Euro-Dollar 2024 Forecast from Commonwealth Bank Won't Please The Bulls

- Written by: Sam Coventry

Image © Adobe Images

The Euro to Dollar exchange rate (EURUSD) looks set to struggle in 2024 and could disappoint those looking for a material fall in the Dollar.

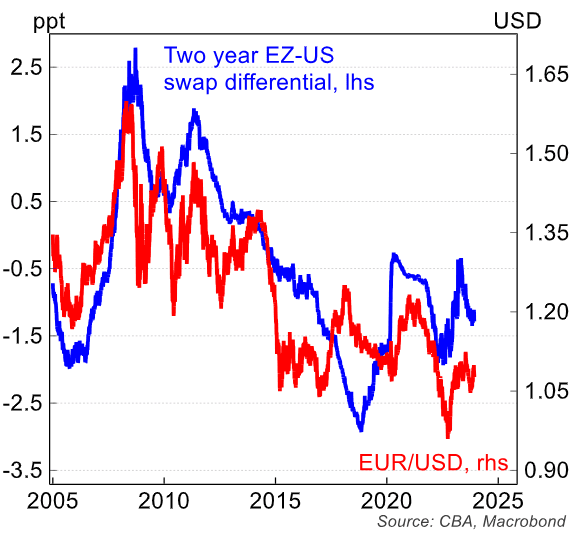

This is according to Commonwealth Bank of Australia (CBA), where analysts see yield differentials - a key driver of FX valuation - little changed over the coming months, which will frustrate the Euro's advance.

In fact, Joseph Capurso, Head of International and Sustainable Economics at CBA, says his team have downgraded their Euro-Dollar forecast for 2024 and now see a more modest

lift in EUR/USD over the coming year than previously forecast.

"We have been bearish about EUR/USD most of the year. We have lowered our forecast for EUR/USD in early 2024 from 1.10 to 1.05 to reflect another lift in the USD," says Capurso.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The Euro-Dollar exchange rate peaked at 1.10 in late November but has steadily been sold over December as investors began to expect European Central Bank (ECB) interest rate cuts to start earlier than expected.

Falling Eurozone inflation and further disappointments in activity data mean ECB Governing Council members aren't as concerned about increasing expectations for rate cuts as their colleagues at the Bank of England and Federal Reserve.

"The weak Eurozone economy can weigh on EUR/USD," says Capurso, who also anticipates increased market risk as the global economy slows to boost the Dollar.

The Euro-Dollar is still expected to rise through the latter half of the year as global economic and market conditions improve. However, "we expect a more modest lift in EUR/USD over the following year than we previously forecast."

Image courtesy of CBA.

"We expect interest rate differentials to remain a headwind for EUR/USD. We expect both the US FOMC and ECB to start a rate cutting cycle from around mid-2024. But with rate cuts occurring at roughly the same pace, the interest rate differential should not change much," explains Capurso.

CBA forecasts EURUSD at 1.05 by the end of March 2024, down from a previous forecast of 1.10. By the end of September, the pair is expected to have risen to 1.12, which is lower than the 1.19 previously expected.

By year-end, the forecast is for 1.15 vs. 1.22 previously.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes