itself and therefore any bouts of strength in the New Zealand Dollar should ultimately be faded by the markets.

Above: The longer-term trend is one of appreciation for GBP/NZD, as shown in the weekly chart above

We will continue to monitor the progress of broader risk sentiment as this will ultimately prove to be more decisive for trends in the New Zealand Dollar than any domestic developments. For now there is a relative calm in FX markets but what the ongoing coronacrisis has shown is that any periods of calm tend to be broken at regular intervals.

Indeed, as one analyst suggests, we should expect the unexpected.

"The only certainty is uncertainty during the COVID-19 crisis. As long as the lockdown continues, new blind spots may appear, with potentially non-linear effects. Rolling lockdowns could make the economy even more vulnerable. On the positive side, we would expect early progress on a cure/vaccine to be very positive for risk," says John Shin, FX Strategist at Bank of America Merrill Lynch.