British Pound Outlook: Short-Term Gains, Longer-Term Range vs. Euro and Dollar say Standard Chartered

© Pound Sterling Live

For Pound Sterling, "short-term Brexit uncertainty reduced, longer-term challenges remain," say analysts at the London-headquartered global banking giant Standard Chartered who have set out there latest views on the Pound, Euro and US Dollar.

It is believed the Pound's recent recovery can therefore extend in over the near-term, but on the longer-term, multi-month timeframe, challenges remain.

"The GBP has gained recently, both against the USD and on a trade-weighted basis, following the announcement of a post-Brexit UK-EU transitional agreement. Although this is likely to lower near-term risks to the GBP, it does not change the longer-term outlook, which is still guided largely by cyclicals and balance of payment fundamentals," say Standard Chartered in a foreign exchange briefing released at the start of the second quartr.

Standard Chartered have an history spanning 160 years and while headquartered in London they operate largely in Asia, Africa and the Middle East and boast £526BN in assets as of March 2017, making them the UK's fifth largest bank.

For analysts near-term gains can potentially be found thanks to the recently struck agreement between the UK and the EU for a 21-month transition period, starting from March next year when the UK formally leaves the EU, significantly reduces the uncertainty caused by the UK’s 2016 Brexit vote.

Another factor to consider in Sterling's outlook is the policy view at the Bank of England, where markets expect one to two interest rate hikes in 2018, which Standard Chartered believe to be a fair assessment. The rule of thumb is that when a central bank is raising interest rates it is supportive of a currency as it attracts inflows of foreign capital from investors eager to profit on the improving yields on offer.

And, recent BoE meetings and appearances from various Monetary Policy Committee members have sought to avoid countering market projections of a rate hike in May as Brexit concerns ease. Standard Chartered believe this raises the prospect of a hike in May, however they also caution the growth impact of a rising Pound needs to be watched closely.

The argument goes that the rising value of Sterling will likely weigh on Britain's export sector by making British-made products more expensive on the global market; the rising Pound could therefore impact on economic growth rates.

We would however point out that the Bank of England has shown a tolerance for the recovering Pound noting that the UK remains heavily reliant on imports, therefore the recovery in Sterling we have seen over recent months can have a deflationary effect on imported goods which will help British consumers.

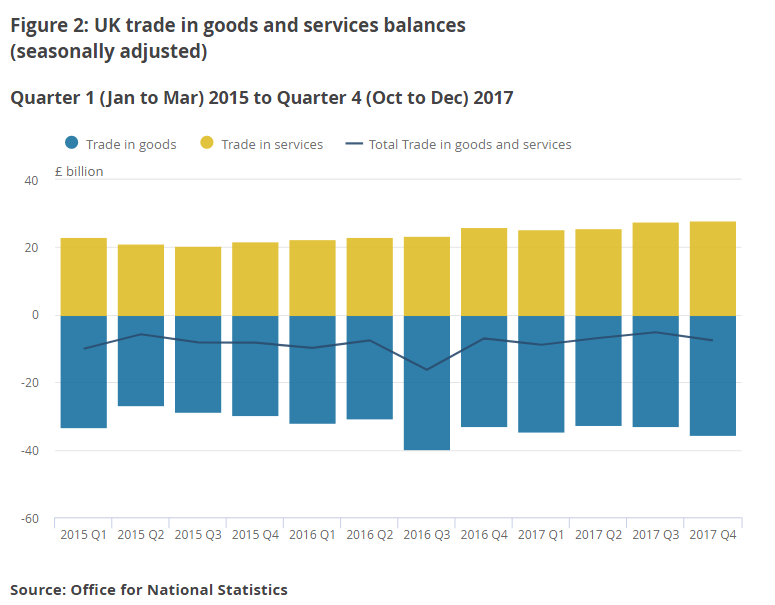

Yet, other longer-term concerns for the UK currency remain in the form of the UK’s current account deficit - which stem from the UK's large import-export imbalance which according to Standard Chartered continue to present "potential funding risks" and therefore "pose long-term challenges" for Sterling.

Above: The UK imports more than it exports, and for the Pound to rise the gap this imbalance creates must be funded by investment inflows.

The most recent data reported by the ONS on the UK's balance of payments showed a widening in the trade in goods deficit was due to imports increasing by £1.1 billion, along with a fall in exports of £1.8 billion. However, the overall current account deficit narrowed owing to solid inflows of capital from UK investments held abroad and inbound foreign investments.

If this inflow situation were to deteriorate, Sterling could come under pressure.

Put together, the recent Brexit relief contrasted with structural challenges has Standard Chartered believing the Pound can make "short-term gains" but will ultimately remain constrained and endure a "medium-term range".

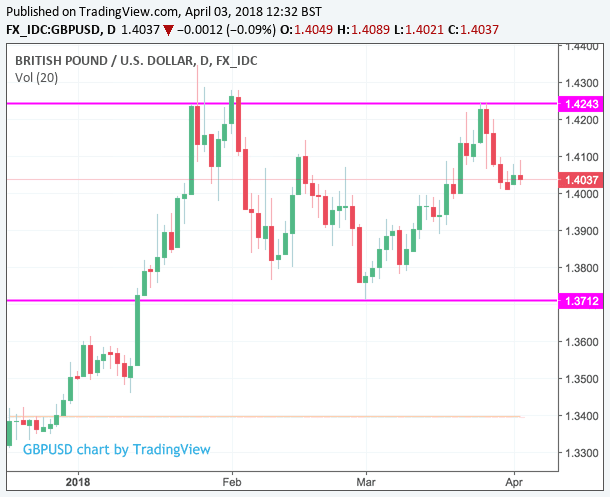

In the case of the Pound-to-Dollar exchange rate this suggests the upside limit towards 1.43 could be tested near-term, but longer-term a sideways range defined by 1.4242 at the top and 1.3712 at the bottom can be identified:

Regarding the Pound-to-Euro exchange rate, the longer-term range is more clearly defined and we believe likely to hold. The top is defined by 1.15 and the bottom by 1.11:

The findings suggests that those looking to make international payments with Sterling face a limited window in which to transact; indeed we reported at the start of this week that strategists at Swissquote Bank and DNB Markets share the same view saying they too see challenges for Sterling on the horizon.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

Euro: More Strength

The Euro is meanwhile forecast to maintain its recent period of outperformance with Standard Chartered expecting policy changes at the European Central Bank to be positive.

The ECB is widely expected to announce the ending of its money-printing programme - officially known as the asset purchase programme - in July and markets are expecting the first interest rate rise to take place in July 2019.

The ECB is clearly well behind the Bank of England on the matter but it is noted that the biggest gains for a currency are made at the start of the cycle.

"We expect further medium-term EUR strength; flows remain supportive, and the ECB is beginning to talk about possible interest rate hikes," say Standard Chartered.

Dollar: More Weakness

The US Dollar is meanwhile expected to weaken further as it extends its multi-month downtrend.

"We retain our conviction that the USD is likely to weaken further over the coming 12 months," say Standard Chartered. "We expect USD weakness over the medium term, as 2018 Fed rate hikes are likely priced-in with a greater possibility of stimulus withdrawal elsewhere in G10."

The Federal Reserve upgraded its growth forecasts for 2018 and 2019 to 2.7% and 2.4%, 3.0 respectively. However, it left long-term growth and inflation 2.0 forecasts unchanged, "suggesting that the fiscal stimulus is unlikely to boost the economy’s underlying potential," say Standard Chartered.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.