Pound Sterling Predicted to Experience Tough 2023, but 2024 has Silver Linings says BofA

- Written by: Gary Howes

- 2023 will be tough for GBP says Bank of America

- As UK consumers come under strain

- Global risk sentiment to offer some support

- But 2024 has silver linings

Image © Adobe Images

2023 will be a difficult year for the British Pound shows new research from Bank of America, although 2024 will potentially see a more sustainable rally.

Bank of America has studied its books and finds its clients have pared back shorts on the Pound, but nevertheless remain bearish and unwilling to go long.

Shorts are trading positions that would deliver returns if the Pound falls in value, while longs would deliver profits on advances. The positioning gives an indication of where sentiment towards the currency lies.

Analysts at the bank say this as evidence that the market's stance on the Pound is "less bad" but not "much better".

"This provides a ceiling on the extent to which GBP can recover, and consequently, our bias is to fade any rallies," says Kamal Sharma, FX Strategist at Bank of America in London.

The Pound to Dollar exchange rate (GBP/USD) has rallied from multi-year lows set in September 2022 amidst a broader pullback in the value of the U.S. Dollar and the market's embrace of the more orthodox fiscal policies of Prime Minister Rishi Sunak.

But the Pound to Euro exchange rate (GBP/EUR) has not seen a similar uplift, in part because investors judge the Eurozone economy to be better positioned than that of the UK for 2023.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Consumer Matters

The UK economy is expected by researchers at BoFA to be hampered by structural imbalances, namely the twin current account and budget deficits.

These deficits mean the UK economy is now largely driven by the household sector and consumption.

"The UK has transitioned into a demand-led economy," says Sharma.

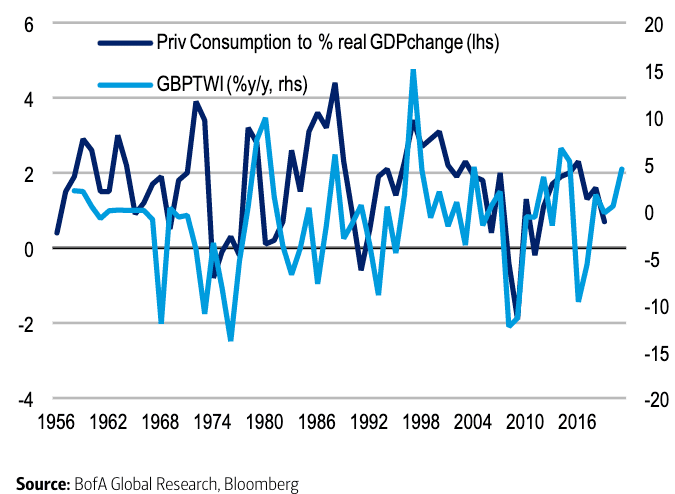

Above: "Consumption has increasingly become an important driver for GBP" - Bank of America.

Therefore, when the UK consumer struggles, so does the economy.

As the chart shows, the retrenchment in the UK consumer owing to the 'cost of living crisis' is consistent with a weaker Pound.

Oxford Economics estimates that real UK household disposable income fell by 1.7% over the calendar year, which would be the biggest year decline since 2011.

"This year will be another challenging one for household finances as inflation is set to remain high, fiscal policy is being tightened, and mortgage costs will rise," says Edward Allenby, Assistant UK Economist at Oxford Economics.

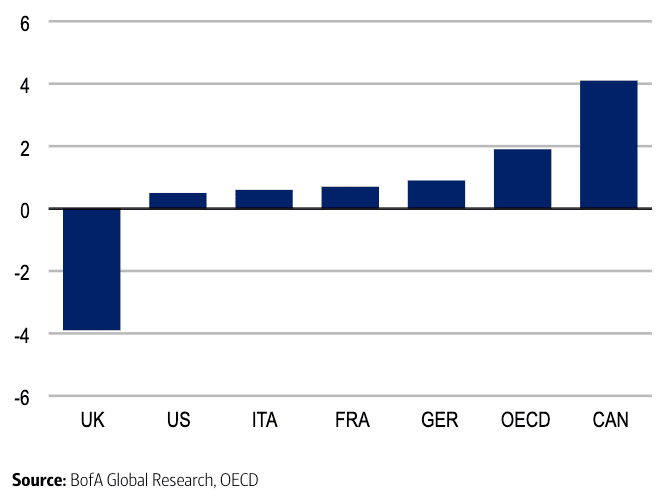

Above: "UK has experienced significant household income deterioration since 2019" - Bank of America.

"The drag on household income and fall in GDP per capita are factors that we think will set the tone for the pound in the coming year. Current trends do not look promising," says Sharma.

"Connecting the dots... we see little prospect for a sustained recovery in GBP through 2023, which may turn out to be a holding pattern year," he adds.

Global Market Sentiment Also Matters

Although the UK domestic story is unsupportive, global factors could limit the downside in the Pound.

"Our analysis shows that GBP has become increasingly sensitive to global risk metrics as idiosyncratic risk premium has fallen, leaving GBP exposed to the ebb and flow of global market sentiment," says Sharma.

This means if global markets can continue to recover over 2023 the Pound would benefit, but any setbacks to sentiment would also result in a setback to Sterling's valuations.

At the time of writing, markets are concerned that the U.S. Federal Reserve might have to raise interest rates by more than they were anticipating at the start of the year.

Higher interest rates, for longer, in the U.S. will raise the cost of money not only in the world's largest economy but also right across the global financial system.

This would weigh on stocks and investor spirits, which would pose an additional headwind to the Pound.

"This is also the limiting factor in any sustained GBP recovery given the inherent instability of risk sentiment," says Sharma.

Silver Linings in 2024

But looking ahead to next year sees Bank of America turn more constructive on the Pound's prospects.

"Whilst politics and the relationship with Europe remain in the background, we note that there has been more interactive debate on the pros and cons of Brexit. This matters ahead of a general election in 2024, as it could shape the relationship over the coming years," says Sharma.

He notes polling from What the EU Thinks? has shown that a larger proportion of voters believe that the decision to leave the EU was wrong.

Media meanwhile report the UK and EU will soon strike a new deal on the Northern Ireland protocol, thereby healing a festering wound in relations between the two sides.

"Direction of travel matters, and among potential scenarios, there could be a constellation of views in the next government that would seek to enhance rather than weaken the relationship with the EU. In this scenario, we would expect a significant recalibration in GBP," says Sharma.

An expected fall in inflation over the coming months will also set up a more constructive backdrop for Sterling in 2024.

"Lower inflation next year should support a rebound in real income and consumer spending in H1 2024," says Allenby at Oxford Economics.

Bank of America forecasts Pound Sterling will struggle over the coming cycle but, crucially, "we think that the lows are in place for this cycle."

(If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Bank of America's Pound Exchange Rate Forecasts

In a year-ahead overview, Bank of America said it expects the Euro-Pound exchange rate to trade at 0.89 by the end of the first quarter 2023, 0.89 by the end of the second quarter, 0.90 by the end of the third quarter and 0.91 by year-end.

This translates into a GBP/EUR profile of 1.12, 1.12, 1.11 and 1.10.

The GBP/USD forecast profile - as per an update issued on February 10 - are 1.18 for the end of the first quarter, 1.18 for the end of the second quarter, 1.19 for the end of the third quarter and 1.21 for year-end.