Pound Sterling Bulls Launch Fresh Assault into Stubborn Resistance Levels

- Written by: Gary Howes

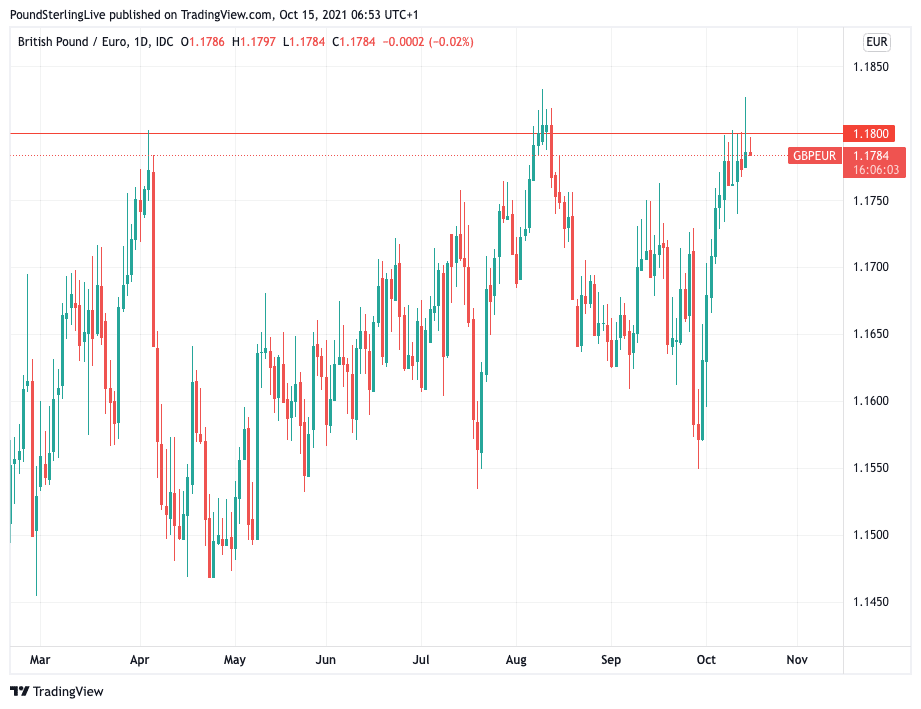

- GBP/EUR fails to close above 1.18, again

- GBP/USD fails to hold 1.37

- Despite supportive Bank of England hike expectations

- ABN AMRO lift GBP forecasts

- TD Securities says GBP/EUR is cheap

Image © Adobe Images

- Market rates at publication:

GBP/EUR: 1.1785 | GBP/USD: 1.3680 - Bank transfer rates:

1.1550 | 1.3397 - Specialist transfer rates:

1.1720 | 1.3612 - For a specialist rate quote, see here

- Set an exchange rate alert, here

The British Pound will once again try to break some key levels against the Euro and Dollar having suffered a string of failures to do so over recent days; supported by Bank of England policy expectations and firmer global markets but hampered by technical headwinds.

The Pound to Euro exchange rate (GBP/EUR) rallied on Thursday to come within a whisker of the 2021 high but yet again failed to close above the 1.18 level.

This marks the sixth day in succession where the exchange rate attempted to breach the top of the 2021 range at 1.18 as the intensity of selling in this region now leaves a more significant capitulation increasingly likely.

In short, the Pound is a 'sell on rallies' at these levels which reinforces the significance of technical resistance and will sap the energy out of the bulls, not just in GBP/EUR but in other cross exchange rates.

Unless a big break occurs soon a capitulation to lower levels is all but assured as buyers run out of ammunition.

Above: Daily chart detailing the formidable resistance to Sterling at GBP/EUR 1.18.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The Pound to Dollar exchange rate (GBP/USD) meanwhile failed to hold above 1.37 and the Dollar's comeback is consistent with those analysts who say further gains by the Greenback are likely over coming weeks.

The general pattern observed over the past two weeks is that the Pound rallies in the European session and is sold in the U.S. session, so a good start on Friday is by no means an indicator of a strong close.

Global markets are in a constructive mood creating the risk backdrop that tends to favour the Pound against the Euro and Dollar, however Sterling's inability to fire is testament to a currency that has fallen out of favour of late.

"Why is Sterling not stronger?" questions Ulrich Leuchtmann, Head of FX and Commodity Research at Commerzbank.

"Sterling isn’t really able to get going. Despite the fact that the Bank of England officials increasingly put their foot down." he observes in a note dated October 14.

The key focus for markets at present is the intention of the Bank of England to raise interest rates again by as early as December, or early 2022.

This tends to raise the cost of finance throughout the economy and increases the yield paid on UK financial assets, which in turn attracts foreign investor capital which in turn bids up the Pound.

But this mechanism appears to have broken down for the Pound.

"That is what happens when it is difficult to shake off the impression that in addition to all the difficulties the rest of the world is facing, everything seems to be particularly tough in the UK: particularly severe supply shortages, particularly steep shortage of labour, particularly high risks of inflation short-term," says Leuchtmann.

Advertiser's note: The failure of Sterling to sustain gains will frustrate those looking to buy foreign exchange and underlines the importance of setting automatic orders.

Participants who had orders in place with us have this week benefited from advances above 1.18 in GBP/EUR, but those simply waiting for higher rates will have waited in vain for five days now.

Horizon Currency can set you an order to automatically secure your ideal target rate, we can also transfer your funds at a spot rate that is better than TranferWise and XE are offering. Find out more.

While the near-term outlook for Sterling continues to frustrate those seeking greater purchasing power, some analysts are backing an eventual move higher, even if any advance is slow.

Economists at ABN AMRO have this week upgraded their Pound Sterling forecasts, acknowledging a rate hike at the Bank of England now looks imminent.

Economists at the Amsterdam based global lender and investment bank predict the first rate hike from the Bank of England to fall on December 16, taking the Bank rate to 0.25% from 0.10%.

They expect another rate hike in the first half of 2022.

It is worth noting financial markets are pricing in a more aggressive path of rate hikes and expect a total of three 25 basis point increases before the end of September 2022.

"What does this mean for GBP/USD and EUR/GBP? We think that an early rate hike by the BoE gives some support to sterling," says Georgette Boele, Senior FX Strategist at ABN AMRO.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

ABN AMRO do not expect the European Central Bank (ECB) to be nearly as proactive and they anticipate this to weigh on the Euro.

They hold a new Euro-Pound exchange rate forecast of 0.85 for year-end, 0.84 for the end of quarter 1 2022, 0.83 for the end of the second quarter, 0.81 for the end of the third quarter and 0.80 for the end of 2022.

This is down from 0.84, 0.84, 0.83, 0.82 and 0.82 respectively.

The above targets translate into a new set of Pound-Euro forecasts of 1.1764 for year-end, 1.19 by the end of the first quarter 2022, 1.2050 by the end of the second quarter, 1.2324 by the end of the third quarter and 1.25 by end of 2022.

The previous set of forecasts were 1.19, 1.19, 1.2050, and 1.22 for both the end of Q3 2022 and year-end 2022.

The outlook for the Pound-Dollar exchange rate however shows the impact of the recent and ongoing trend of USD strength.

ABN AMRO's updated forecasts for the pair are 1.36 for year-end, 1.37 for the end of the first quarter 2022, 1.38 for the end of the second quarter, 1.40 for the end of the third quarter and 1.40 for year-end 2022.

The previous forecasts saw a rather flat profile of 1.40 for the entire horizon.

Analysts at TD Securities meanwhile says one of their models shows Pound Sterling is the cheapest G10 currency at the moment over a 1-3 month outlook horizon.

The bank remains short EUR/GBP (i.e. holds a trade that delivers gains if the Euro falls in value against the Pound), "given the cross still holds a 1-sigma risk premium on a mix of positioning and valuation," says Mark McCormick, Global Head of FX Strategy at TD Securities.

"We also think the energy shock will likely aid in GBP's carry advantage, despite prospects for a growth downgrade," says McCormick. "Positioning is also short".