Euro-Dollar Could See Three-Month Highs if ECB Pares Back Pandemic QE Programme

- Written by: James Skinner

- EUR/USD eyeing 1.18 amid third corrective setback

- But any QE cutback from ECB could revive appetite

- Placing three-month highs above 1.19 in contention

Image © European Central Bank

- EUR/USD reference rates at publication:

- Spot: 1.1811

- Bank transfers (indicative guide): 1.1398-1.1480

- Money transfer specialist rates (indicative): 1.1705-1.1750

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Euro-to-Dollar rate was on course for a hat-trick of losses in the mid-week session but could have scope for a recovery toward three month highs if the European Central Bank (ECB) hits the right notes for the single currency on Thursday.

EUR/USD was approaching the round number of 1.18 on Wednesday when slipping toward its third consecutive daily loss but could find itself back in demand if the ECB announces on Thursday that it intends to begin the process of winding down its crisis-inspired quantitative easing programme.

The bank’s September policy decision is out at 12:45, is followed by a press conference at 13:30 and could garner more attention than usual after several policymakers each alluded in the last fortnight to the possibility of a policy recalibration this week.

“One thing is clear: recent data are very positive. The European economy will be able to recover its pre-pandemic income levels by the end of this year or the beginning of next year. We will have new projections in the coming days and will take our decisions accordingly,” executive board member Luis de Guindos told El Confidencial last week.

Perceptions are that purchases under the Pandemic Emergency Purchase Programme could be reduced in what might be a supportive development for the Euro given that this would effectively mark the beginning of the end for the emergency bond buying programme.

It comes at a point when the ECB has already been buying a lesser volume of European government bonds than has the Federal Reserve across the Atlantic.

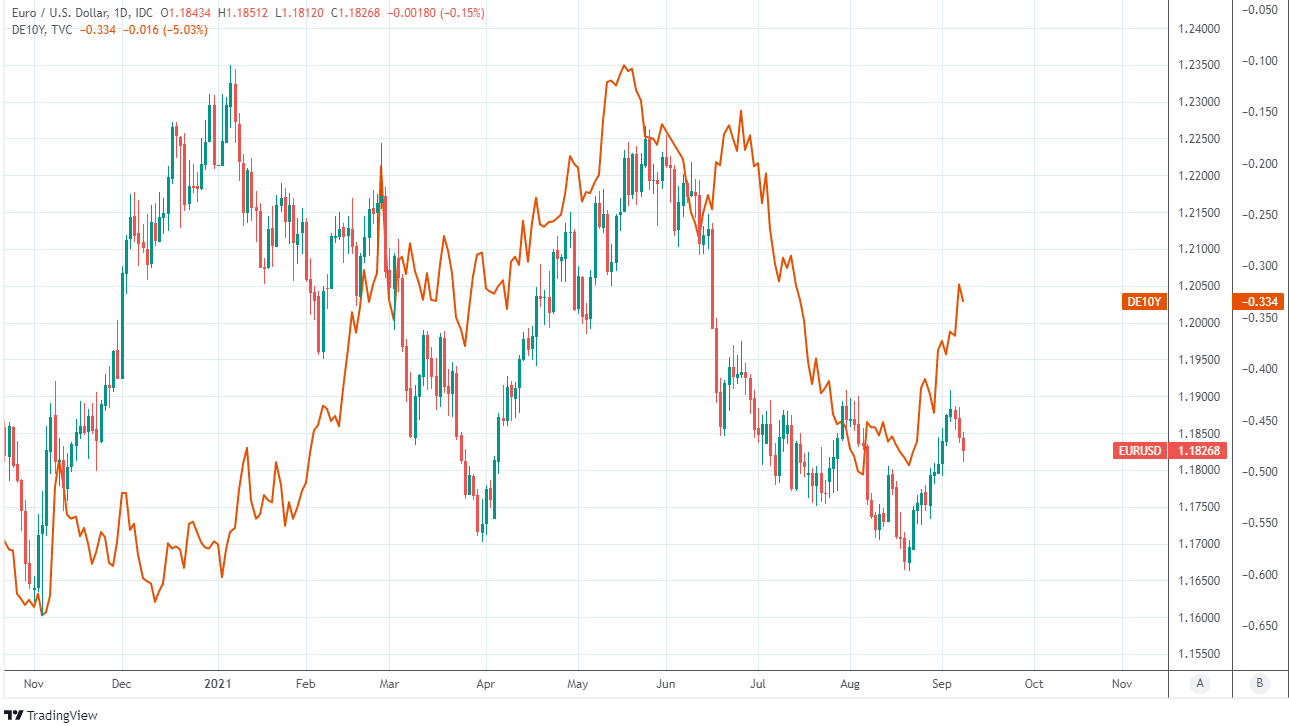

Above: Euro-Dollar rate shown at daily intervals alongside 10-year German government bond yield.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

While the Fed is widely expected to pack away its $120BN per month quantitative easing programme quicker than the ECB once its tapering process commences, any adjustment from Frankfurt this week would widen that Euro-favourable differential for at least a short-lived period.

This is why European government bond yields have risen along with Euro exchange rates since August 25 when the ECB’s chief economist Philip Lane first suggested in an interview with Reuters that a change may be announced this week.

Europe’s single currency had risen briefly above 1.19 last week to trade at its highest since the middle of June and such levels could be brought back into contention on Thursday if the ECB does after all begin to wind down its pandemic-inspired bond buying programme.

“We’ll have to assess at the September meeting the appropriate calibration for the final quarter of the year, taking into account the movement in market interest rates and the inflation outlook,” chief economist Philip Lane told Reuters.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“Our commitment to maintaining favourable financing conditions throughout the pandemic crisis phase means that the purchase decision should be viewed as an implementation issue. It’s subordinated to the deeper commitment, which is favourable financing conditions,” Lane later said.

The ECB had purchased a net €1.34 trillion of European government bonds under its €1.85 trillion Pandemic Emergency Purchase Programme by September 03, with €65BN bought in August alone and at around a €16.2BN per week pace.

This is after saying in March that weekly purchases would be carried out at a “significantly higher pace” over the coming quarters than in the first months of the year, as part of an effort to ensure financing costs were reduced and that financing conditions remained favourable.

“Looking ahead, we believe ECB hawks will push further in favour of an exit strategy from emergency monetary policy measures. Initially, we expected the debate about the future of the PEPP to happen in December or early next year,” says Steen Jakobsen, chief investment officer at Saxo Bank.

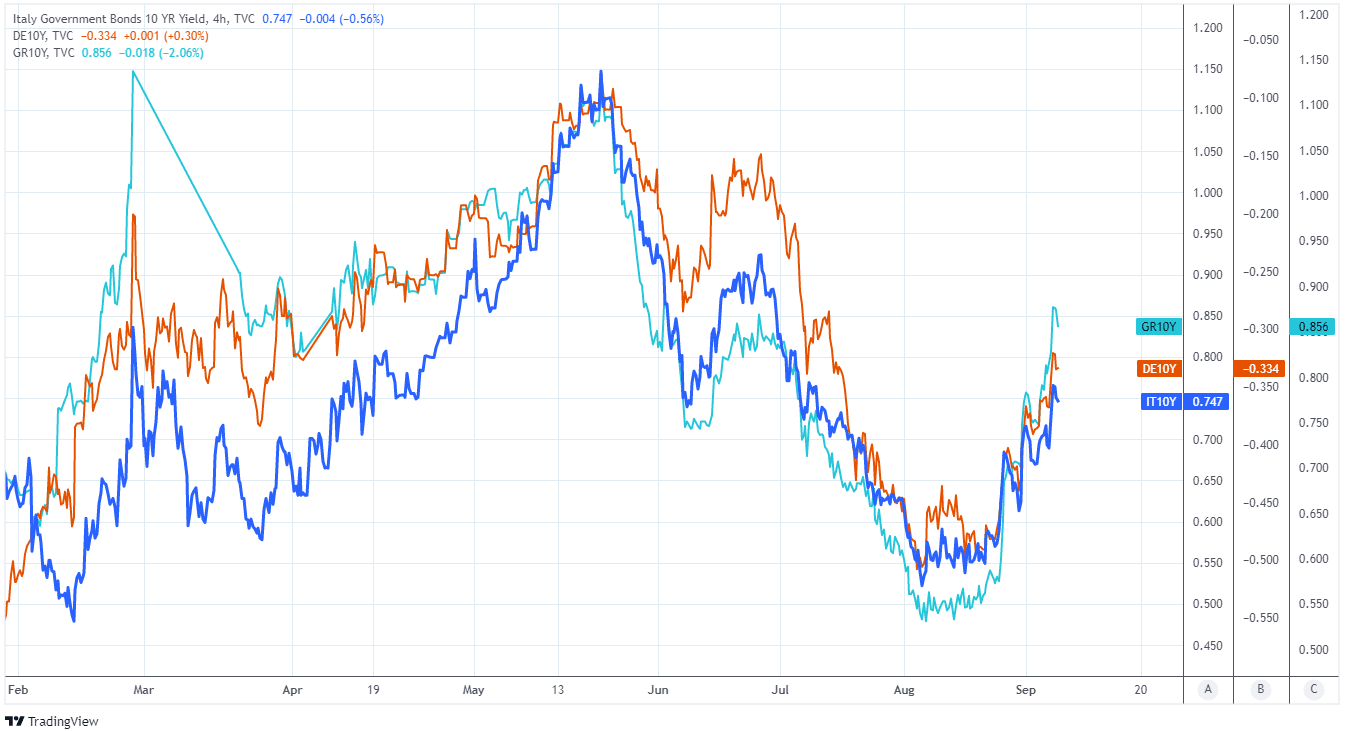

Above: Italian, German and Greek 10-year government bond yields.

Technically, and with a little over €500BN left in the PEPP envelope coming into September, the ECB could afford to maintain August’s pace of purchases for a further seven months before it would become necessary to increase the size of the envelope.

But financing costs have fallen significantly across the globe since March and especially in Europe, opening a window of opportunity for the ECB to reduce its footprint in the bond market without adversely affecting the Eurozone economies as they recover from the pandemic.

Italian, German and Greek 10-year government bond yields may have risen sharply during the weeks since chief economist Lane’s interview with Reuters, but they were still no higher on Wednesday than they had been in March this year.

Despite the possibly imminent adjustment to the ECB’s quantitative easing programme, many analysts doubt that Thursday’s meeting will provide more than fleeting support for the Euro currency.

“We suspect the ECB would offset this “tapering” by making it clear that it will pursue persistent and expanded asset purchases through other vehicles like the APP once PEPP winds down after March 2022,” says Shahab Jalinoos, head of FX strategy at Credit Suisse.

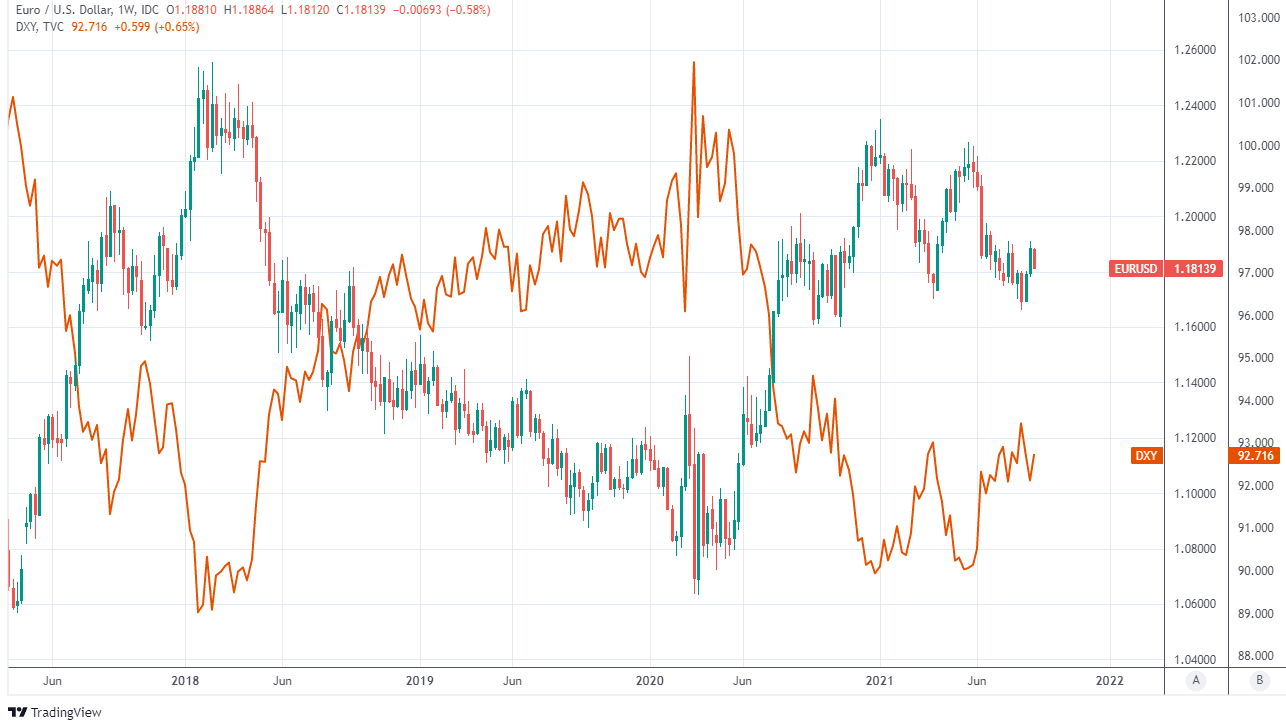

Above: Euro-Dollar rate shown at weekly intervals alongside U.S. Dollar Index.

“This dovish structural message would likely offset the upward pull on euro area bond yields, and EUR, from PEPP taper. We remain of the view too that the ECB is not inclined to tolerate a persistent rally in EURUSD given the resulting disinflationary pressures that would arise. We suggested we would look to sell EURUSD on any pop towards 1.2000 linked to a PEPP taper,” Jalinoos writes in a research note this week.

Jalinoos and the Credit Suisse team have, like others, advocated taking any ECB-induced rally this week as an opportunity to sell the Euro-Dollar rate from better levels due in part to the longer-term outlook for Eurozone monetary policy.

That longer-term outlook was illustrated by the ECB’s last set of forecasts, which envisaged Eurozone inflation falling back beneath the bank’s 2% target in the coming months and remaining there for some years, despite the economic recovery.

This is seen by analysts and economists as likely to necessitate a continuation of the ECB’s original quantitative easing programme until long after the PEPP scheme has been wound down next year, which is a medium-term headwind for the Euro given that few other central banks are expected to persist with such a yield-suppressing policy over the long-term.