Natwest / RBS Forecast Pound Sterling Gains vs. Euro and US Dollar in 2018

Natwest Markets have released research confirming they believe the British Pound can appreciate in 2018.

"Sterling is set to experience episodes of acute volatility in 2018," is the message from Natwest Markets, but the general trend should be higher, particularly against the Dollar.

Natwest Markets - the investment banking arm of the Royal Bank of Scotland Group - make the call in a note detailing their forecasts for the U.K. economy, Bank of England policy and the British Pound for 2018.

While volatility will be elevated, Natwest Markets believe, "market expectations are once again extremely pessimistic, just as they were at the start of 2017, so the balance of risks favours another test of the bearish Sterling consensus next year."

This sets up Natwest Markets as being in the more optimistic camp of Sterling forecasters for 2018.

"Despite the cacophony of negative commentary a year ago, Sterling is on course to end 2017 at roughly the same level as it started the year. It even flirted a couple of times with an upside break of the range. We expect something similar in 2018," says analyst Paul Robson at Natwest Markets.

Brexit is expected to once again dominate and will at times cast a dark shadow over Sterling sentiment, most clearly through a substantial risk premium. Robson also notes the government’s weak parliamentary position brings additional uncertainty.

The trade-weighted measure of Sterling value is 13% below its pre-referendum level, so the currency’s risk premium is already very large.

But, a "negative economic narrative for the UK will shift in 2018 as real household purchasing power starts to rise as inflation falls and wage growth starts to pick up," argues Robson.

The analyst believes Pound Sterling’s risk premium can subside on confirmation that the ultimate destination of Brexit is unlikely to be a “no-deal” or extreme “hard exit” outcome.

The consensus leans to the hard-Brexit end of the spectrum of probable outcomes, and so having these assumptions proved incorrect "is where Sterling’s potential upside largely resides," says Robson.

Risks Do Remain

Robson does identify one particular vulnerability to the Pound - the U.K's persistent trade deficit that has resulted from the country importing more than it exports.

This has left the U.K. reliant on inflows of investment funds to balance the books, but Robson is concerned over the long-run ability of foreign investors to fund the country's deficit:

"While international investors have been willing to fund the UK’s borrowing habit (government and households), this is not sustainable in the long-run. Interest rates will have to rise and/or Sterling will have to fall over the long-run, ceteris paribus."

Indeed, the Bank of England recently warned of the prospect of the 'lowest ever' Pound exchange rate profile were the UK's current account come back to bite. If inflows of foreign investment dry up, the Pound would have to fall sharply.

Bank of England: Higher Rates Ahead

Underpinning the value of the Pound in 2018 will be the assumption that the Bank of England will continue to raise interest rates.

"With the BoE having finally delivered a (long-signalled) Bank Rate hike, we believe the barrier to the next rise is lower than the market expects. We think policymakers are unlikely to believe that ‘one and done’ is sufficient and current market pricing is at the extremely dovish end of what we would consider to be a feasible path for policy," says Natwest Markets economist Ross Walker.

Brexit negotiation progress is meanwhile seen as critical to expectations for interest rate rises in 2018, the Bank is only likely to pursue interest rate rises if it feels business investment is responding in a positive manner to signs of progress concerning Brexit.

Indeed, we have seen money markets price in the next rate rise for September 2018, brought forward from November 2018 on signs that the E.U. and U.K. are making progress in Brexit negotiations.

This has driven the value of the Pound up into late November, and according to Natwest, this trend can extend into the new year.

Where will the Pound go?

Nevertheless, assuming investment inflows are sustained, and even increased, "Sterling resilience to the same concerns in 2017 suggests that international investors feel adequately compensated for such risks at circa 1.20 for GBP/USD and 0.95 for EUR/GBP."

Natwest Markets therefore do not expect Sterling to sustain weakness beyond these levels for very long in 2018, if at all.

"Continued global wealth generation, mixed with a high regard for UK law and property rights can support Sterling at the range lows as UK assets offer safety from a number of global political developments," says Robson.

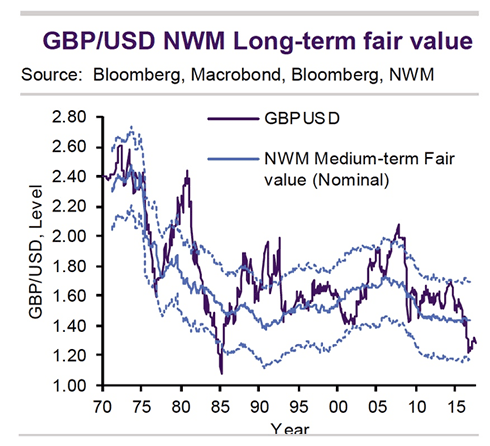

Above: Models confirm the Pound to be undervalued against the Dollar. Source: Natwest Markets

"Modest Sterling Trade Weighted Index gains are expected, with GBP/USD gravitating towards 1.35/40 and EUR/GBP to 0.86.

EUR/GBP at 0.86 gives us a GBP/EUR exchange rate of 1.16.

However, "risks are likely to become more two way from late summer, most obviously versus the EUR on central bank policy, Brexit and politics."

Hence, the forecasts show the Pound fading back against the Euro from mid-year.

Forecasts

Pound-to-Euro in 2018: 1.18 by end-March, 1.16 by end-June, 1.15 by end-September, 1.12 by end-December.

Pound-to-Dollar in 2018: 1.35 by end-March, 1.37 by end-June, 1.39 by end-September, 1.4 by end-December.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Natwest Markets Forecasts for the U.K. Economy

Concerning the U.K. economy, Natwest note Capital expenditure - or investment - is more resilient than previously thought, no shock to capex in 2018 is now expected owing to Brexit as previously thought.

Export growth should maintain their upward trajectory.

"An improved global economic backdrop – most notably in the Euro Area where GDP growth is expected to remain close to 2% in 2018 and 2019 – and competitive is expected to provide some support for UK exports."

UK GDP growth is forecast to be 1.5% in 2017, 1.3% in 2018 and 1.4% in 2019, this contrasts with the official OBR forecasts of 1.5% in 2017, 1.4% in 2018, 1.3% in 2019.

Inflation appears to be nearing its peak. Natwest Markets forecast CPI inflation to climb to 3.1% in November-December 2017 – recent wholesale oil price rises complicate the precise timing.

CPI inflation is forecast to decline to 2.4% by end 2018 and to return to its 2.0% target in June 2019.

Soft Start to New Month, But Underlying Economic Data is Promising

Pound Sterling - the best performer in November amongst the family of the world's major currencies - was caught by a bout of profit taking at the start of the new month.

With the major story of Brexit taking a backseat Sterling found itself a passenger to moves in its bigger cousins, the Euro and Dollar.

The Euro pushed higher against major competitors in a broad-based move ensuring the Pound-to-Euro exchange rate edged lower to record a low of 1.1310 before recovering to 1.1344.

The Pound-to-Dollar exchange rate meanwhile went as low as 1.3458 at one stage before recovering to 1.3493 ahead of the weekend.

Paring gains on Sterling makes sense for traders - after recording a 0.60% gain on the Euro in November and a 3.33% gain against the Dollar, markets are opting to calm the uptrend ahead of a key meeting of European leaders that will decide whether or not Brexit negotiations should move on to the issue of trade.

We have seen Sterling rally over recent days amidst hopes that a breakthrough in Brexit talks is imminent, but nothing has been officially confirmed and until final confirmation comes through lingering doubt will nurture caution.

"Sterling continued to profit from hopes that EU and the UK were making progress to start a next stage in the Brexit negotiations. However, the issue of the Irish border remains a tough nut to crack. Negative headlines on this issues might block further sterling gains," says Piet Lammens, an analyst with KBC Markets in Brussels.

The yes or no answer delivered by the European Union heads of state a meeting of the European Council on December 15 presents a binary risk for Sterling: Yes and the Pound will move higher, no and it will move lower.

Responsible traders would be forgiven for cutting exposure to Sterling upside ahead of such an event.

"There are still potential obstacles: we still need clarity on citizens’ rights issues and the EU side will need to confirm that it is willing to leave the full resolution of the Irish border situation until Phase II of the talks," says Bilal Hafeez at Nomura Plc.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.