Pound Sterling: Analyst Predictions Ahead of Bank of England Decision

- Written by: Gary Howes

- Pound Sterling's moment in the spotlight arrives

- Chances of a rate hike close to 50/50

- Guidance on future rate hikes however more important

- Watch the medium-term inflation forecasts closely

- Analyst views on how GBP might behave

Image © Adobe Stock

The Bank of England's November policy decision is due at 12 GMT on Thursday and an interest rate hike could be delivered in order to address inflation levels that are expected to remain elevated over coming months.

The British Pound fell in the first half of this week before recovering some of that lost ground into the midweek session; the moves appear to be part of the market's pre-announcement dance whereby money is repositioned in anticipation of expected outcomes.

The UK currency will initially react to the midday decision on whether or not to raise interest rates, with gains more likely than not to follow a vote to hike interest rates.

A decision to forgo a rate hike might be met with weakness in the Pound.

But the more enduring moves that decide where it ends the day and trends over the remainder of the year could well rest with the guidance contained elsewhere in the policy decision statement, accompanying minutes and the Monetary Policy Report.

There are numerous signals to watch out for and nuances in communication to interpret, meaning that volatility could well be the order of the day before any trend can establish.

- Reference rates at publication:

Pound to Euro: 1.1796 \ Pound to Dollar: 1.3659 - High street bank rates (indicative): 1.1540 \ 1.3348

- Payment specialist rates (indicative: 1.1720 \ 1.3582

- Find out about specialist rates, here

- Or, set up an exchange rate alert, here

What the market is expecting

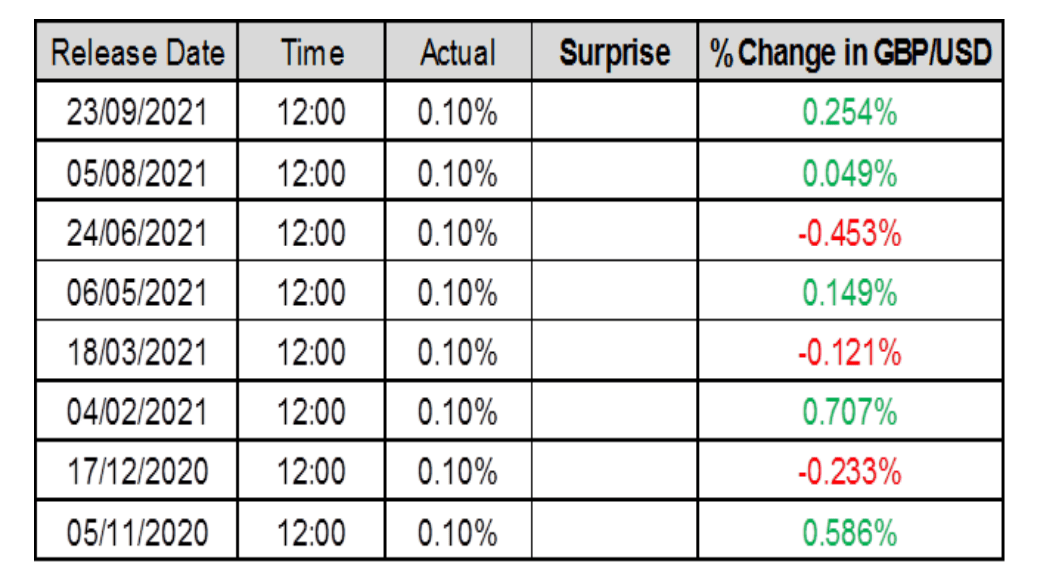

As of Wednesday short-sterling futures indicated UK rates are expected to rise to 1.35% by December 2022.

A series of 'hawkish' speeches from Bank of England policy makers has pushed money markets and Sterling toward a possible UK rate rise on Thursday.

"Such an early move had neither been warned of, nor bet on, as recently as August," says Mike Dolan, an analyst with Thomson Reuters.

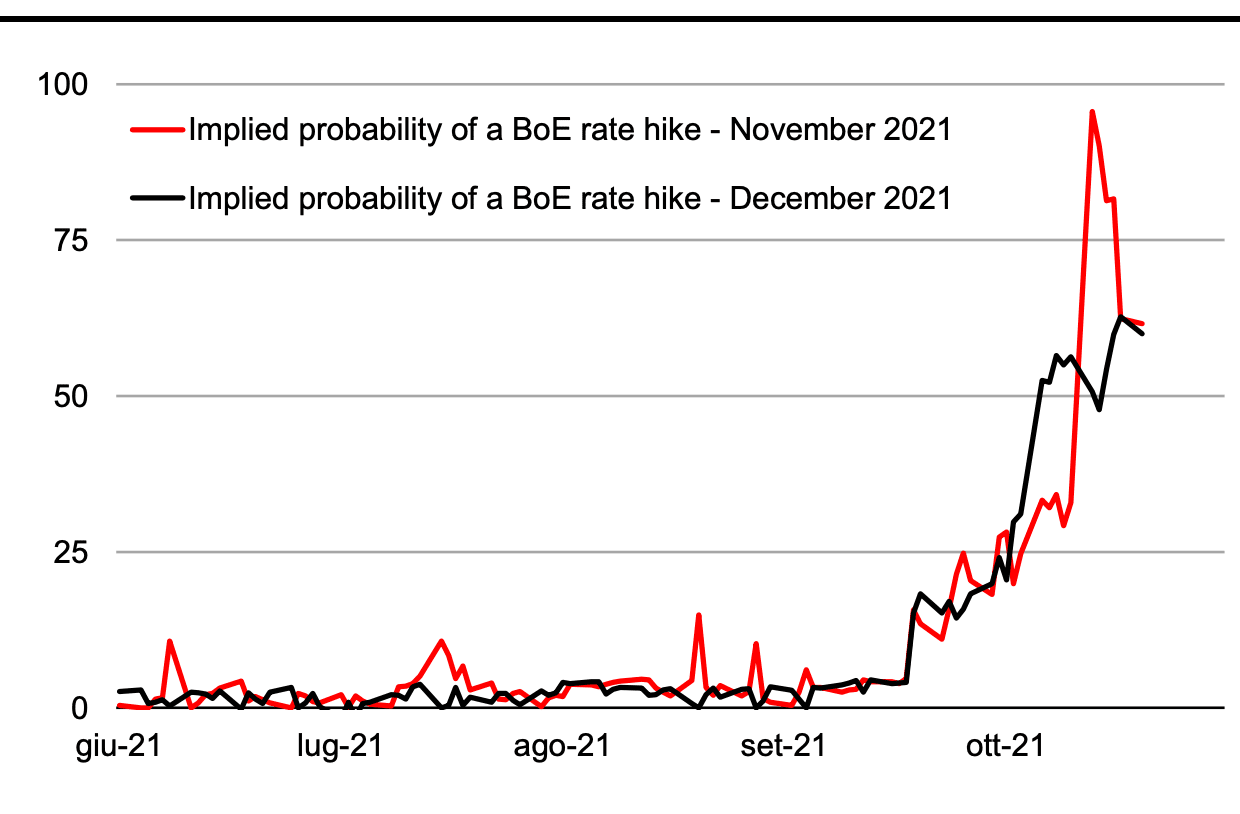

Roberto Mialich, FX Strategist at UniCredit says the probability of a November hike had jumped to as high as 100% following the hawkish turn by policy makers, but this expectation has since faded over recent days and has now converged with the probability of a move in December.

He presents the following chart:

Above: "A BOE RATE HIKE EITHER IN NOVEMBER OR DECEMBER IS EQUALLY PRICED INTO THE UK OIS CURVE" - UniCredit.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Watch the inflation forecasts

For the Pound, much depends on the quarterly Monetary Policy Report which will contain updated forecasts that policy makers rely on to set interest rates.

An important point to note is this: the medium-term inflation forecast - the most important in terms of monetary policy - depends on where interest rates move in the interim.

Therefore they are as much an inflation forecast as they are an assimilation by the Bank of the market's own expectations for future interest rate rises.

"The question is how much of rate hikes the Bank sees as consistent with inflation at the target towards the 2 year horizon," says Anders Eklöf, Chief FX Strategist at Swedbank.

Economist Philip Shaw at Investec says he expects inflation projections to end the three-year horizon below the Bank's mandated 2% target.

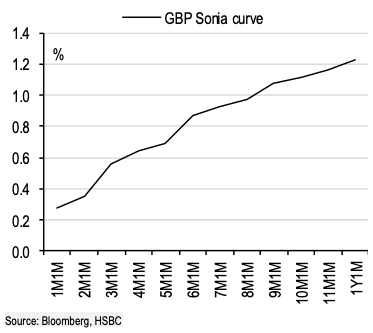

"This is because the BoE’s forecasts are conditioned on a path in the Bank rate implied by the yield curve over the 15 days prior to the compilation of the MPR. The curve has been very steep, and is now implying a Bank rate of 1.25% by the end of 2022," explains Shaw.

Above: Money markets are suggesting the Bank Rate could be above 1.0% by the end of 2022.

Derek Halpenny, Head of Research, Global Markets EMEA at MUFG says the OIS implies a 90bp increase in the Bank rate over one year, +70bps in two years and +50bps in three years.

"These are sizeable changes in market rates and should show up in sharper returns to below the 2% inflation target at the end of the forecast horizon," says Halpenny.

But Dominic Bunning, Head of European FX Research at HSBC, says if inflation projections remain elevated, despite the market's assumption that up to 85 basis points of hikes are likely by the middle of next year, GBP would be supported.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Rates will only need to rise by a limited extent

Most analysts we follow find that the market is too aggressive in its expectations for the number of hikes that will be delivered, or need to be delivered, by the end of 2022.

The Bank could be in agreement and communicate this message.

"By raising rates on Thursday and forecasting below target inflation the committee would be putting across a message that rates need to rise, but probably only to a limited extent," says Investec's Shaw.

MUFG's Halpenny says Governor Bailey will want to argue that by acting sooner and ensuring inflation does not become entrenched would mean less is required going forward.

Robert Wood, Chief UK Economist at Bank of America expects the Bank to cut 2021 and 2022 growth forecasts, raise inflation at the two year horizon but cut inflation to 1.8% at the three year point as supply problems fade.

"That should justify earlier hikes but also fewer than the market prices," says Wood.

What economists are expecting

Economists are split on the question of whether the first hike comes in November or December with a Bloomberg survey of institutional analysts showing 13 out of 29 expect a hike on Thursday.

Investec now expects the committee to raise the Bank rate by 15bps to 0.25% on Thursday and are looking for a 25bp hike in February and a further increase to 0.75% in November.

Their working assumption is that rates will rise by a further 50bps over 2023.

"We expect the BoE to remain on hold in December and hike by 25bps in February 2022," says Halpenny.

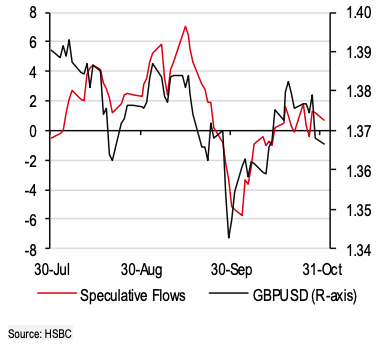

Above: GBP is relatively unconstrained by positioning heading into the event.

Daniel Vernazza, Chief International Economist, at UniCredit says the MPC will probably hold fire in November, following recent hawkish comments from several MPC members, but he cannot rule out the possibility of a small hike.

"We expect a 15bp rate hike in December, followed by a 25bp hike in May and again in November 2022. We think this will likely be a policy mistake," says Vernazza.

Bank of America's Wood says the Bank will argue temporary supply disruptions and a need to remove 'emergency' policy settings justify a gradual normalisation of policy.

What could happen to the pound

A rate hike in November but a semblance of caution in the manner in which it was delivered may cause the pound to slump as expectations of higher rates over the course of 2022 are unwound and front-end yields moderate," says Simon Harvey, Senior FX Market Analyst at Monex.

Bank of America's FX strategist Kamal Sharma says there are obvious headwinds to the Pound given the amount of tightening that is now expected by the market.

"The risks are asymmetric and we expect GBP to weaken somewhat but this is too early to argue that we are policy mistake territory," says Sharma.

Chris Turner at ING is in the camp arguing that the Bank will struggle to deliver on all the hawkish pricing packed into the GBP money market curve.

He expects the EUR/GBP exchange rate can correct up to the 0.8500 area on Thursday. (GBP/EUR down to 1.1765.

"GBP has become more correlated with global equities which may reflect the increased prospect of a rate hike. Better global conditions means that’s a policy step that is viewed more positively," says MUFG's Halpenny.

Above: "BOE MEETING – 60 MINS IMPACT ON GBP" - MUFG.

"Based on the recent FX response to central bank guidance we could well see GBP dismissing this guidance of slower tightening going forward. However, we would expect GBP to ultimately weaken on the back of a 15bp hike and guidance suggesting the need for less tightening than what is currently priced," says Halpenny.

MUFG finds there has been a clearer directional trend for the GBP which has strengthened following the last two policy updates.

"The UK rate market has already priced in the BoE policy rate rising towards 0.50% by year end so the scope for the BoE to provide hawkish surprise is more limited now," says Halpenny. "It creates a higher hurdle for the GBP to strengthen further following the upcoming BoE policy meeting."

UniCredit's Mialich says a steady BoE meeting outcome could weigh somewhat on Sterling.

But - as noted early on in the piece - because expectations have converged with December downside impacts to Sterling of forgoing a November rate hike are relatively limited says Mialich.

"This could reduce the risk of some disappointment regarding the GBP, should the BoE opt for a move in December, as we expect (also in order to have more data on the UK labor market)," he says.

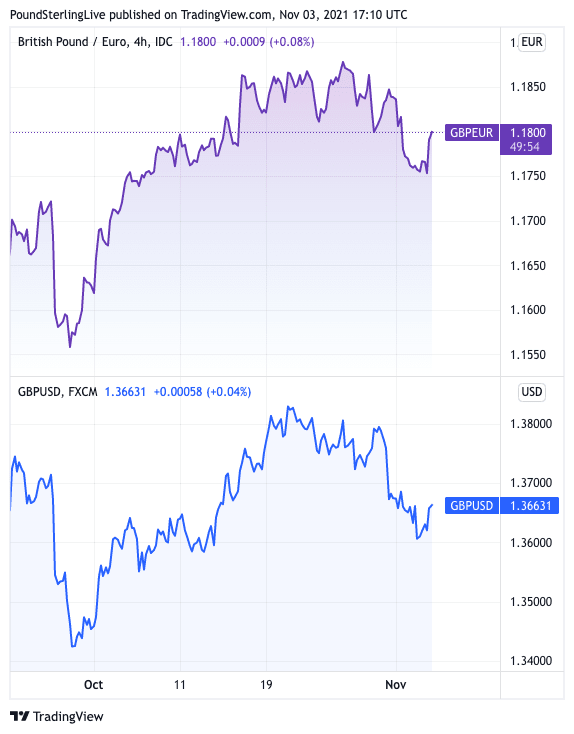

Above: Four hour charts for GBP/EUR (top) and GBP/USD (bottom).

Swedbank anticipate a "couple of hikes" will take the Bank Rate back to 0.50% over the next 3 months.

"That may be enough to give GBP a near-term boost vs the EUR," says Eklöf.

Foreign exchange analysts at Goldman Sachs have told clients they are 'bearish' on the Pound's prospects in the near-term as the Bank of England will disappoint market expectations, in their view.

"The 'rubber meets the road' for the Bank of England, and markets have set a high bar for the MPC to deliver, essentially fully pricing a 15bp hike for this meeting and close to 60bp cumulatively through February," says Zach Pandl, an economist with Goldman Sachs.

The Wall Street bank says it will prove difficult for the Bank of England to significantly over-deliver at this point, and sets up room for disappointment if the MPC guides towards a more "measured" pace.

Paul Robson at NatWest Markets says the outcome of the BoE meeting looks no more than a coin toss.

"We have a bias to fade any significant Sterling weakness," he says, noting that the recent UK budget was more accommodating than had previously been expected and this could support the UK's economic outlook in the face of tightening monetary conditions.