EUR/USD Protected by a Crowded Market

Image © Adobe Stock

- Bearish bets so heavy they could limit losses

- Threat of short-covering shock on rebound now impacting

- Other limiters include interest rate differentials

EUR/USD bulls and bears are currently battling it out within the 1.11 range, amidst evidence the market may have made a floor under the May 1.1107 lows.

Bears will be trying to take out the floor and push the market lower whilst bulls have their backs to the wall defending it in the hope that a rebound will deliver profit.

The bet against the single-currency in favour of the Dollar comes amidst lacklustre Eurozone economic data which contrasts against an ongoing strong expansion of the U.S. economy.

It would seem on the face of it that bears should win given the majority of investors are 'short' the pair - i.e. engaged in bets against the Euro. Yet the sheer weight of bearish bets may actually now pose a threat to the downtrend as the market finds it is running low on fresh entrants into an already crowded trade - fresh entrants are required to keep the trend moving.

The risk of a short-covering rally meanwhile grows in the event of a sudden counter-trend move.

Any sudden rebound goes against the trend forcing traders out of the market which in turn accelerates the move as more and more Euros are bought to close out positions creating a feedback loop higher.

Martin Miller, an analyst at Thomson Reuters says the net short position on EUR/USD has reached a high 12.63bn Euros, an increase from the 11.91bn in the previous week.

This shows it is getting extreme and could be vulnerable to a short-covering rally.

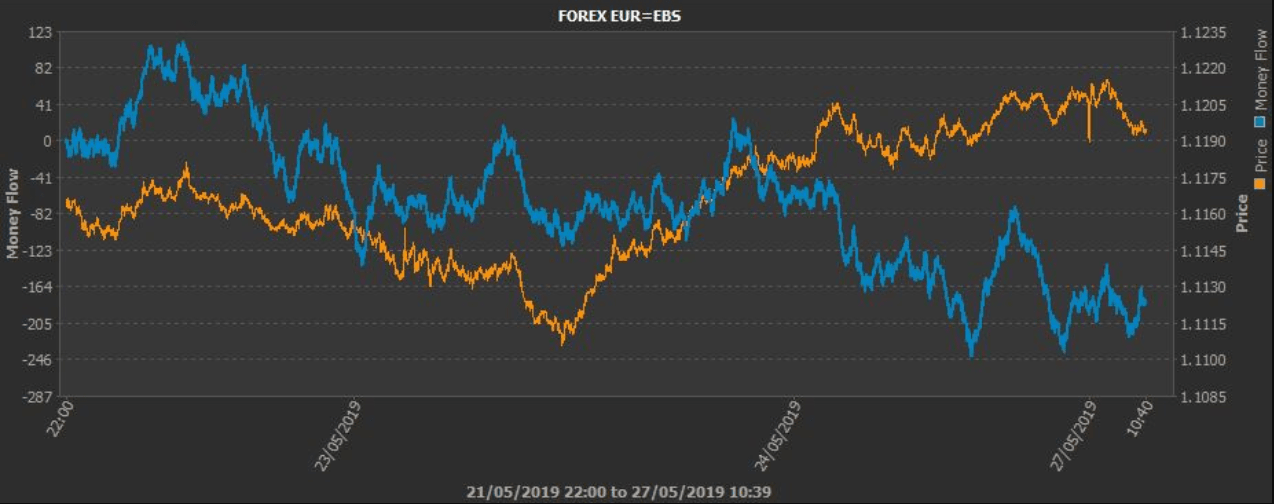

“In the week ended May 21, the futures market was short an equivalent EUR/USD cash position of 12.63 billion euros, up from 11.91 billion euros the previous week. EBS flow data since May 21 shows those shorts may have been added to, so buy stops associated with them could be triggered, creating a bigger recovery higher,” says Miller.

Positioning imbalances are not the only factor seen limiting downside development for EUR/USD.

Traditionally the pair has been seen as particularly sensitive to the interest rate differential between the U.S. and Europe. Put simply this decides where the big money managers park their capital to earn interest - the higher the rate the better, all other things being equal.

Analysts generally use yields on U.S. and German government bonds as a proxy for ‘interest rates’ in ‘the U.S. and Europe’ and at the moment the fall in U.S. Treasury bond yields is outpacing German bunds and this is limiting EUR/USD losses, according to Richard Pace, another analyst at Reuters.

The reason for this, it seems, is increasing fears the U.S. economy is going to slow down and the Federal Reserve (Fed) who are in charge of setting interest rates, will have to cut interest rates to try to inspire growth.

Pace notes: “Dealers should be wary of dovish Fed rhetoric at FOMC 19 June,” suggesting he sees the possibility the Fed could announce a rate cut, or more likely, hint one is on the way, at that meeting.

Options markets, which are used by many investors to hedge currency devaluation exposure, are suggesting the threat of a break below the 1.1106 lows is not that great, and Pace sees “bids touted toward bottom of long term range at 1.1106, 1.11 barrier defence.”

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement