The New Zealand Dollar is Forecast to Suffer Further Losses as RBNZ Fires the Starting Gun on an Easing Cycle with a Rate Cut

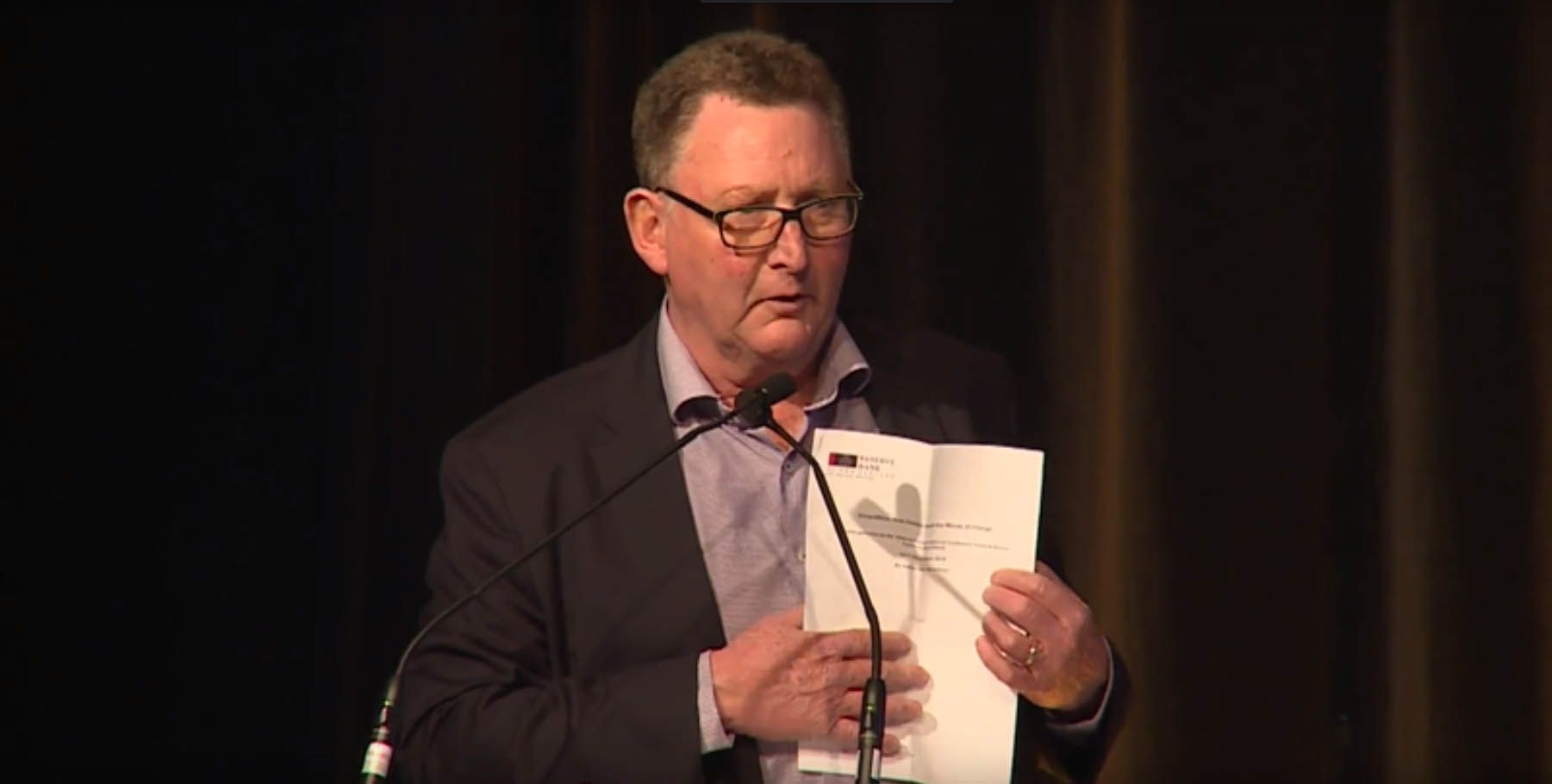

Above: RBNZ Governor Adrian Orr. File Image © Pound Sterling, Still Courtesy of Financial Services Council NZ

- RBNZ cut interest rate to 1.5%

- New Zealand Dollar falls, then recovers

- But trend lower entrenched as RBNZ is now embedded in easing cycle

The New Zealand Dollar fell sharply after the Reserve Bank of New Zealand (RBNZ) cut interest rates by 25 basis points, taking the OCR to 1.5% and signalled further interest rate cuts are likely over coming months.

The move was not entirely unexpected by markets that have for some time suspected the RBNZ would be the first major global central bank that would cut interest rates.

The New Zealand Dollar fell on the call, but soon recovered.

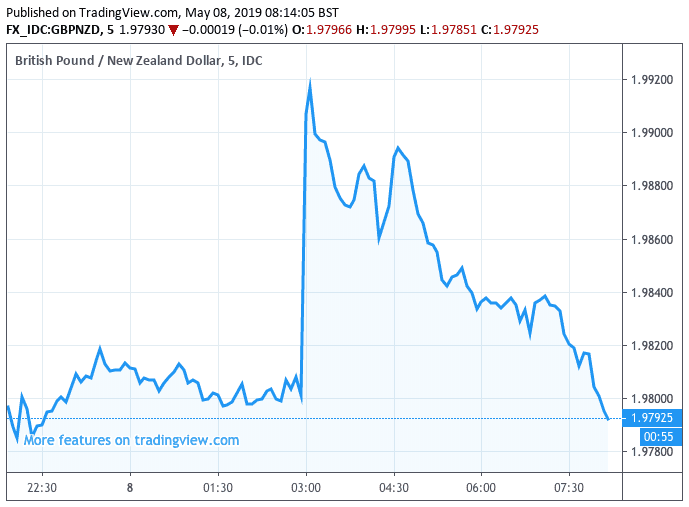

The currency is more-or-less back to where it was ahead of the interest rate cut:

The Pound-to-New Zealand Dollar exchange rate is quoted at 1.9840 at the time of writing, having been as high as 2.008 in the wake of the rate cut. The New Zealand-to-U.S. Dollar exchange rate is quoted at 0.6590 having been as low as 0.6519.

Above: The knee-jerk response in the GBP/NZD to the rate cut.

The statement released by the RBNZ noted downside risks to trading partner growth, particularly in China and its projections leave the door open to a further cut later in the year.

The New Zealand Dollar has been trending lower since March when the market first began increasing bets that an interest rate cut was coming; the promise of further cuts should keep the trend of depreciation alive.

For many years the RBNZ's base rate which sat at 1.75% was notably higher than the benchmarks set at other major central banks: the interest rate advantage attracted global capital inflows as yield-hungry investors sought out superior returns, bouying the New Zealand Dollar as a result.

The tide is now turning on the New Zealand Dollar's relative interest rate advantage.

"We expect the NZD to continue to lag its peers now that the RBNZ has entered into an easing cycle, while pricing should ebb and flow as markets regather after this Statement," says Sharon Zollner, Chief Economist at ANZ in Aukland.

Above: The NZ Dollar has been trending lower since expectations for an interest rate cut at the RBNZ began to grow in earnest.

However, the NZ Dollar's recovery since the interest rate cut was announced has surprised some.

The explanation for the relatively robust response is that while markets expect further interest rate cuts in the future, the next cut is still likely a long way off.

"It wasn’t all guns blazing, however: the forecast OCR track implied only a half chance of a further cut, sometime next year," says Zollner.

We feel had a more aggressive stance been signposted by Governor Adrian Orr then the New Zealand Dollar would have come under greater pressure.

"The RBNZ has downgraded its near-term outlook substantially, meaning the hurdle for a further cut is high for now. As before, we expect a further OCR cut in November, with one more cut to follow early next year," says Zollner.

It's not just a slowing China that was behind the RBNZ's decision: domestic economic activity is of concern with the RBNZ saying:

“The outlook for employment growth is more subdued and capacity pressure is expected to ease slightly”.

“The Monetary Policy Committee decided a lower OCR is necessary to support the outlook for employment and inflation consistent with its policy remit.”

As is usually the case with central bank policy decision making, it all boils down to inflation.

Inflation in New Zealand has - like in much of the developed world - been disappointing for a prolonged period of time by trending well below the 2.0% target the RBNZ is tasked with maintaing.

According to data, inflation has averaged 1.6% in New Zealand in the decade since the financial crisis, and "the RBNZ, which brought 2% inflation-targeting to the world, has had enough of this undershooting," says Kit Juckes, a foreign exchange strategist with Société Générale in London.

According to Juckes, there is a wide significance to the RBNZ's reaction to stubbornly low inflation, and the RBNZ move could reflect a mood shift at many central banks.

OECD inflation is above 2%, but has been trending lower again in recent months, Core CPI inflation in the G7 economies averages 1.5% and hasn't bene above 2% since then financial crisis. Over that period, it has averaged 1.4%.

"For a long time, it was accepted wisdom that that's fine, in line with a view that 2% inflation-targeting means ‘close to but below 2%'. That's not good enough, for many," says Juckes.

Whether or not central banks like the RBNZ will be able to revive inflation remains to be seen and Juckes thinks there FX space will soon be driven by central banks looking to stoke inflation and those happy to sit on inflation that runs below target.

"The ones trying hard for higher inflation will end up with weaker currencies," says Juckes. "This group will eventually include the US, but strangely, not the UK (despite history telling us otherwise), and less strangely, not the Eurozone."

Overnight we’ll hear more from RBNZ Governor Adrian Orr when he testifies about the Monetary Policy Statement at the Parliamentary Select Committee on Finance & Expenditure.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement