Euro-Dollar Pulls Back, Brittle European Consumer Sentiment Cited

- Written by: Sam Coventry

Image © Adobe Images

The Euro to Dollar exchange rate (EUR/USD) has retreated towards the key 1.08 level amidst a broader U.S. Dollar recovery and soft Eurozone consumer sentiment, potentially signalling an end to the February recovery.

EUR/USD was as high as 1.0866 on February 27 but has since pulled back to 1.0813 after the European Commission's Economic Sentiment Indicator (ESI) for February fell to -9.5, down from -9.3 and below expectations for -9.2.

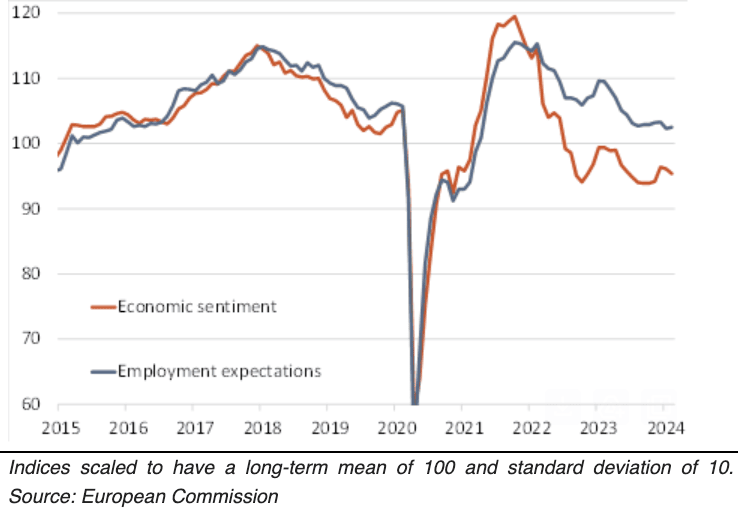

"The Eurozone economy remains in rough waters," says Salomon Fiedler, an economist at Berenberg Bank, "today's economic sentiment survey suggests that near-term risks are tilted to the downside."

Above: Eurozone economic sentiment and employment conditions: image courtesy of Berenberg.

The Euro-Dollar has been trending higher since mid-February, but this has largely been a function of USD weakness amidst a paring of the outperformance seen at the start of the year.

These confidence data underpin the uninspired performance of the Eurozone's economy and point to an ongoing malaise in the Eurozone that will limit the Euro's rebound potential.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

"The risk is that the ECB cuts policy interest rates sooner than June, which should limit EUR relief rallies," says Elias Haddad, Senior Markets Strategist at Brown Brothers Harriman & Co. "This reading remains consistent with unimpressive economic activity in the eurozone."

The ESI's fall was driven by worsening confidence across the board for services, manufacturing, retail trade, and construction.

"EURUSD’s loss of minor support around 1.0850 overnight added to the negative undertone for price action on the short-term chart. EUR losses have steadied around the 1.08 level but the rebound in price, so far, has been limited. A rebound back through 1.0835 resistance intraday will ease bearish pressure on the EUR and put a move back up to the mid/upper 1.08s on the cards." says Shaun Osborne, Chief FX Strategist at Scotiabank.

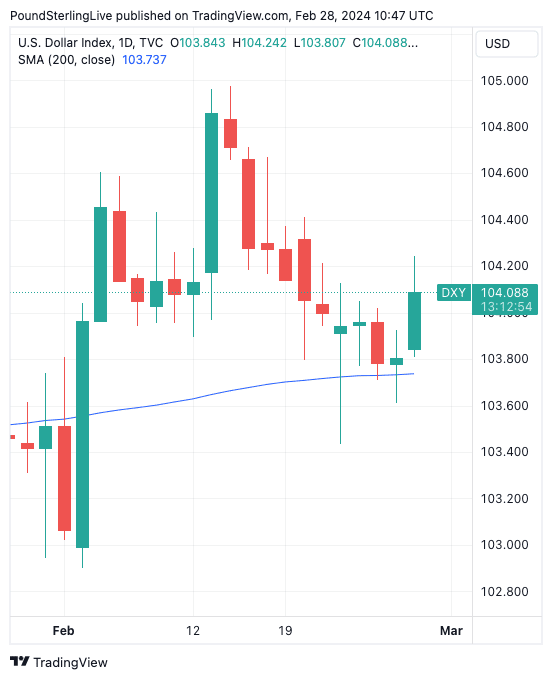

Recent Euro-Dollar strength has had the Dollar's recent pullback to thank as it corrected after a strong start to the year. We note that month-end flows could also prove a USD headwind as March approaches, but this would only underscore arguments that recent USD weakness is more technical in nature than any fundamental shift in trend.

"The sliding dollar trend might not gain much traction given the ongoing US economic exceptionalism and US yields hovering near 3-month highs," says George Vessey, Lead FX Strategist at Convera.

"The US dollar index (DXY) has found some decent support around its 200-day moving average, currently located at 1.03.73 and is trading back above the 104 mark today," he adds.

Above: The Dollar index, a measure of broader USD performance, at daily intervals.

BBH's Haddad says the Fed is unlikely to cut rates anytime soon, even as other major central banks tilt more dovish.

"The U.S. data continue to come in mostly firmer while Fed officials remain very cautious about easing too soon. We believe that the current market easing expectations for the Fed still need to adjust," he says. "When they do, the dollar should see further gains after this current period of consolidation."

We look forward to Thursday's release of the core PCE index, which may offer Euro-Dollar some direction should it hint that U.S. inflation remains persistent.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes