Pound Forecasts: HSBC Warn of "Sizeable Descent" vs. Euro and US Dollar

HSBC Bank warn markets are under-estimating the prospect of a "no deal" outcome to Brexit negotiations, and this could send the Pound hurtling lower against the Euro and Dollar.

To be sure, we reported last month that the UK high-street lender had rowed back from their prediction that the Pound would fall to 1.0 against the Euro and had upgraded their targets for the UK currency as analysts acknowledged they might be too negative on the currency.

These upgraded targets however still leave a lot of downside from current levels and analysts warn markets are being too optimistic on the currency with regards to the shape and form of Brexit negotiations.

In short, markets are under-estimating the prospect of “no deal” brexit occurring.

The Pound’s Focus Will Soon Change

Sterling rallied through the course of September with the Pound-to-Euro exchange rate recovering from multi-month lows just below 1.08 and rising back to 1.14. The Pound-to-Dollar exchange rate rose from lows towards 1.28 in late-August to reach highs above 1.26 in mid-month.

The rise in Sterling was largely the result of a shift in tone at the Bank of England where policy-makers surprised markets by saying their tolerance for high inflation rates are wearing thin and a rate rise was imminent.

The Pound therefore was moving to the beat of economic fundamentals and interest rate expectations. Brexit was a back-seat driver; but the issue might now take the steering wheel.

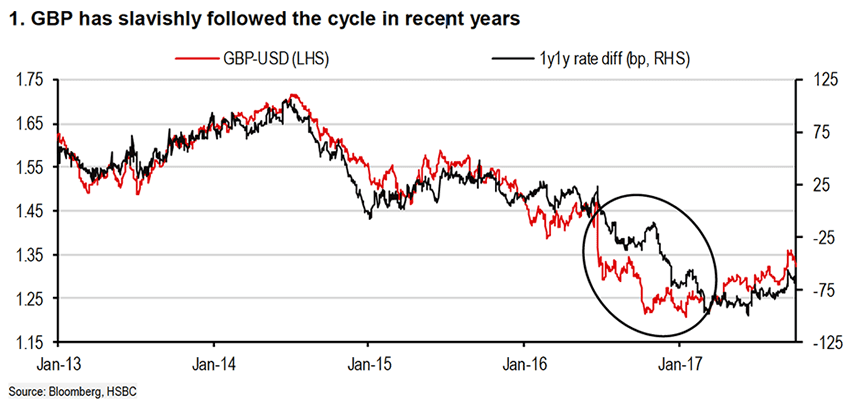

In a note dated October 5, HSBC argue "2017 saw GBP-USD get back in the saddle, largely tracking the vagaries of the cycle, or at least the cycle as captured in relative interest rate expectations."

Above: Sterling tracks interest rate differentials unless political uncertainty is heightened, as per the circled period in the above when Brexit came to the fore.

“GBP has been fixated on cyclical, rather than political or structural drivers; we believe this will change,” says Dominic Bunning, FX Strategist with HSBC Bank plc in London. “We believe that ignoring political factors is a dangerous strategy.”

Brexit to the Fore

Currency markets are a slippery customer and the one thing the team at Pound Sterling Live can attest to is that those with an interest in the market will only ever achieve success by ensuring they are looking at multiple drivers and constantly assessing the shifts in importance for those drivers.

With this in mind, now could be the time when the Bank of England steps aside and Brexit becomes the predominant focus for Sterling.

At least this is a scenario HSBC are betting on:

“The sole focus on interest rate differentials is a mistake, in our view. We believe this has led to an overly optimistic consensus for GBP/USD, and a sizeable descent for the pair in 2018,” says Bunning.

"We believe the market will move through the gears and reconsider politics much more actively as the finish line for Article 50 negotiations looms into view. One way to remove the political blinkers is adopting a more straightforward view of a complicated situation," adds the analyst.

HSBC believe politics will come into clearer focus as time marches towards March 2019, when only one Brexit outcome will be possible.

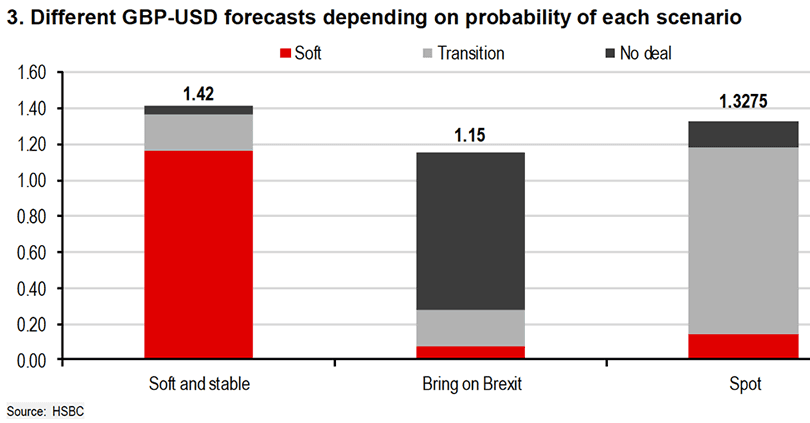

At present a number of options are possible, on one end of the spectrum there is a ‘soft brexit’ and on the other a ’no deal’.

Analysts believe the market is under-pricing the risk of a “no deal” Brexit and they see GBP-USD falling to 1.26 but say each outcome carries different implications for GBP-USD, ranging from 1.45 down to 1.10.

Types of Brexit

A 'super-soft Brexit' would see the Pound recover to 1.45 but ultimately remain below pre-referendum levels over the long-term.

A smooth and stable transition would see the Pound recovery to 1.30-1.35 against the Dollar.

"Assuming the extended relationship would be relatively close to that already prevailing between the UK and EU, and sufficiently long lasting to allow time for a smooth Brexit, it would be supportive for GBP," says Bunning.

A "no-deal" could see the Pound fall down to 1.10 against the Dollar.

"The UK government has argued that “no deal is better than a bad deal”, but we would expect no deal to be a very bad deal for GBP. The uncertainty unleashed regarding every aspect of the UK’s relationship with the EU would be enormous," says Bunning.

At the Conservative Party conference David Davis, the Secretary of State for the Department for Exiting the European Union told delegates his deptartment was preparing for all possible outcomes to negotiations, suggesting that were the European Union to prove to restrictive in their negotiating position the UK would walk away.

The prospects of a deal being reached are also diminished by fresh signs of instability in the ruling Conservative Party as talk of a challenge to Theresa May's leadership is reignited following her botched conference address.

The EU will find little reason to compromise with the UK were they to perceive the UK's hand as being weakened by political instability. We believe this indeed raises the risk of a no-deal.

No scenario targets are given for where Sterling might go against the Euro, but we know HSBC forecast the Pound-to-Euro exchange rate at 1.12 by end-2017, up from 1.0 previously.

1.11 is seen by the end of the first-quarter 2018, 1.09 by mid-2018 and 1.05 by year-end 2018.

We would imagine the interpretation on Sterling-Euro could range by similar margins as per the margins seen in Sterling-Dollar

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Pound Sterling is set to end the first week of October on a dour note as political uncertainty in the UK escalates.

We wrote at the head of the week that the markets were overplaying the prospect of political uncertainty as per Theresa May’s future - we argued that May was secure in her post and that markets would soon see this.

Of course, this was prior to May’s infamous conference speech.

“The writing is on the wall for May. We can’t just carry on. I think having lost an election the party must look for a new leader to take us forward”, says Grant Shapps, a former chairman of the Conservative Party and minister.

Shapps claims to have to gathered 48 names and intends to take them to No 10 with five former cabinet colleagues to urge May to resign and therefore has been outed as the key rebel in a move to oust the Prime Minister.

Shapps out into the open - this could either bust rebellion open + increase calls for resignation

— Laura Kuenssberg (@bbclaurak) October 6, 2017

The prospect of such an outcome is clearly negative for the UK currency which has suffered tremendously under the weight of uncertainty posed by Brexit and political instability in the UK and this latest development only adds to the pressures.

“We think the risk/reward of being long GBP is not attractive and prefer selling into rallies,” says strategist Hans Redeker at Morgan Stanley who says “signs of a split within the Tory Party may weigh on GBP as it raises concerns about PM May's leadership.

The impact on Sterling of the ongoing political uncertainty is notable with the Pound-to-Dollar exchange rate now 2.35% down on the week and the Pound-to-Euro exchange rate down 1.31%. In fact, the Pound has not managed to advance against any of the world's top-20 currencies.