The British Pound: Running on Fumes, with International Factors in Driving Seat

- Written by: James Skinner

Image © David Holt, Accessed: Flikr, Licensing Conditions: Creative Commons

- GBP lower against most rivals Thursday, now running on fumes.

- GBP reverses gains Vs EUR on ECB's last bullet, U.S.-China talk.

- GBP gains on falling USD as markets eye China deal, Fed cuts.

- Price action result of volatility in EUR and USD exchange rates.

- Brexit in back seat, international factors in GBP driving seat.

- Brexit limbo leaves GBP eyeing 10 Downing Street for cues.

The Pound saw volatile swings Thursday and was lower against its European counterparts by the London close but higher relative to commomity currencies and the U.S Dollar, with international factors firmly in the driving seat of the British unit amid another period of limbo in the Brexit process.

Parliament is suspended and Prime Minister Boris Johnson busy behind the scenes seeking to pull together the various moving parts needed in order to honour his "do or die" pledge to deliver Brexit on October 31, while constrained by legislation imposed on the executive by the opposition and rogue MPs from within the governing Conservative Party last week.

With the government's hands tied behind its back as far as the exit process goes and meaningful new-news on the path out of the EU thin on the ground, Pound Sterling is being driven largely by developments in the international arena, of which there is no shortage.

Sterling was the whipping boy of other major currencies Thursday as investors responded to the European Central Bank (ECB) interest rate decision, U.S. inflation figures and the latest U.S.-China trade headlines.

The ECB cut its deposit rate, which is the rate it charges (used to pay) banks that park money with it overnight, by 10 basis points to -0.50% in line with market expectations. This means the ECB effectively, but in a roundabout way, will pay governments and companies even more in return for them borrowing money from the market. It also means investors who loan money to some governments and corporations could face a loss from the get-go.

European bondholders were in the money too after the ECB said it will buy €20 bn of corporate and government debt per month from November 01, without specifying an end date for the program. The upshot is that Eurozone interest rates and bond yields are set to move lower and remain lower for much longer than investors previously anticipated, although the resulting volatility in the Euro suggests markets aren't yet sure if this is a good or bad thing.

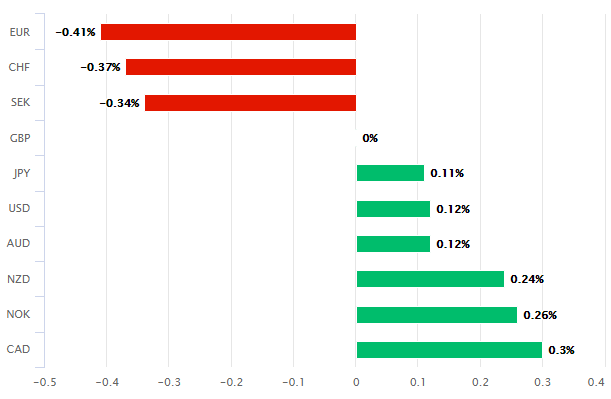

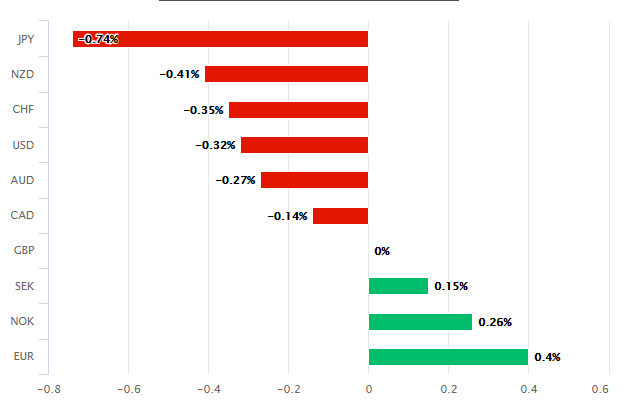

Above: Pound Sterling Vs G10 rivals at the London close on Thursday.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.* Advertisement

Above: Earlier Pound Sterling performance Vs G10 at 13:00 noon on Thursday.

"The joke in the Q&A that there was unanimity that fiscal policy should become the main tool to help the economy is a simple admission of the truth - Mr Draghi may be able to find a trick or two up his sleeve, but they won't be new, and definitely won't be magic. The euro seemed to turn around almost as soon as the joke was delivered," says Kit Juckes, chief FX strategist at Societe Generale. "The euro's fall is nearly, but not quite, over. The dollar's long rally is likewise nearly, but not quite done."

Markets were said to be looking for a €30 bn per month bond program so the smaller value of the purchases should have boosted the Euro, although the task of gauging ever-fluctuating expectations was complicated this month by influential voices at the ECB who'd publicly advocated against such a move.

But might have come to expect less of the bank by the time the decision was announced, which would explain why the Euro sold off after the announcement. However, earlier losses could simply have been due to investor fears that Draghi may have kept an ace card up his sleave for use in the press conference, with the subsequent recovery coming when that card didn't materialise. Volatility in Europe prompted swings in the Pound-to-Euro rate and an angry response from President Donald Trump.

European Central Bank, acting quickly, Cuts Rates 10 Basis Points. They are trying, and succeeding, in depreciating the Euro against the VERY strong Dollar, hurting U.S. exports.... And the Fed sits, and sits, and sits. They get paid to borrow money, while we are paying interest!

— Donald J. Trump (@realDonaldTrump) September 12, 2019

"The Governing Council’s commitment to keep QE going for an unlimited amount of time was significantly more dovish than even our forecast of 24 months so it is not surprising that 10-year euro-zone government bond yields slumped by 4-20bp following the decision and that the euro depreciated by roughly 0.7% against the US dollar – although the single currency has since more than pared its losses (albeit not before Mr Trump managed to tweet about it!)," says Simona Gamborini at Capital Economics.

The Pound-Euro rate was not the only Sterling pair to see notable swings Thursday, as the Dollar and broader market was also volatile, which impacted other British exchange rates. The Pound entered the Wednesday session lower against all major rivals but turned higher against its European counterparts following the ECB decision, only to hand back those gains within hours.

"There is still scope for the euro to fall, particularly if US/Chinese trade talks reach yet another impasse, higher tariffs are introduced and the USD/CNY rises as we expect (to 7.5) or higher. But the inability of Mr Draghi to drive the euro lower with his latest ‘QEternity' announcement is further evidence that euro weakness from here would have less to do with the ECB, than what happens elsewhere," says Kit Juckes, chief FX strategist at Societe Generale.

Above: Pound-to-Euro rate shown at hourly intervals.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

Sterling closed the day higher against the U.S. Dollar and commodity currencies, despite having started off lower, following a Bloomberg News report claiming the U.S. is eyeing a deal that temporarily ends the trade war with China. That followed a decision by President Trump to delay the implementation of some tariffs announced in August until the middle of next month, rather than the original October 01 date that coincides with the 70th anniversary of the People's Republic of China.

"The US's offer to delay the tariff hike on some Chinese imports appears to have weakened the USD across the board and pushed USDRMB below 7.10. We're inclined to be a buyer of that dip but as noted in prior FX Dailies, we see few reasons to be doing anything substantive on this side of the September FOMC," says Stephen Gallo at BMO Capital Markets.

A tariff delay, not to mention an agreement that ends the trade war between the world's two largest economies, would be positive for the global economic outlook but particularly for growth in Europe. Europe, which is home to many of the UK's largest export markets, has been badly hurt by the tariff fight and its growth prospects greatly diminished. The European mood has been especially downbeat because the trade war is ravaging the continent's factories right as it grapples with the threat of Brexit.

"I would expect the people screaming “Trade Deal Now!” will of course see an imminent trade deal in all that. True, this is better than nothing. Yet getting a real deal done from here within the parameters both sides have set will be akin to threading a needle on the back of a galloping horse wearing thick riding gloves. Nonetheless, once again we will have to watch markets play out the “It’s all good; it’s all good; oh dear, it’s not!” news-cycle," says Michael Every, a strategist at Rabobank.

Above: Pound-to-Dollar rate shown at hourly intervals.

The Dollar has benefitted from increased demand for safe-have assets, not to mention bond yields that are either above or at least close to the rate of inflation, as a result of the trade war in recent months which is why some analyst see the trade headlines behind the decline in value of the greenback Thursday. The U.S. Dollar did however, experience a brief rally in the noon hours after inflation figures surprised on the upside.

Inflation rose 10 basis points and was 1.7% in August, in line with expectations . But core inflation, which is seen by central bankers as a better measure of locally-generated price pressures because it ignores volatile energy items, rose 30 basis points and was an annualised 2.4% last month.

The more important core number hit another high last month and remains above the 2% target of the Federal Reserve (Fed), which could complicate its task of justifying a widely-expected rate cut next Wednesday. The bank is expected to cut the Fed Funds rate from 2.25% to 2% on July 18.

Markets have come to expect a series of Fed rate cuts before year-end as an ongoing global growth downturn catches brought on by the trade war with China bites the U.S. economy, and as President Donald Trump heckles the central bank from the virtual sidelines of his Twitter account, baiting it with relentless criticism in the apparent hope that it'll help to keep the economic expansion going by reducing borrowing costs for companies and consumers.

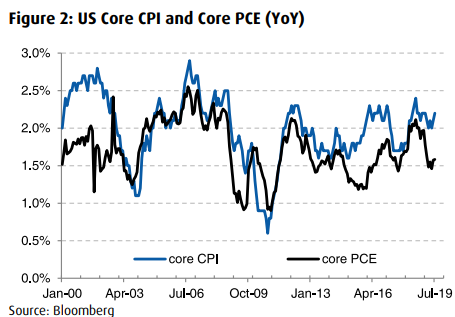

"With core CPI averaging 0.3% higher than core PCE (the indicator that traditionally has carried more weight with the FOMC) this century, a core CPI of 2.3% does not suggest that inflation could slow the Fed. At present, core PCE is running 6 tenths below core CPI, as shown in Figure 2. Although core PCE may well accelerate in Q4, chances of it reaching 2.0% are slim," says BMO's Gallo.

Above: BMO Capital Markets graph of official U.S. inflation rate and Fed's preferred measure (black).

International headlines may have driven the Pound back and forth Thursday but beyond the current session, the market focus will inevitably return to the Brexit saga that's still being written in Westminster. Brexit is in limbo again as markets await the next moves from Prime Minister Boris Johnson as well as a Supreme Court verdict on whether the current suspension of parliament, rules around which are a matter of Royal Prerogative, was lawful.

"The risk of a no deal at the end of October cannot be entirely dismissed. No Deal on 31st October is the default until a delay is agreed with the EU or there’s a deal. And Boris Johnson could ignore the law, the courts might not intervene, the opposition might fail to work together to form a new Government, or Johnson could refuse to recommend the would-be Prime Minister to the Queen," says Andrew Wishart at Capital Economics. "The most likely scenario seems to be that there is another delay."

Brexit limbo comes after the opposition hijacked the parliamentary agenda and passed the 'Benn Bill', aided by 21 Conservative Party MPs, requiring Prime Minister Boris Johnson to seek a third extension to the Article 50 negotiating period. The request is contrary to government policy and passing of the bill opens a constitutional can of worms, but markets have celebrated because it delays a 'no deal' Brexit for at least a few more months.

"There was a sign of compromise in talk of the whip being returned to the 21 rebel Tory MPs," Every says. "We also saw the Tory party shoot down the Brexit Party’s offer of an electoral pact. Many will breathe a huge sigh of relief on that front. Yet that Boris/Toff-Fibbentrop Pact did at least suggest a path to a working UK governmental majority if and when a new election is held – now even that isn’t assured and potentially five more years of this chaos looms."

Above: Pound-to-Dollar rate shown at weekly intervals.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement