Sell the Pound against Swedish Krona says RBC Capital Markets

- Written by: Gary Howes

Image © Adobe Images

Foreign exchange strategists at RBC Capital markets are expecting the Pound to suffer near-term losses against the Swedish Krona.

In fact, so confident is RBC Capital's Adam Cole he has initiated a sell recommendation on GBP/SEK for the coming week.

Cole is RBC's Head of FX Strategy and the call comes on the back of last week's recommendation to buy NOK against SEK, a trade that banked 0.4% profit.

Seasonality appears to be a major factor behind the trade.

"Month-end flow favours GBP/SEK lower from both sides," explains Cole. "For GBP, flow is dominated by UK institutions reducing their USD shorts as the fall in US equities (S&P -5.3% MTD) leaves them overhedged on their holdings."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

On the Krona side, RBC Capital finds flow is dominated by overseas holdings of Swedish equities and foreign investors will have SEK to buy, given the near-6% fall in the OMX.

"Beyond month-end, GBP is likely to have to digest another run of negative

news on the NI Protocol and EU’s response to the UK’s domestic legislation to override it, as it gets its second parliamentary reading this week," says Cole.

Meanwhile, the key domestic even for the Krona is this week's Riksbank decision which markets expect to result in a 50bp rate hike.

The expectation at RBC Capital is this will be a neutral outcome for SEK.

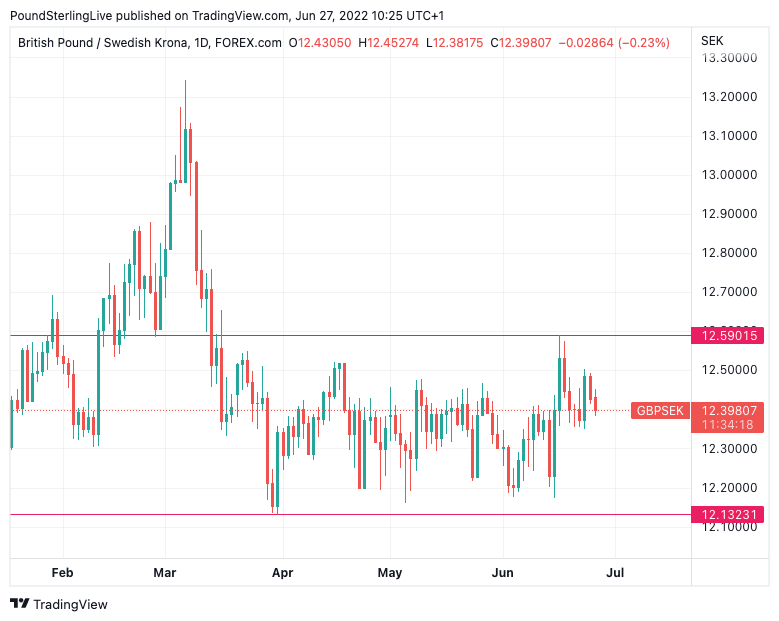

RBC Capital are targeting a move lower in the Pound to Krona exchange rate to 12.15.

Spot is currently located at 12.39 as a 0.25% decline puts the trade in a strong footing early on in the week.

A look at the charts shows the GBP/SEK has maintained a tight range since the middle of March:

Above: GBP/SEK at daily intervals.

The rangebound nature of GBP/SEK could imply the odds of a material breach in either direction is currently limited, which in turn minimises risks to trading the pair.